A gold IRA is an excellent tax-efficient way to invest in gold. This account can be set up with a custodian, transferred from your 401k, or even held in an offshore vault. But before you make that final decision, it's important to understand how the process works and what you need to do to maximize your tax benefits.

Precious metals IRAs are a tax-efficient way to invest in gold

Gold IRAs offer a unique tax-saving strategy for investing in precious metals. Instead of letting gold value depreciate, you can invest in gold through your Individual Retirement Account (IRA). This method will help you save on taxes and improve your after-tax returns.

Most IRA companies charge an annual administrative fee that can be as little as $50 or as much as $150. They also charge a storage fee, which is paid to the depository that holds your investment. Some depository custodians charge a flat fee, while others base their fee on the amount of gold in your account. In addition, some IRA providers may choose to charge a commission for buying gold.

They can be set up with a custodian

If you want to own physical gold, a gold IRA can be a great option. Unlike traditional IRAs, you can buy gold bars from one ounce to a hundred ounces. Gold IRAs are managed by a custodian and can be funded through wire payments or checks sent to the custodian's office. Gold IRAs can also hold gold bullion coins. The coins are typically sold in sets of 20 or 500 pieces, and can be kept in a safety deposit box or with a gold IRA custodian.

IRA custodians are required to comply with the IRA rules and regulations. This means that they must be approved by the Internal Revenue Service (IRS) to hold your funds. There are two types of IRAs: custodians and trustees. Both must be approved by the IRS, and they both record transactions. However, a custodian doesn't make investment decisions or offer investment advice on behalf of clients.

They can be held in an offshore vault

There are a few advantages of holding your gold IRA in an offshore vault. First, you can avoid taxation and penalties by keeping your account in a private place. In addition, you can be assured that your assets are safe and secure. Second, you can take control of your account decisions. By transferring your account to an offshore vault, you will be able to reduce volatility, minimize risk, and maintain your standard of living.

Offshore gold vaults are located in countries that are economically stable and have low taxes. Singapore offers all the attributes of a perfect gold storage venue, and the country has emerged as one of the leading precious metals hubs in Asia.

They can be transferred from a 401k

You can also transfer funds to a gold IRA indirectly through a broker. In order to transfer funds to a gold IRA, you must transfer funds from your brokerage account to the custodian's office. When you make the transfer, you can choose from various types of gold assets such as gold bars, weighing from one to 100 ounces.

You must fill out the required paperwork for the rollover process. This will include providing the details of the account and amount you wish to transfer. Once the transfer is complete, the administrator will wire the funds to your gold IRA account. Once your account has been set up, you can start purchasing gold and other precious metals. The custodian will use the funds in your account to purchase the metals.

They can be rolled over

Rolling over your retirement funds into gold is one way to increase your financial security. While there are many different ways to do this, it is important to consider your specific financial goals. Using a gold IRA rollover guide can help you decide which strategy will be most beneficial for you.

A gold IRA rollover helps you to diversify your retirement savings. This type of investment is not as volatile as paper currency or the stock market, so it can protect you from a rapidly depreciating U.S. dollar. This type of investment is also an ideal option if you are concerned about inflation and the United States dollar.

Frequently Asked Questions

Is it a good retirement strategy to buy gold?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

Physical bullion bars are the most popular way to invest in gold. There are other ways to invest gold. It is best to research all options and make informed decisions based on your goals.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. Owning gold stocks should work well if you need cash flow from your investment.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

How can I withdraw from a Precious metal IRA?

First, decide if it is possible to withdraw funds from an IRA. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it's time to make withdrawals from your precious-metal IRA, you'll need a place to keep your coins safe. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Either way, you'll need to weigh the pros and cons of each before choosing one.

Bullion bars, for example, require less space as you're not dealing with individual coins. But, each coin must be counted separately. However, individual coins can be stored to make it easy to track their value.

Some people like to keep their coins in vaults. Some prefer to keep them in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

How much money should I put into my Roth IRA?

Roth IRAs allow you to deposit your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you can't touch your principal (the initial amount that was deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. Also, taxes will be due on any earnings you take. Let's assume that you contribute $5,000 each year to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 So you would only have $6,500 left. The amount you can withdraw is limited to the original contribution.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. Your traditional IRA allows you to withdraw your entire contribution plus any interest. You can withdraw as much as you want from a traditional IRA.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal required, unlike a traditional IRA. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads and Example. Risk Metrics

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

irs.gov

How To

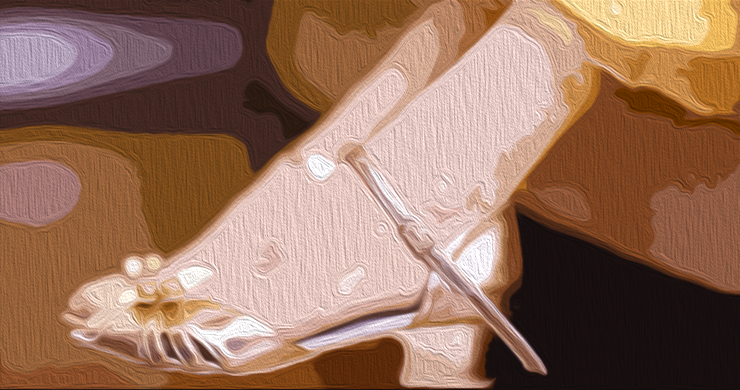

How to Keep Physical Gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

You can also buy gold directly. You'll need to open a bank account, buy gold online from a trusted seller, or open an online bullion trading account. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It is also easier to check how much gold you have stored. A receipt will be sent to you indicating exactly how much you paid. This will allow you to see if there were any tax omissions. You're also less susceptible to theft than investing with stocks.

However, there can be some downsides. For example, you won't benefit from banks' interest rates or investment funds. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com has more information about how to buy gold in an IRA.