The Crypto Economy Reaches $1.74 Trillion as Bitcoin Hits $45K

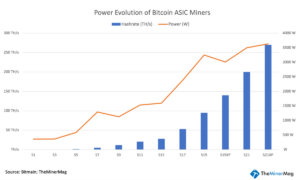

The digital currency market has experienced a significant surge, reaching a valuation of $1.74 trillion in the past 24 hours. Bitcoin, in particular, has climbed above the $45K threshold, showcasing a 4.65% increase in comparison to the U.S. dollar. Additionally, global trading volume has seen a substantial rise of 20% from Monday.

Crypto Sector Grows Amidst ETF Speculation and Pre-Halving Optimism

Fueling this growth is the anticipation of a potential approval for a spot bitcoin exchange-traded fund (ETF) this week. As a result, the entire crypto sector has witnessed a 4.65% increase in the last 24 hours. Bitcoin, the leading cryptocurrency, achieved a peak of $45,922 during the day, although it has since receded to the vicinity of the $45,500 range. Other top ten crypto assets have also experienced gains, with solana (SOL) leading the pack with more than an 8% increase.

Bitcoin and Ethereum Show Positive Movement

Bitcoin has risen by 6.4% while ethereum (ETH) has seen a spike of 4% higher on Tuesday at 8 a.m. Eastern Time (ET). Bitcoin's market valuation dominates the market by 50.8%, while ether's market cap accounts for 16.5% of the $1.74 trillion crypto economy. The surge above the $45K range for bitcoin has resulted in nearly $84 million in short liquidations, according to coinglass.com statistics. Ethereum shorts saw $25.96 million wiped out, and solana (SOL) short positions witnessed $10 million erased.

Altcoins Experience Double-Digit Gains

In addition to bitcoin and ethereum, several altcoins have seen significant gains as well. Sei (SEI), astar (ASTR), and ordi (ORDI) have recorded gains between 15% to 22% over the past day. Moreover, all three have also experienced increases between 24% to 55% against the U.S. dollar over the past seven days.

Market Losers Amidst Overall Growth

Despite the broad market rise, bitcoinsv (BSV), helium (HNT), and maker (MKR) have seen losses between 2.8% to 6.3%. However, the overall market sentiment remains optimistic as it awaits the potential approval of a spot bitcoin ETF in the United States. With bitcoin surpassing the $45K mark and the upcoming halving in April, there is an expectation for further value appreciation. These developments, along with regulatory and technological advancements, paint a bullish picture for the future of cryptocurrencies.

Share Your Thoughts on the Crypto Market

What are your thoughts on the recent market action in the crypto economy? Feel free to share your opinions and insights in the comments section below.

Frequently Asked Questions

Is gold a good investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It is also an excellent way to diversify you portfolio. There is much more to gold than meets your eye.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

Gold is not created by governments, but it is extracted from the earth. It's hard to find and very rare, making it extremely valuable.

The supply and demand for gold determine the price of gold. When the economy is strong, people tend to spend more money, which means fewer people mine gold. Gold's value rises as a result.

The flip side is that people tend to save money when the economy slows. This leads to more gold being produced which decreases its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you have gold to invest, you will reap the rewards when the economy expands.

Additionally, you'll earn interest on your investments which will help you grow your wealth. Plus, you won't lose money if the value of gold drops.

How much of your IRA should include precious metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. They don't require you to be wealthy to invest in them. There are many methods to make money off of silver and gold investments.

You might also be interested in buying physical coins, such bullion rounds or bars. Also, you could buy shares in companies producing precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

Regardless of your choice, you'll still benefit from owning precious metals. Even though they aren't stocks, they still offer the possibility of long-term growth.

And unlike traditional investments, they tend to increase in value over time. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

Should You Invest in Gold for Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you are unsure of which option to invest in, consider both.

You can earn potential returns on your investment of gold. Retirement investors will find gold a worthy investment.

Most investments have fixed returns, but gold's volatility is what makes it unique. As a result, its value changes over time.

But this doesn't mean you shouldn't invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is much easier to store than bonds and stocks. It is also easily portable.

As long as you keep your gold in a secure location, you can always access it. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. When the stock market drops, gold usually rises instead.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Do not buy too much at one time. Start by purchasing a few ounces. You can add more as you need.

Keep in mind that the goal is not to quickly become wealthy. It is to create enough wealth that you no longer have to depend on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's not exactly legal – WSJ

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement funds

How To

Online buying gold and silver is the best way to purchase it.

First, understand the basics of gold. It is a precious metal that is very similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types today of gold coins. One is legal tender while the other is bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They can't be exchanged in currency exchange systems. A person can buy 100 grams of gold for $100. For every dollar spent, the buyer gets 1 gram of Gold.

You should also know where to buy your gold. There are a few options if you wish to buy gold directly from a dealer. First, you can visit your local coin store. You might also consider going through a reputable online seller like eBay. You can also look into buying gold online from private sellers.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. Private sellers will charge you a 10% to 15% commission for every transaction. You would receive less money from a private buyer than you would from a coin store or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

The other option is to purchase physical gold. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

A bank or pawnshop can help you buy gold. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks often charge higher interest rates then pawnshops.

You can also ask for help to purchase gold. Selling gold can be as easy as selling. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Bitcoin Surges Over $45K as Market Anticipates ETF Approval and Halving

Sourced From: news.bitcoin.com/bitcoin-soars-past-45k-as-market-eyes-etf-approval-setting-stage-for-aprils-halving/

Published Date: Tue, 02 Jan 2024 14:30:46 +0000