Bitcoin as a Monetary Base Asset

Bitcoin is evolving into a digital base money with diverse perspectives on its utility. While some see it as a medium for everyday transactions, others liken it to modern gold for value storage. Moreover, Bitcoin is increasingly recognized as a decentralized global platform for securing and validating off-chain transactions.

The Transparent Nature of Bitcoin's Monetary Policy

Bitcoin functions similarly to physical gold concerning denominations like the dollar, reshaping the concept of monetary base assets. With a fixed supply of 21 million units and a transparent algorithm, Bitcoin ensures a non-discretionary monetary policy. This stands in contrast to traditional fiat currencies like the US dollar, which rely on centralized authorities for supply management, raising concerns about predictability in today's volatile environment.

The Debate on Leveraging Bitcoin

Within the Bitcoin community, there is widespread skepticism towards leveraging Bitcoin due to the immutable 21 million supply cap. Many believe that any form of leverage undermines Bitcoin's core principles, akin to fiat currency practices. This skepticism is rooted in the distinction between commodity credit based on real savings and circulation credit lacking such backing.

Lessons Learned from the 2022 Crypto Credit Crunch

The collapse of leveraged-based Bitcoin lending companies like Celsius and BlockFi in 2022 highlighted the risks associated with leveraging Bitcoin. The crypto market faced a significant upheaval, emphasizing the pitfalls of centralized yield instruments and the importance of transparency, trust, and risk management in the crypto lending sector.

The Need for Bitcoin-Based Yield Products

Despite the challenges, the Bitcoin community recognizes the necessity of credit and yield mechanisms to foster a robust Bitcoin-centric economy. Yield products built on Bitcoin can drive adoption and utilization, supporting the vision of a thriving Bitcoin-based financial system.

