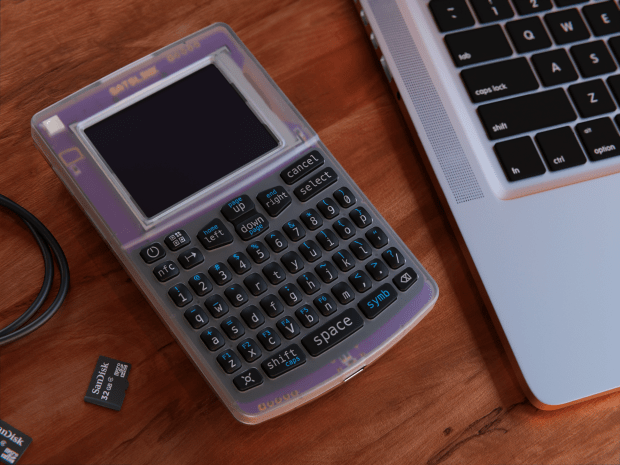

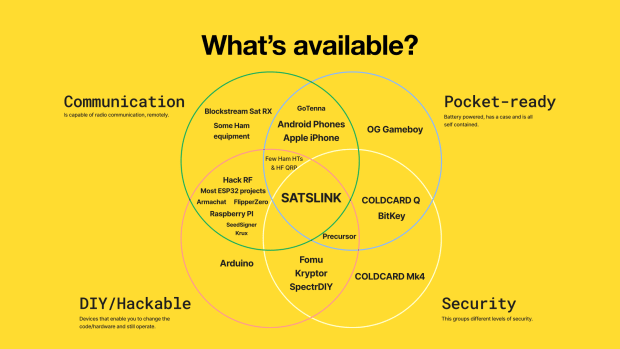

Coinkite, a leading name in the bitcoin industry, recently unveiled their newest product, Satslink. This under-production gadget ingeniously intersects multiple areas of communication and mobile technology, providing developers with the power to design a myriad of unique applications.

Unlocking Endless Possibilities for Developers

Unlike other products that rely on a predetermined framework, Satslink utilizes open, adaptable hardware wrapped within the robust exterior of the Coldcard Q1. This approach offers unprecedented variety and flexibility to developers. Those who acquire this device gain the freedom to determine its function, sparking their creativity with the vast array of possibilities this hardware piece can facilitate.

Satslink: A Peer-to-Peer, Multi-Purpose Device

At its core, Satslink is a peer-to-peer, multi-purpose gadget ripe for hacking. In line with other Coinkite products, it features a secure element that enables users to safely store private keys within the device. Although it shares the external design with the Coldcard Q1, the internals are vastly different from the company's most recent hardware wallet. Rather than focusing solely on air-gapped security, Satslink aims to bring secure communications into everyday use in ways few would have thought possible.

Technical Features of Satslink

Satslink utilizes ESP32-S3, a low-power MCU-based system on a chip (SoC) with integrated 2.4 GHz Wi-Fi and Bluetooth Low Energy (Bluetooth LE). It comprises a high-performance dual-core microprocessor (Xtensa® 32-bit LX7), a low-power coprocessor, a Wi-Fi baseband, a Bluetooth LE baseband, RF module, and numerous peripherals. Programmed in micropython, Satslink's source is fully available and field upgradable without any locked ROM areas. The device also includes a MicroSD slot for easy data transfer.

Target Audience and Potential Applications

"The initial target is developers and enthusiasts," says NVK, a spokesperson for Coinkite. "However, thanks to its consumer-friendly form factor, they can start using anything the community creates. This includes hot and sovereign lightning wallets and Nostr clients!"

Nostr, the open communications protocol that gained popularity after Twitter founder Jack Dorsey endorsed and funded the project, is among the top potential uses for Satslink. With its peer-to-peer communication capabilities, Satslink can serve as a Nostr client. Thanks to its relay function, it can send and receive messages as Nostr posts without internet connection, creating a localized Nostr network made up of numerous Satslink devices.

Satslink: A Sovereign Controller for Your Bitcoin Stack

Another exciting possibility that bitcoin enthusiasts may find appealing is using Satslink as a sovereign controller for their home-based bitcoin stack. Given its networking capabilities, the device can connect to the home stack on demand and perform desired actions remotely and securely. It can serve as a transaction coordinator or even function as a full wallet. However, Coinkite advises against using Satslink as a primary cold storage solution for substantial bitcoin amounts.

Expanding Communication Features

Satslink's communication features also include NFC and a QR code reader, opening up even more potential uses. This combination, paired with Satslink's adaptability and programmability, could even transform it into a hardware wallet from another manufacturer. Although the desirability of such a transformation is subjective, it is certainly possible to convert a Satslink into Blockstream's JADE wallet or other similar DIY hardware wallets.

