Bitcoin Magazine

Hey there, fellow crypto enthusiasts! Excited to dive into the ever-evolving world of Bitcoin technology with you. Today, we're breaking down the latest trends that challenge the conventional portrayal of Bitcoin as digital gold. Let's explore how Lightning data is reshaping the narrative and paving the way for a new era of possibilities.

The Rise of Bitcoin Tech: Unveiling the Hidden Gems

2025 has been abuzz with discussions around Bitcoin's role as a store of value, but amidst the noise, a silent revolution is brewing. Enter Bitcoin technology companies, the unsung heroes driving innovation and redefining the landscape of digital transactions.

The Surprising Success of Bitcoin Companies

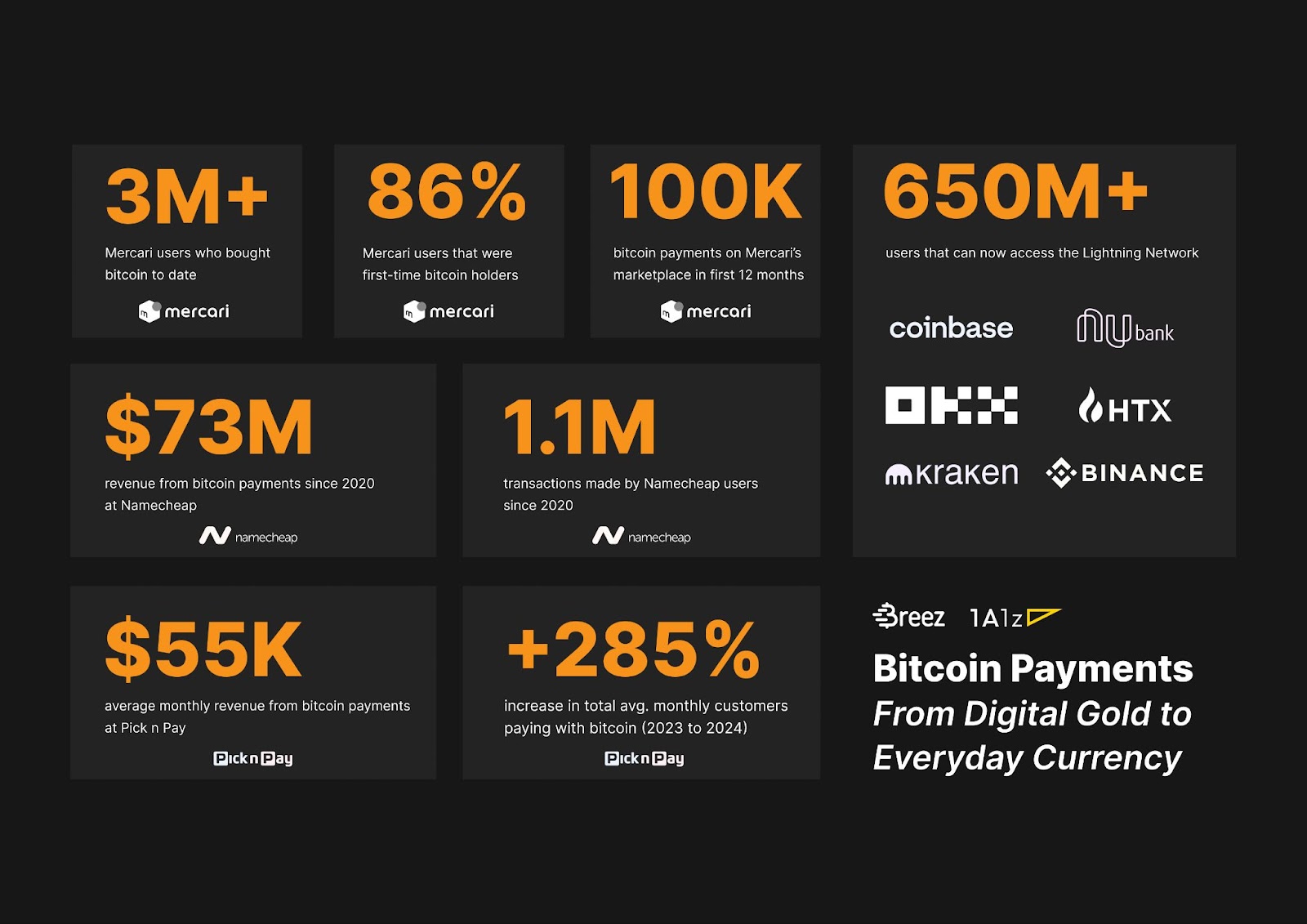

Despite skeptics highlighting Bitcoin's base layer's empty blocks and low transaction fees, new data is painting a different story. Companies are showcasing impressive adoption metrics, hinting at a more profound market fit beyond traditional strategies.

