Charles Hoskinson Expresses Frustration Over Cardano's Security Classification

Charles Hoskinson, co-founder of Input Output Global (IOHK) and the Cardano blockchain initiative, recently expressed his frustration in a video over the U.S. regulator's decision to categorize the cryptocurrency cardano as a security. He finds it perplexing and critical that bitcoin is exempt from being tagged as a security, and he mocks the situation as a "pathetic joke." He also points out the apparent free pass granted to "Team Orange."

Hoskinson Questions the Treatment of Cardano Compared to Bitcoin

In a video clip shared by Altcoin Daily, Charles Hoskinson passionately discusses his views on cardano's ADA classification as a security, contrasting it with bitcoin and other cryptocurrencies. He questions the logic behind this categorization, highlighting what he perceives as inconsistencies and unfair treatment in the regulatory approach.

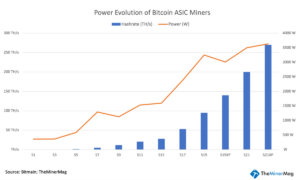

Hoskinson questions the absence of an expectation of profit among fervent bitcoin supporters, known as the "Orange pill moon boys." He criticizes the perceived decentralization of Bitcoin, noting that targeting a few entities could potentially lead to a 51% attack on the network due to the nature of its hashpower distribution. He sees this oversight as a glaring problem and calls it a "pathetic joke."

Adam Back Responds to Hoskinson's Assertions

After Altcoin Daily released the video, users of platform X reacted to Hoskinson's assertions. In a thread on X, Blockstream founder Adam Back responded by simplifying the distinction between bitcoin and other cryptocurrencies. He states that Bitcoin did not do an initial coin offering (ICO), and it is decentralized with no CEO or incorporation. Back argues that Cardano, ETH, and similar cryptocurrencies clearly pass the Howey test, while Bitcoin is considered a commodity.

In response, Hoskinson clarifies that Cardano didn't have an ICO. Instead, he details an airdrop and subsequent trading of ADA by a diverse group of individuals who also used the platform for various projects. He further explains that the voucher sale of a different asset outside of the United States, priced in Yen and settled in Bitcoin, does not constitute an ICO of ADA.

Hoskinson's Frustration with "Team Orange" Lobbying

Hoskinson refutes the notion that an airdrop is equivalent to an ICO, citing even the SEC's ambiguity on the matter. He points to the SEC's settlement with EOS and Block.one as an example. Hoskinson emphasizes that ADA was not publicly offered by a centralized entity, contrasting it with Ethereum's ICO for ether, which has not been classified as a security.

Expressing his frustration, Hoskinson criticizes the bitcoin community for labeling non-Bitcoin projects as inferior or fraudulent. He condemns the efforts by Bitcoin advocates to push U.S. authorities to outlaw cryptocurrencies other than Bitcoin. He also dismisses the argument that Bitcoin's mining process is fundamentally different, noting that Satoshi Nakamoto, Bitcoin's creator, initially had complete control over the network and remained anonymous due to legal uncertainties.

The Blockstream executive responds by comparing bitcoin with gold and diamonds, arguing that none of these are securities. He maintains that ether, ADA, and similar cryptocurrencies are securities and emphasizes that these assets are "both unregistered and unregisterable securities too."

What are your thoughts on the debate between Charles Hoskinson and Adam Back? Share your opinions in the comments section below.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments based on the price of gold. You can speculate on future prices, but not own the metal. You can only hold physical bullion, which is real silver and gold bars.

Is gold a good IRA investment?

For anyone who wants to save some money, gold can be a good investment. You can diversify your portfolio with gold. There is much more to gold than meets your eye.

It has been used as a currency throughout history and is still a popular method of payment. It's sometimes called “the world's oldest money”.

Gold is not created by governments, but it is extracted from the earth. This makes it highly valuable as it is hard and rare to produce.

Gold prices fluctuate based on demand and supply. If the economy is strong, people will spend more money which means less people can mine gold. This results in gold prices rising.

On the flip side, people save cash for emergencies and don't spend it. This leads to more gold being produced which decreases its value.

This is why it makes sense to invest in gold for individuals and companies. If you invest in gold, you'll benefit whenever the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

How much do gold IRA fees cost?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes account maintenance and any investment costs.

To diversify your portfolio you might need to pay additional charges. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge annual management costs. These fees range between 0% and 1 percent. The average rate per year is.25%. These rates can be waived if the broker is TD Ameritrade.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

bbb.org

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

How To

Tips to Invest in Gold

Investing in Gold has become a very popular investment strategy. There are many benefits to investing in gold. There are several options to invest in the gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

Before buying any type gold, it is important to think about these things.

- First, verify that your country permits gold ownership. If you have permission to possess gold in your country, you can then proceed. If not, you may want to consider purchasing gold from overseas.

- Secondly, you should know what kind of gold coin you want. You can choose between yellow gold and white gold as well as rose gold.

- Third, consider the cost of gold. It is best to start small and work your way up. When purchasing gold, diversify your portfolio. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Last but not least, remember that gold prices fluctuate frequently. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Cardano’s Charles Hoskinson Clashes With Blockstream’s Adam Back Over Crypto Security Classification

Sourced From: news.bitcoin.com/cardanos-charles-hoskinson-clashes-with-blockstreams-adam-back-over-crypto-security-classification/

Published Date: Tue, 28 Nov 2023 14:30:52 +0000