Potential for a Price Rise

Bitcoin has experienced a remarkable surge of over 150% in 2023, grabbing the attention of Wall Street and sparking a race among firms to launch the first Bitcoin exchange-traded fund (ETF).

All eyes are now on the U.S. Securities and Exchange Commission (SEC) as they prepare to make a decision on the approval of a spot Bitcoin ETF, scheduled for January 10.

If history is any indication, this ruling will have a significant impact on the price of Bitcoin, although the direction of this impact remains uncertain.

Advocates of a Bitcoin ETF argue that its approval by the SEC would pave the way for a flood of institutional and retail investments, driving the price of Bitcoin to new heights.

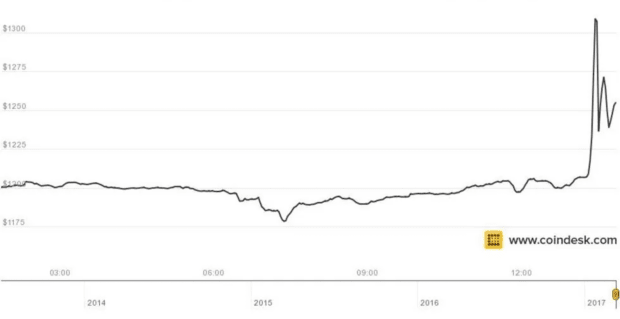

A look at past events reveals how the expectation of ETFs has influenced Bitcoin's price. In 2017, the price of Bitcoin surged to over $1,400, driven by the anticipation of the first Bitcoin ETF. This was a significant increase from its previous lows in the $600 range.

Investors believed that the introduction of a Bitcoin ETF would facilitate the entry of institutional money into the market, leading to a buying frenzy. However, the SEC ultimately rejected the proposal, resulting in a sharp decline in Bitcoin's price. Within days, the price dropped below $1,000.

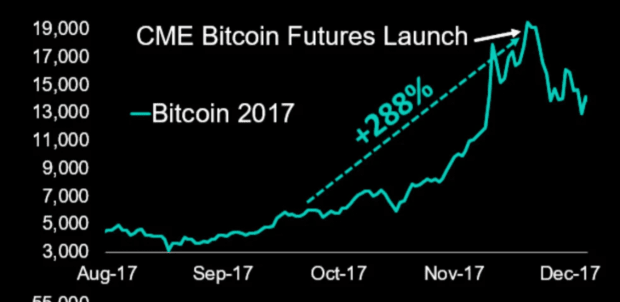

Nevertheless, the introduction of Bitcoin futures in 2017 brought renewed attention, and the market surged above $20,000 that year.

Fast forward to 2021, Bitcoin once again reached all-time highs, surpassing $60,000. The successful launch of Bitcoin futures ETFs in Canada and Europe played a role in this rally. These ETFs allowed investors to gain exposure to Bitcoin without directly holding the cryptocurrency. The anticipation of a similar product in the U.S. contributed to the bullish sentiment.

Earlier this year, the spread of fake news regarding ETF approval caused Bitcoin's price to rise by several thousand dollars within minutes. This suggests that approval could result in significant upside volatility.

Potential for a Price Fall

On the other hand, there are arguments suggesting that the approval of a Bitcoin ETF could lead to a price correction.

Some market experts express concerns that the ETF could become a target for short sellers, increasing volatility. They also speculate that the ETF approval could be a "sell the news event."

Furthermore, approval of a Bitcoin ETF may subject the cryptocurrency market to greater regulatory scrutiny. This increased oversight could lead to higher taxation, reporting requirements, and potential restrictions on the use of Bitcoin, which may dampen investor enthusiasm.

In addition, some believe that the market may have already priced in the possibility of a Bitcoin ETF approval. A decision to deny it could result in disappointment and a sell-off, similar to what occurred in 2017 when the Winklevoss Bitcoin ETF was rejected.

While the SEC's final decision is eagerly awaited by the crypto community, it is crucial to remember that it is just one of many factors influencing Bitcoin's price.

Market sentiment, macroeconomic conditions, and geopolitical events will also play a significant role in shaping the future of the coin.

