Bitcoin's recent price volatility has sparked curiosity regarding whether large-scale bitcoin hodlers are capitalizing on price dips to amass more bitcoin. While initial metrics may suggest an uptick in long-term holdings, a deeper analysis unveils a more intricate narrative, especially amidst the current extended period of choppy consolidation.

Long-Term Holders and Accumulation Trends

At first glance, it appears that long-term Bitcoin holders are increasing their holdings. Based on the Long Term Holder Supply data, there has been a rise from 14.86 million to 15.36 million BTC since July 30th. This surge of approximately 500,000 BTC has led to speculation that long-term holders are actively leveraging price dips, potentially laying the groundwork for a significant price rally.

However, this interpretation may be misleading. Long-term holders are defined as wallets that have held BTC for 155 days or more. As we have recently crossed the 155-day mark since the last all-time high, it is probable that many short-term holders from that period have transitioned into the long-term category without engaging in new accumulation. These investors are now holding onto their BTC, anticipating higher prices. Therefore, this chart alone does not necessarily signify fresh buying activity from established market participants.

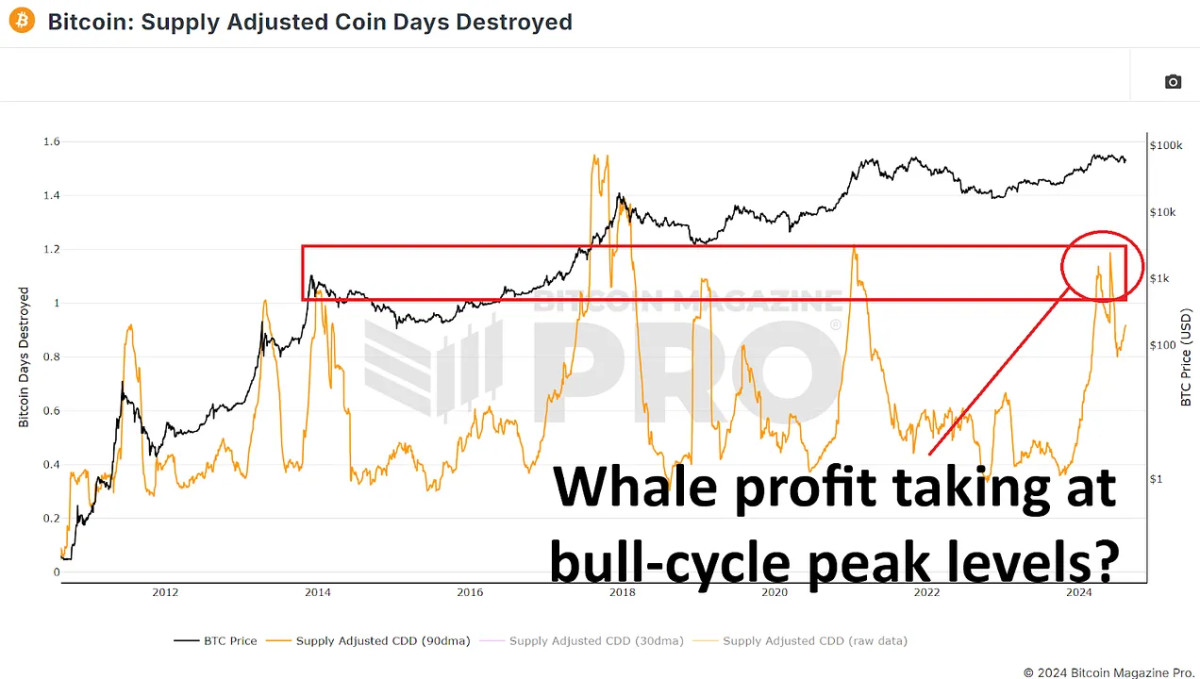

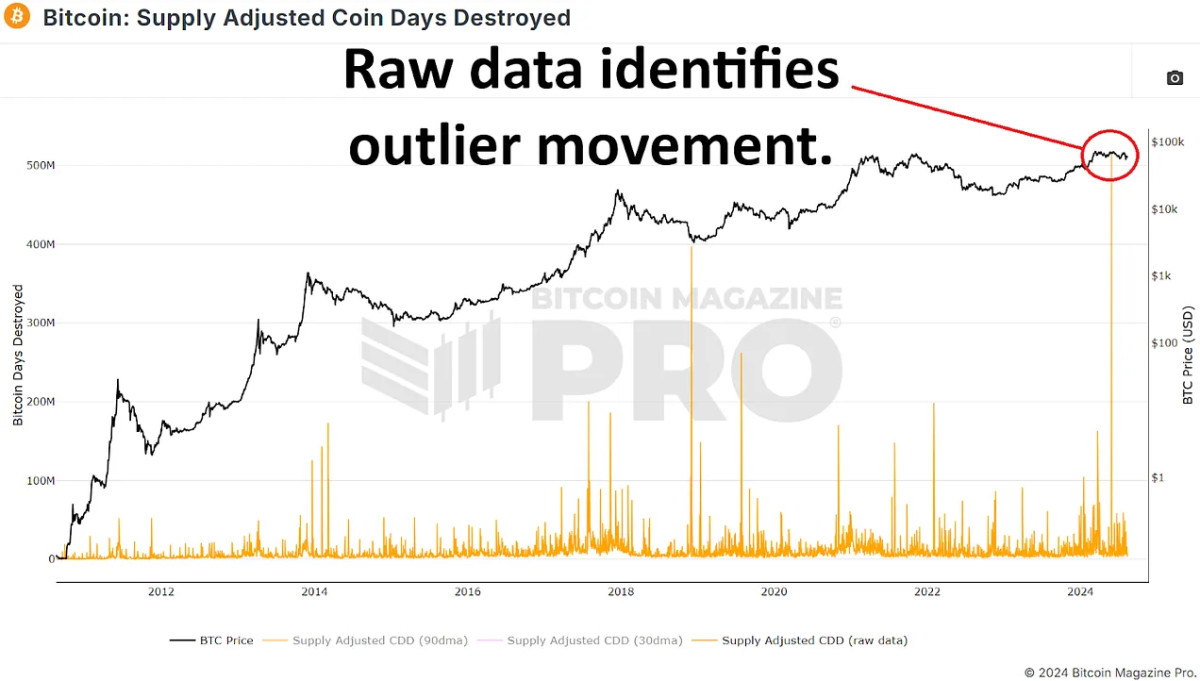

Understanding Coin Days Destroyed

Examining the Supply Adjusted Coin Days Destroyed metric over the past 155 days can offer insights into the behavior of long-term holders. This metric evaluates the velocity of coin movement, giving more weight to coins held for extended durations. An increase in this metric could indicate that long-term holders with a significant amount of bitcoin are actively moving their coins, implying more selling rather than accumulating.

While there has been a notable rise in this data, primarily influenced by a single substantial transaction of around 140,000 BTC from a known Mt. Gox wallet on May 28, 2024, excluding this outlier reveals a more typical data pattern for this market cycle stage, akin to periods in late 2016 and early 2017 or mid-2019 to early 2020.

Analysis of Whale Wallet Behavior

To ascertain whether whales are purchasing or offloading bitcoin, analyzing wallets holding substantial coin volumes is essential. By examining wallets with a minimum of 10 BTC (equivalent to approximately $600,000 at current prices), we can gauge the activities of significant market participants.

