A recent study conducted by Glassnode on onchain activities has revealed that the scarcity of the bitcoin supply has tightened. This observation comes despite a substantial increase in the value of bitcoin throughout the current year.

Bitcoin's Tightening Supply Defies Price Rally, Reveals Glassnode Study

Over the past year, BTC has experienced a surge of 71% and a 114% increase from the beginning of the year to the present. Glassnode's latest report indicates that despite these price surges, the availability of bitcoin remains limited, largely due to steadfast holders.

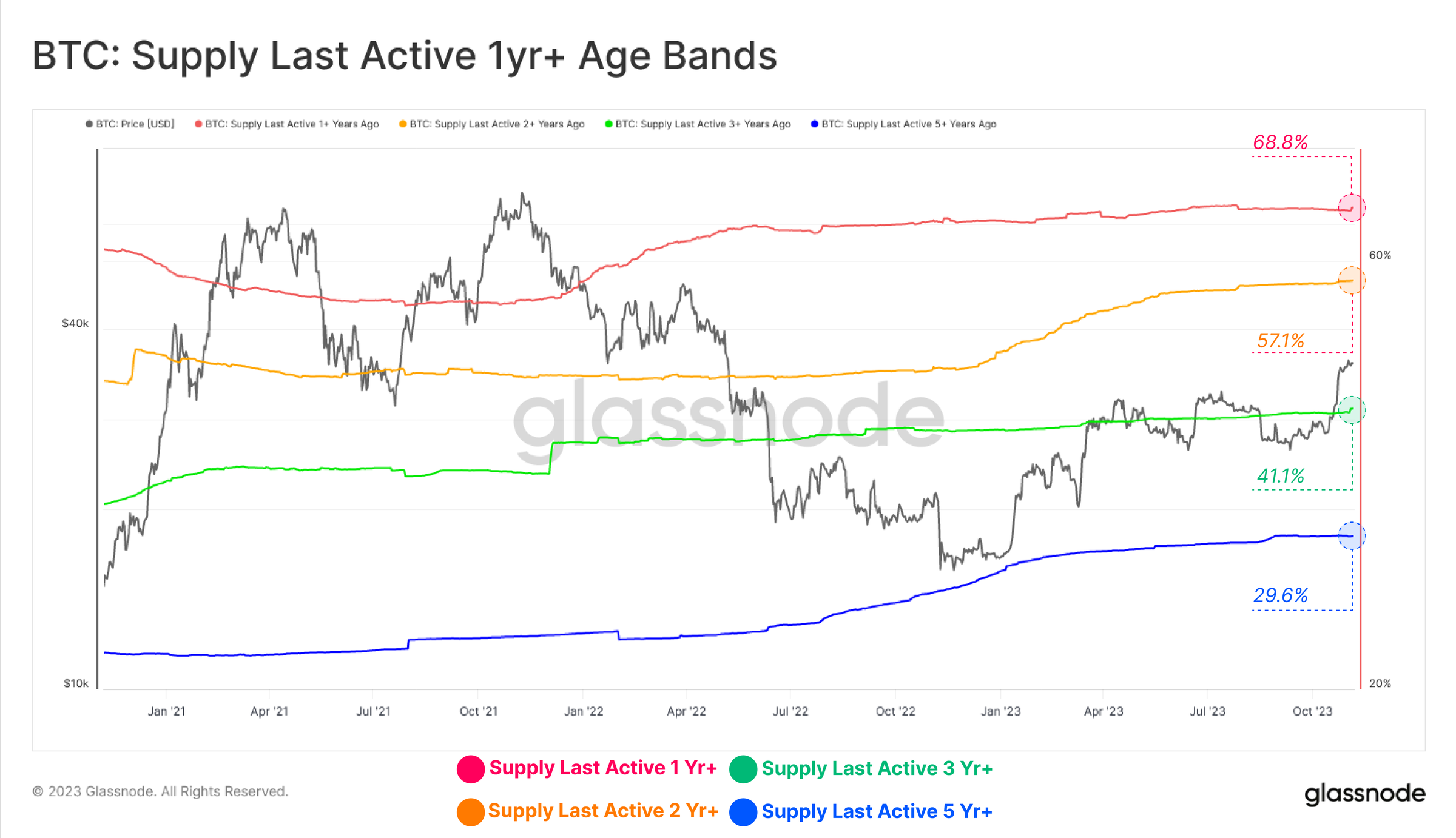

An in-depth analysis of onchain data shows that approximately 68.8% of all bitcoins have not been moved in over a year. Additionally, the non-liquid supply index has reached a record-breaking 15.4 million BTC. The Glassnode team has identified that long-term investors hold a significant amount of bitcoin, nearing record levels, while the supply held by short-term investors has dwindled to unprecedented lows.

This growing gap in supply indicates a solidification of holdings, as current investors are hesitant to part with their bitcoin. Since July 2022, the difference between the supplies held by long-standing and recent investors has widened, reaching new heights. This highlights the significant contrast between dormant and circulating supplies.