While the possibilities are inexhaustible, it remains to be seen what users will actually create with this innovative product. Satslink is currently available for preorder on Coinkite's website for $189. The shipping date for this promising product is yet to be announced.

Frequently Asked Questions

Should You Invest in Gold for Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. You can invest in both options if you aren't sure which option is best for you.

You can earn potential returns on your investment of gold. It is a good choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. As a result, its value changes over time.

However, this does not mean that gold should be avoided. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold? It's a tangible asset. Gold is much easier to store than bonds and stocks. It's also portable.

You can always access your gold if it is stored in a secure place. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold rises in the face of a falling stock market.

Another benefit to investing in gold? You can always sell it. Just like stocks, you can liquidate your position whenever you need cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

Don't buy too many at once. Start with just a few drops. Add more as you're able.

Don't expect to be rich overnight. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Even though gold is not the best investment, it could be an excellent addition to any retirement plan.

What precious metal is best for investing?

This question depends on how risky you are willing to take, and what return you want. Gold is a traditional haven investment. However, it is not always the most profitable. Gold may not be right for you if you want quick profits. If patience and time are your priorities, silver is the best investment.

If you don’t want to be rich fast, gold might be the right choice. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Should You Purchase Gold?

Gold was a safe investment option for those who were in financial turmoil. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Experts believe this could change soon. They say that gold prices could rise dramatically with another global financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

Consider these things if you are thinking of investing in gold.

- Before you start saving money for retirement, think about whether you really need it. You can save for retirement and not invest your savings in gold. The added protection that gold provides when you retire is a good option.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each offer varying degrees of security and flexibility.

- Remember that gold is not as safe as a bank account. Losing your gold coins could result in you never being able to retrieve them.

You should do your research before buying gold. And if you already own gold, ensure you're doing everything possible to protect it.

What are the pros and cons of a gold IRA?

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. An IRA is a great way to save money and not have to pay taxes on the interest you earn. However, there are also disadvantages to this type of investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management charges ranging anywhere from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. Many insurers require that you own at least one ounce of gold before you can make a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. Some providers restrict the amount you can own in gold. Others allow you the freedom to choose your own weight.

You will also have to decide whether to purchase futures or physical gold. The price of physical gold is higher than that of gold futures. Futures contracts provide flexibility for purchasing gold. They enable you to establish a contract with an expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does include coverage for damage due to natural disasters. You might consider purchasing additional coverage if your area is at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. For safekeeping, banks typically charge $25-40 per month.

You must first contact a qualified custodian before you open a gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians can't sell assets. Instead, they must hold them as long as you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. The plan should also include information about how much you are willing to invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. The company will review your application and send you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner can help you decide the type of IRA that is right for your needs. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

Is physical gold allowed in an IRA.

Gold is money, not just paper currency or coinage. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

Another reason is that gold has historically outperformed other assets in financial panic periods. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Even if your stock portfolio is down, your shares are still yours. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold offers liquidity. This allows you to sell your gold whenever you want, unlike many other investments. The liquidity of gold makes it a good investment. This allows one to take advantage short-term fluctuations within the gold price.

Can the government steal your gold?

You own your gold and therefore the government cannot seize it. You worked hard to earn it. It belongs to you. However, there may be some exceptions to this rule. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. If you owe taxes, your precious metals could be taken away. You can keep your gold even if your taxes are not paid.

Is it possible to hold a gold ETF within a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow contributions from both the employer and employee. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

A Individual Retirement Annuity (IRA), is also available. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs will not be taxed

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not exactly legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

investopedia.com

How To

3 Ways To Invest in Gold For Retirement

It is important to understand the role of gold in your retirement plan. There are several options to invest in precious metals if your employer has a 401k. You might also consider investing in gold outside your workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are the three rules to follow if you decide to invest in gold.

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, put cash into your accounts. This will help you to protect yourself against inflation while also preserving your purchasing power.

- Physical Gold Coins – Physical gold coins are better than a paper certificate. Physical gold coins can be sold much faster than paper certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. In other words, spread your wealth around by investing in different assets. This will reduce your risk and give you more flexibility in times of market volatility.

—————————————————————————————————————————————————————————————-

By: Namcios

Title: Introducing Satslink: The Versatile Bitcoin Device by Coinkite

Sourced From: bitcoinmagazine.com/business/coinkites-newest-bitcoin-device-can-serve-as-a-lightning-wallet-and-nostr-client

Published Date: Sat, 14 Oct 2023 15:39:43 GMT