Block: Pioneering Lightning-Powered Transactions

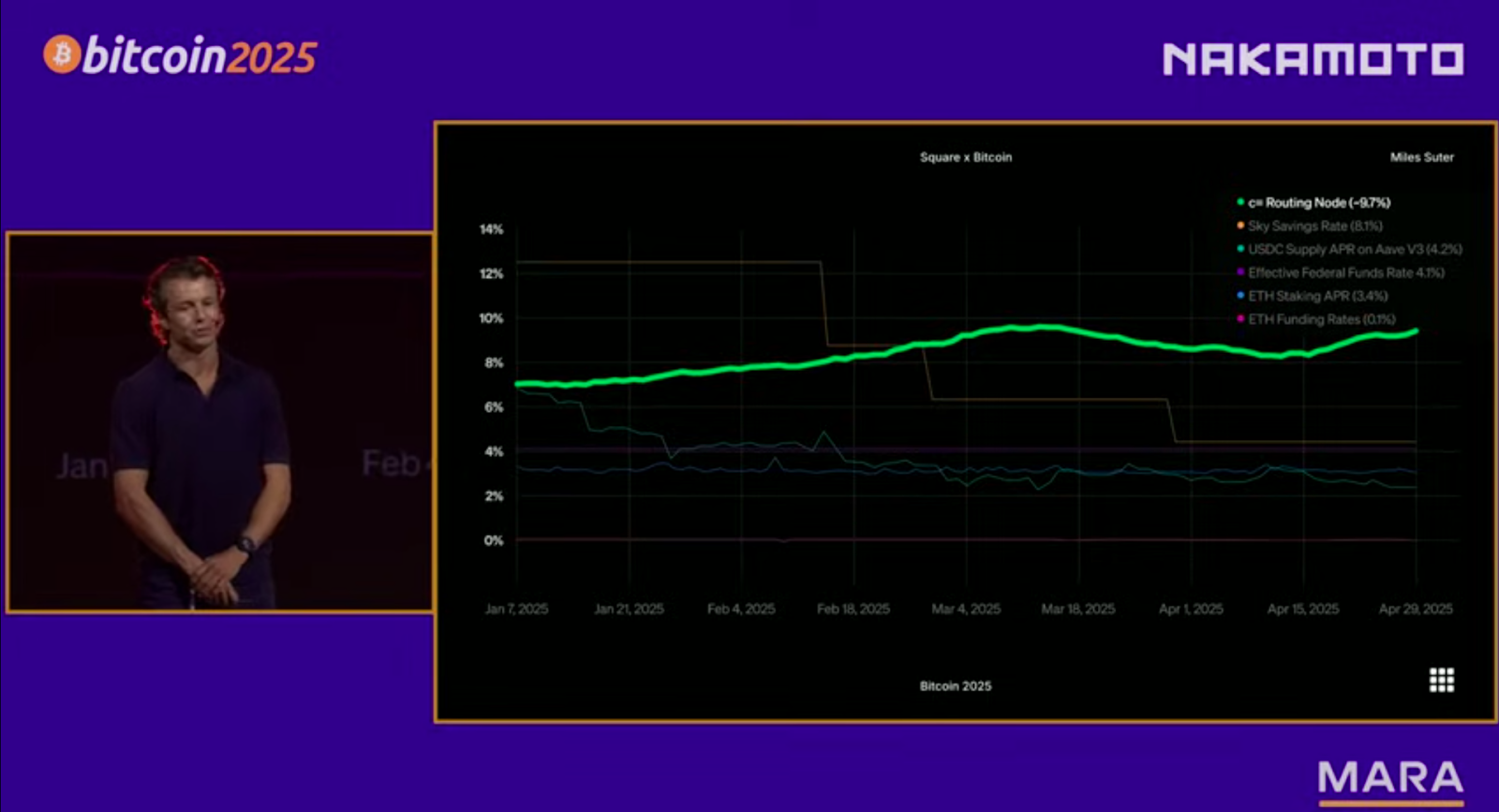

At Bitcoin Vegas 2025, Block, the force behind Cash App, revealed a staggering 9.7% yield from their Bitcoin Lightning node. This isn't just about digital gold; it's about real-time, efficient payments transforming the industry.

Unveiling Block's Lightning Success

Block's innovative approach to routing real payments across the Lightning network is not just about numbers; it's about real-world solutions driving tangible results.

Ego Death Capital: Fueling Bitcoin's Infrastructure

Ego Death Capital's strategic investments in Bitcoin infrastructure have been pivotal in shaping the ecosystem. By supporting key players in the industry, they're accelerating Bitcoin's evolution into a versatile currency and network.

Empowering Bitcoin Start-ups

From Breez to Relai, Ego Death Capital's portfolio boasts a lineup of successful ventures reshaping the financial landscape with Bitcoin at the core.