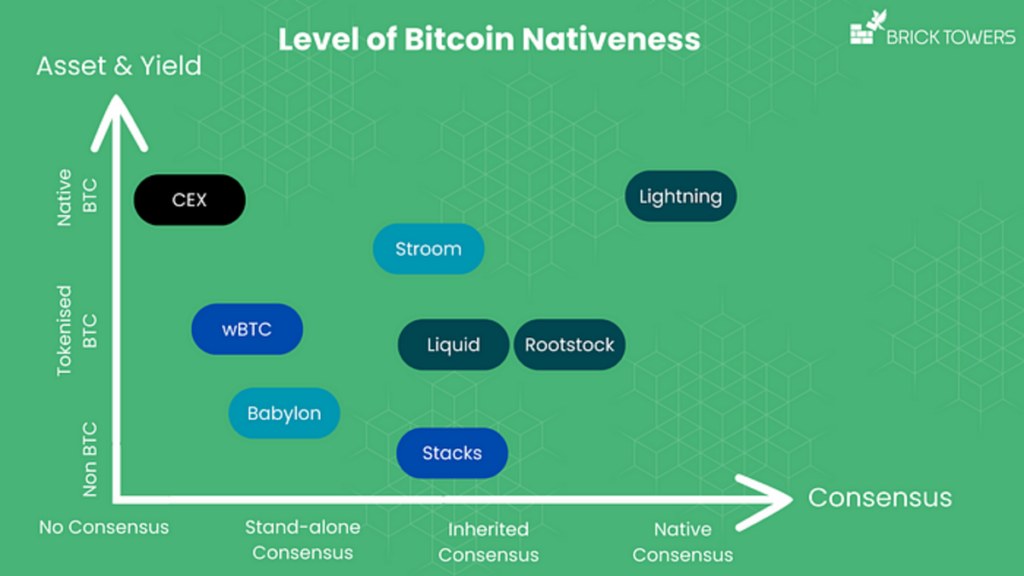

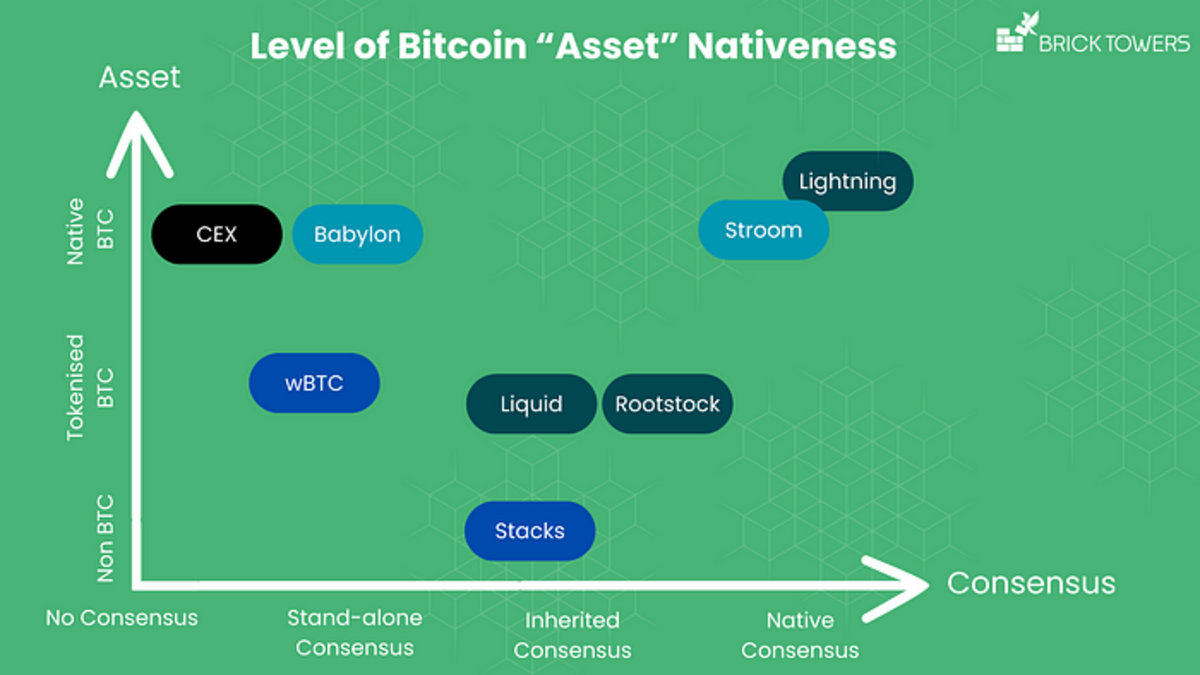

Assessing Bitcoin Yield Products Along a Trust Spectrum

Bitcoin yield products can be evaluated based on their alignment with Bitcoin's consensus, asset used, and yield generation. This trust spectrum helps determine the level of decentralization and transparency of Bitcoin yield products, with native consensus products being perceived as the most trust-minimized.

The Gold Standard: Native Bitcoin Alignment

The ideal Bitcoin-based yield product would exhibit native Bitcoin consensus, asset, and yield, mimicking near-perfect alignment with Bitcoin. Projects like Brick Towers aim to provide customers with a trust-minimized approach to earning yield on their Bitcoin holdings by leveraging native Bitcoin solutions.

By embracing native Bitcoin solutions, the Bitcoin community can pave the way for a robust and secure financial ecosystem built on the principles of transparency, trust, and decentralization.

Frequently Asked Questions

How is gold taxed in an IRA?

The fair value of gold sold to determines the price at which tax is due. You don't have tax to pay when you buy or sell gold. It isn't considered income. If you sell it later you will have a taxable profit if the price goes down.

As collateral for loans, gold is possible. Lenders will seek the highest return on your assets when you borrow against them. In the case of gold, this usually means selling it. It's not guaranteed that the lender will do it. They might just hold onto it. They might decide that they want to resell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. It is better to leave it alone.

How do I Withdraw from an IRA with Precious Metals?

First decide if your IRA account allows you to withdraw funds. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, figure out how much money will be taken out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. You'll have to weigh the pros of each option before you make a decision.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. You will need to count each coin individually. However, keeping individual coins in a separate place allows you to easily track their values.

Some prefer to store their coins in a vault. Some prefer to keep them in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

How much should your IRA include precious metals

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. They don't require you to be wealthy to invest in them. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You might consider purchasing physical coins, such as bullion bars and rounds. Stocks in companies that produce precious materials could be purchased. You might also want to use an IRA rollover program offered through your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And unlike traditional investments, they tend to increase in value over time. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

Is it a good idea to open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. It is impossible to get back money if you lose your investment. This includes all investments that are lost to theft, fire, flood, or other causes.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items have been around thousands of years and are irreplaceable. You would probably get more if you sold them today than you paid when they were first created.

You should choose a reputable firm that offers competitive rates. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

You won't get any returns until you retire if you open an account. Keep your eyes open for the future.

How much should precious metals make up your portfolio?

Before we can answer this question, it is important to understand what precious metals actually are. Precious Metals are elements that have a very high relative value to other commodities. This makes them extremely valuable for trading and investing. Today, gold is the most commonly traded precious metal.

But, there are other types of precious metals available, including platinum and silver. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is also unaffected significantly by inflation and Deflation.

In general, prices for precious metals tend increase with the overall marketplace. However, they may not always move in synchrony with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Since these are scarce, they become more expensive and decrease in value.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

How much are gold IRA fees?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees will vary depending upon the type of IRA chosen. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

In addition, most providers charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% annually. However, these rates are typically waived if you use a broker like TD Ameritrade.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

irs.gov

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not legal – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

Starting early is the best way to save for retirement. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. It is essential to save enough money each year in order to maintain a steady growth rate.

Additionally, tax-free opportunities like a traditional 401k or SEP IRA are available. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. This makes them great options for people who don't have access to employer matching funds.

Save regularly and continue to save over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————-

By: Pascal Hügli

Title: Exploring the Role of Bitcoin as a Digital Base Money

Sourced From: bitcoinmagazine.com/markets/can-bitcoin-be-a-productive-asset-

Published Date: Thu, 13 Jun 2024 15:30:21 GMT