Following Bitcoin's peak earlier this year, there has been a marginal increase in the number of wallets holding at least 10 BTC. Similarly, wallets holding 100 BTC or more have experienced a slight uptick. However, a reversal in this trend is observed for larger wallets holding 1,000 BTC or more, indicating a minor decrease. Particularly noteworthy is the decline in wallets holding 10,000 BTC or more from 109 to 104 in recent months, suggesting that some major holders may be taking profits or redistributing their holdings across smaller wallets.

Impact of ETFs and Institutional Inflows

Bitcoin ETFs, with assets under management peaking at $60.8 billion on March 14th, have witnessed a subsequent AUM decrease of approximately $6 billion. While this decrease appears significant, when factoring in the price decline of bitcoin since the all-time high, it roughly offsets the amount of newly mined Bitcoin during the same period. ETFs have helped alleviate selling pressure from miners and potentially large holders but have not accumulated enough to substantially impact the price positively.

Emergence of Retail Interest

Interestingly, amidst indications of significant selling by big holders, there has been a notable surge in smaller wallets (holding between 0.01 and 10 BTC) accumulating bitcoin. These smaller wallets have added tens of thousands of BTC, showcasing heightened interest from retail investors. While there has been a net shift of around 60,000 bitcoin from wallets holding 10+ BTC to those with less than 10 BTC, this redistribution is a common occurrence throughout a bull cycle and does not raise immediate concerns.

The prevailing narrative of whales accumulating bitcoin amidst price dips and choppy market conditions appears unsubstantiated. While long-term holder supply metrics may initially appear positive, they predominantly reflect the shift of short-term holders to the long-term category rather than new accumulation.

The rise in retail holdings and the stabilizing effect of ETFs could lay a robust foundation for future price growth, particularly if there is renewed institutional interest and sustained retail inflows post-halving. However, these factors currently contribute minimally to any potential Bitcoin price appreciation.

The pivotal question remains whether the ongoing distribution phase transitions into a new accumulation phase, potentially propelling Bitcoin to new highs in the upcoming months, or if the flow of old coins to newer participants persists, dampening the upside potential for the remainder of the bull cycle.