Furthermore, Glassnode has introduced a new metric called the Activity-to-Vaulting Ratio, which has shown a decline since June 2021, with a notable drop in trajectory post-June 2022. According to Glassnode, this shift indicates a decrease in market "exuberance" from the 2021-22 cycle.

An analysis of spending patterns conducted by Glassnode reveals a trend of accumulation and retention among investors, rather than active trading. The Sell-Side Risk Ratio for short-term holders has surged after the rally, suggesting profit-taking in the short term. In contrast, this metric remains historically low for long-term holders.

Glassnode's evaluation of wallet activity shows significant contributions to wallet sizes across the board, indicating a boost in investor confidence. "Shrimps" and "Crabs" have been actively buying bitcoin, absorbing 92% of the bitcoin mined since May 2022. "Shrimps" hold less than one bitcoin, "Crabs" hold 1-10 BTC, and "Fish" hold anywhere between 10-100 BTC.

In conclusion, Glassnode analysts state, "The bitcoin supply is historically tight, with various supply metrics indicating multi-year and all-time highs in 'coin inactivity.' This suggests that the supply of bitcoin is extremely tightly held, which is impressive considering the strong price performance year-to-date."

What are your thoughts on Glassnode's report regarding the tightening bitcoin supply? Feel free to share your opinions and thoughts on this subject in the comments section below.

Frequently Asked Questions

What are the fees for an IRA that holds gold?

The Individual Retirement Account (IRA), fee is $6 per monthly. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

If you want to diversify, you may be required to pay extra fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Most providers also charge an annual management fee. These fees are usually between 0% and 1%. The average rate for a year is.25%. These rates are usually waived if you use a broker such as TD Ameritrade.

What precious metals can you invest in for retirement?

These precious metals are among the most attractive investments. Both can be easily bought and sold, and have been around since forever. You should add them to your portfolio if you are looking to diversify.

Gold: The oldest form of currency known to man is gold. It's stable and safe. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver has been a favorite among investors for years. This is a great choice for people who want to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinium is another precious metal that is becoming increasingly popular. It's resistant to corrosion and durable, similar to gold and silver. However, it's much more expensive than either of its counterparts.

Rhodium: Rhodium can be used in catalytic convertors. It is also used to make jewelry. It's also relatively inexpensive compared to other precious metals.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It's also more affordable. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

How is gold taxed by Roth IRA?

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

You don't pay tax if you have the money in a traditional IRA/401k. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

Each state has its own rules regarding these accounts. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

How to Open a Precious Metal IRA

The first step is to decide if you want an Individual Retirement Account (IRA). You must complete Form 8606 to open an account. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. This form should be completed within 60 days after opening the account. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. Contributions must be made on a regular basis. These rules are applicable whether you contribute through your employer or directly from the paychecks.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. But, you'll only be able to purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option can be provided by some IRA companies.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they aren't as liquid than stocks and bonds. This makes it harder to sell them when needed. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose money over time and not gain it.

Can the government take your gold?

Your gold is yours and the government cannot take it. You worked hard to earn it. It belongs to you. This rule could be broken by exceptions. You could lose your gold if convicted of fraud against a federal government agency. Your precious metals can also be lost if you owe tax to the IRS. However, even if taxes are not paid, gold is still your property.

Is gold a good investment IRA option?

For anyone who wants to save some money, gold can be a good investment. It is also an excellent way to diversify you portfolio. But gold is not all that it seems.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the oldest currency in the world.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. That makes it very valuable because it's rare and hard to create.

The supply and demand factors determine how much gold is worth. The economy that is strong tends to be more affluent, which means there are less gold miners. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This leads to more gold being produced which decreases its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you invest in gold, you'll benefit whenever the economy grows.

Your investments will also generate interest, which can help you increase your wealth. In addition, you won’t lose any money if gold falls in value.

Do you need to open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. It is impossible to get back money if you lose your investment. This includes investments that have been damaged by fire, flooding, theft, and so on.

Protect yourself against this type of loss by investing in physical gold or silver coins. These items are timeless and have a lifetime value. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Remember that you will not see any returns unless you are retired if you open an Account. Remember the future.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

irs.gov

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

finance.yahoo.com

How To

The growing trend of gold IRAs

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

Gold IRA owners can now invest in physical gold bullion or bars. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

A gold IRA allows investors to manage their assets without worrying about market volatility. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also get the unique benefits of owning physical Gold, including its durability, portability, flexibility, and divisibility.

Additional benefits of the gold IRA include the ability to quickly pass ownership to heirs. Additionally, the IRS does not consider gold a money or a commodity.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Glassnode Data Shows Bitcoin Supply Less Liquid Than Ever Despite Market Gains

Sourced From: news.bitcoin.com/glassnode-data-shows-bitcoin-supply-less-liquid-than-ever-despite-market-gains/

Published Date: Wed, 08 Nov 2023 18:30:10 +0000