Conclusion

In conclusion, the price of Bitcoin stands at a crossroads as investors eagerly anticipate the SEC's decision on the Bitcoin ETF.

Previous instances have shown that ETF expectations can have a substantial impact on Bitcoin's price. However, it is essential to consider the broader market dynamics.

Whether Bitcoin's price rises or falls after the SEC ruling will depend on various factors, including how the market interprets and reacts to the decision.

As the crypto world anxiously awaits this decision, the future of Bitcoin remains uncertain. Nevertheless, it undeniably marks a pivotal moment for the world's only decentralized cryptocurrency.

Frequently Asked Questions

Should you Invest In Gold For Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. If you are unsure which option to choose, consider investing in both options.

Not only is it a safe investment but gold can also provide potential returns. It's a great investment for retirees.

While most investments offer fixed rates of return, gold tends to fluctuate. As a result, its value changes over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold can be stored more easily than stocks and bonds. It can also be transported.

As long as you keep your gold in a secure location, you can always access it. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold usually rises when the stock market falls.

Another benefit to investing in gold? You can always sell it. You can also liquidate your gold position at any time you need cash, just like stocks. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

You shouldn't buy too little at once. Start small, buying only a few ounces. Next, add more as required.

Don't expect to be rich overnight. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

How much is gold taxed under a Roth IRA

The tax on an investment account is based on its current value, not what you originally paid. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These accounts are subject to different rules depending on where you live. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to wait until April 1. New York is open until 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

What should I pay into my Roth IRA

Roth IRAs are retirement accounts where you deposit your own money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, you can't touch your principal (the initial amount that was deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule says that you cannot withdraw your earnings without paying income tax. So, when you withdraw, you'll pay taxes on those earnings. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's further assume you earn $10,000 annually after contributing. You would owe $3,500 in federal income taxes on the earnings. You would have $6,500 less. You can only take out what you originally contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs won't let you deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Is buying gold a good way to save money for retirement?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

Physical bullion is the most popular method of investing in gold. But there are many other options for investing in gold. You should research all options thoroughly before making a decision on which option you prefer.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. If you require cash flow, gold stocks can work well.

ETFs are an exchange-traded investment that allows you to gain exposure to the market for gold. You hold gold-related securities and not actual gold. These ETFs usually include stocks of precious metals refiners or gold miners.

What are the benefits to having a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It will be tax-deferred up until the time you withdraw it. You control how much you take each year. There are many types to choose from when it comes to IRAs. Some are more suitable for students who wish to save money for college. Some are for investors who seek higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. This account is a good option if you plan to retire early.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. For people who would rather invest than spend their money, gold IRA accounts are a good option.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. It means that you don’t have to remember to make deposits every month. To ensure that you never miss a payment, you could set up direct debits.

Finally, gold remains one of the best investment options today. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in times of economic turmoil gold prices tend to remain stable. As a result, it's often considered a good choice when protecting your savings from inflation.

Who owns the gold in a Gold IRA?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Some experts think that this could change in the near future. According to them, gold prices could soar if there is another financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

Consider these things if you are thinking of investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It is possible to save for retirement while still investing your gold savings. The added protection that gold provides when you retire is a good option.

- Second, ensure you fully understand the risks involved in buying gold. Each account offers different levels of security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. You may lose your gold coins and never be able to recover them.

You should do your research before buying gold. Make sure to protect any gold you already own.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

finance.yahoo.com

How To

Guidelines for Gold Roth IRA

You should start investing early to ensure you have enough money for retirement. It is best to start saving for retirement as soon you can (typically at age 50). You must contribute enough each year to ensure that you have adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles let you make contributions and not pay taxes until the earnings are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

Save regularly and continue to save over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————-

By: Reed Macdonald

Title: Bitcoin ETF Approval: Potential Impact on Bitcoin's Price

Sourced From: bitcoinmagazine.com/markets/why-the-bitcoin-price-will-rise-or-fall-on-the-secs-spot-etf-ruling

Published Date: Tue, 02 Jan 2024 13:49:59 GMT