Breez: Revolutionizing Lightning Payments

Breez's self-custodial Lightning service is democratizing Bitcoin payments, making peer-to-peer transactions seamless and accessible across various sectors.

Driving Global Bitcoin Adoption

Breez's user-friendly approach has led to widespread adoption, with millions of users benefiting from secure, lightning-fast Bitcoin transactions.

LN Markets: Redefining Bitcoin Trading

LN Markets' Lightning-fueled trading platform is setting new standards in Bitcoin derivatives trading. By leveraging the Lightning Network, they offer instant settlements and enhanced user experiences.

The Future of Lightning Trading

LN Markets' forward-looking approach is reshaping the trading landscape, making Bitcoin more accessible and efficient for traders worldwide.

Relai: Simplifying Bitcoin Banking

Relai's user-centric mobile app is making Bitcoin adoption a breeze for Europeans, emphasizing simplicity and self-custody for a seamless banking experience.

Empowering European Bitcoin Users

Relai's growth in the European market signifies a shift towards mainstream Bitcoin adoption, with a focus on user-friendly solutions for newcomers.

Madeira: Pioneering a Bitcoin Economy

The Madeira Bitcoin project is a testament to Bitcoin's potential as a thriving economic force. By embracing Lightning Network transactions, Madeira is paving the way for a Bitcoin-centric economy with global implications.

Transforming Economies with Bitcoin

Madeira's innovative approach to Bitcoin adoption is not just a local phenomenon but a blueprint for other regions to embrace the future of decentralized finance.

As we witness the transformative power of Bitcoin technology, one thing is clear: the future is bright, and the possibilities are limitless. Join the movement, explore the world of Bitcoin innovation, and be part of a revolution that's reshaping the future of finance!

Frequently Asked Questions

Can I hold physical gold in my IRA?

Gold is money. Not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Another reason is that gold has historically outperformed other assets in financial panic periods. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Gold is one of the few assets that has virtually no counterparty risks. You still have your shares even if your stock portfolio falls. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, the liquidity that gold provides is unmatched. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

Is buying gold a good retirement plan?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion is the most popular method of investing in gold. There are many ways to invest your gold. It's best to thoroughly research all options before you make a decision.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you require cash flow, gold stocks can work well.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs can include stocks of precious metals refiners and gold miners.

What are the fees for an IRA that holds gold?

An Individual Retirement Account (IRA) fee is $6 per month. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees can vary depending on which type of IRA account you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

In addition, most providers charge annual management fees. These fees are usually between 0% and 1%. The average rate for a year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

How is gold taxed by Roth IRA?

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

The rules that govern these accounts differ from one state to the next. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. In Massachusetts, you can wait until April 1st. New York allows you to wait until age 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

What are some of the benefits of a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). It is tax-deferred until it's withdrawn. You have total control over how much each year you take out. There are many types and types of IRAs. Some are better for those who want to save money for college. Others are made for investors seeking higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. The earnings earned after they withdraw the funds aren't subject to any tax. This type of account might be a good choice if your goal is to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit to owning IRA gold is the ability to withdraw automatically. It means that you don’t have to remember to make deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Gold is one of today's most safest investments. Its value is stable because it's not tied with any one country. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

What proportion of your portfolio should you have in precious metals

First, let's define precious metals to answer the question. Precious metals are those elements that have an extremely high value relative to other commodities. They are therefore very attractive for investment and trading. Gold is currently the most widely traded precious metal.

There are also many other precious metals such as platinum and silver. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It also remains relatively unaffected by inflation and deflation.

All precious metals prices tend to rise with the overall market. That said, they do not always move in lockstep with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. These precious metals are rare and become more costly.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. You should also diversify because precious metal prices can fluctuate and it is better to invest in multiple types of precious metals than in one.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

bbb.org

How To

Tips for Investing with Gold

One of the most sought-after investment strategies is investing in gold. This is because there are many benefits if you choose to invest in gold. There are many ways you can invest in gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, check to see if your country permits you to possess gold. If the answer is yes, you can go ahead. You can also look at buying gold abroad.

- The second is to decide which kind of gold coin it is you want. There are many options for gold coins: yellow, white, and rose.

- Thirdly, it is important to take into account the gold price. It is better to start small, and then work your way up. It is important to diversify your portfolio whenever you purchase gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Lastly, you should never forget that gold prices change frequently. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: Juan Galt

Title: Bitcoin's Technological Triumph: Lightning Data Shatters Digital Gold Perception

Sourced From: bitcoinmagazine.com/business/bitcoin-tech-booms-lightning-data-defies-digital-gold-narrative

Published Date: Wed, 18 Jun 2025 16:00:47 +0000