For a comprehensive analysis on this topic, watch our recent YouTube video discussing the continued behavior of Bitcoin whales during market fluctuations. Additionally, explore our latest video on enhancing one of the fundamental bitcoin metrics.

Frequently Asked Questions

What are the pros & cons of a Gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. However, there are disadvantages to this type investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. A penalty fee will be charged if you decide to withdraw funds.

A disadvantage to managing your IRA is the fact that fees must be paid. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Insurance companies will usually require that you have at least $500,000. Insurance that covers losses upto $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers limit how many ounces you can keep. Others allow you the freedom to choose your own weight.

It's also important to decide whether or not to buy gold futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts provide flexibility for purchasing gold. You can set up futures contracts with a fixed expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. However, it does cover damage caused by natural disasters. You might consider purchasing additional coverage if your area is at high risk.

You should also consider the cost of storage for your gold. Storage costs will not be covered by insurance. For safekeeping, banks typically charge $25-40 per month.

If you decide to open a gold IRA, you must first contact a qualified custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians cannot sell your assets. Instead, they must retain them for as long and as you require.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. The plan should also include information about how much you are willing to invest each month.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. After receiving your application, the company will review it and mail you a confirmation letter.

You should consult a financial planner before opening a Gold IRA. Financial planners are experts at investing and can help you determine which type of IRA is best for you. They can help you find cheaper insurance options to lower your costs.

What Should Your IRA Include in Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. You don't need to be rich to make an investment in precious metals. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. Shares in precious metals-producing companies could be an option. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You can still get benefits from precious metals regardless of what choice you make. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices rise with time, which is a different to traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

How much should you have of gold in your portfolio

The amount you make will depend on the amount of capital you have. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. You only pay one month.

Consider what type of business your company will be running. My website design company charges clients $1000-2000 per month depending on the order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You may get paid just once every 6 months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Can I hold physical gold in my IRA?

Not only is gold paper currency, but it's also money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

One reason is that gold historically performs better than other assets during financial panics. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

The best thing about gold investing is the fact that there's virtually no counterparty risk. Even if your stock portfolio is down, your shares are still yours. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold is liquid. This allows you to sell your gold whenever you want, unlike many other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows for you to benefit from the short-term fluctuations of the gold market.

How much should precious metals be included in your portfolio?

Before we can answer this question, it is important to understand what precious metals actually are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Gold is by far the most common precious metal traded today.

There are also many other precious metals such as platinum and silver. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also not affected by inflation and depression.

In general, all precious metals have a tendency to go up with the market. They do not always move in the same direction. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors expect lower interest rates which makes bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They become less expensive and have a lower value because they are limited.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

How do I open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). To open the account, complete Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form must be submitted within 60 days of the account opening. Once this is done, you can start investing. You can also contribute directly to your paycheck via payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS stipulates that you must have earned income and be at least 18-years old. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, physical bullion will not be available for purchase. This means that you will not be allowed to trade shares or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option can be provided by some IRA companies.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they aren't as liquid than stocks and bonds. This makes them harder to sell when needed. Second, they are not able to generate dividends as stocks and bonds. So, you'll lose money over time rather than gain it.

Which precious metals are best to invest in retirement?

Gold and silver are the best precious metal investments. Both are easy to sell and can be bought easily. These are great options to diversify your portfolio.

Gold: The oldest form of currency known to man is gold. It is stable and very secure. This makes it a good option to preserve wealth in uncertain times.

Silver: Investors have always loved silver. This is a great choice for people who want to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinum: This precious metal is also becoming more popular. It's durable and resists corrosion, just like gold and silver. It's also more expensive than the other two.

Rhodium. Rhodium is used as a catalyst. It is also used in jewelry-making. It is also quite affordable compared with other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also more affordable. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

How To

Investing gold vs. stocks

These days, it might seem quite risky to invest your money in gold. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief stems from the fact that most people see gold prices being driven down by the global economy. People believe that investing in gold would result in them losing money. In reality, however, there are still significant benefits that you can get when investing in gold. We'll be looking at some of these benefits below.

One of the oldest forms known of currency is gold. It has been used for thousands of years. It was used all around the world as a reserve of value. It continues to be used in South Africa, as a way of paying their citizens.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. Although the price of gold has dropped, production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. But, if your goal is to make long-term investments in gold, this might be worth considering. It is possible to make a profit by selling your gold at higher prices than when you purchased it.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. Before making any investment decisions, we strongly advise that you thoroughly research all options. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Are Bitcoin Whales Accumulating Bitcoin During Price Dips?

Sourced From: bitcoinmagazine.com/markets/are-bitcoin-whales-buying-the-dip-

Published Date: Fri, 16 Aug 2024 19:14:05 GMT