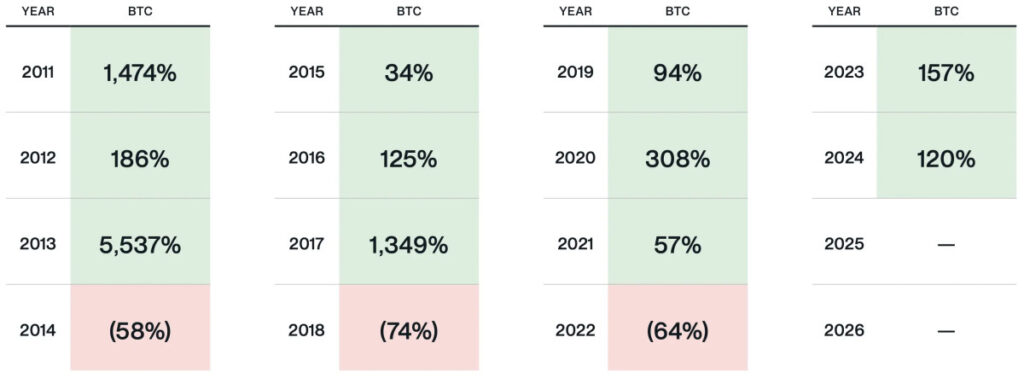

The Bitcoin market has long been defined by its seemingly immutable four-year cycle, a pattern of three years of surging prices followed by a sharp correction. However, a seismic shift in policy from Washington, led by former President Donald Trump, may shatter this cycle and usher in a new era of prolonged growth for the cryptocurrency industry.

The Four-Year Cycle: A Recap

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, recently posed an intriguing question: Can Trump’s Executive Order break crypto’s four-year cycle? His answer, though nuanced, leans towards an emphatic yes.

Hougan clarifies his personal belief that the four-year Bitcoin market cycle is not driven by Bitcoin's halving events. He states, "People try to link it to bitcoin’s quadrennial ‘halving,’ but those halvings are misaligned with the cycle, having occurred in 2016, 2020, and 2024."

Bitcoin’s four-year cycle has been historically driven by a mix of investor sentiment, technological breakthroughs, and market dynamics. Typically, a bull run emerges following a significant catalyst—be it infrastructure improvements or institutional adoption—which attracts new capital and fuels speculation. Over time, leverage accumulates, excesses emerge, and a major event—such as regulatory crackdowns or financial fraud—triggers a brutal correction.

The Executive Order: A Game Changer

The fundamental question Hougan explores is whether Trump’s recent Executive Order, which prioritizes the development of the digital asset ecosystem in the U.S., will disrupt the established cycle. The order, which outlines a clear regulatory framework and even envisions a national digital asset stockpile, represents the most bullish stance on Bitcoin from any sitting or former U.S. president.

The implications are profound:

Regulatory Clarity: By eliminating legal uncertainty, the EO paves the way for institutional capital to flow into Bitcoin at an unprecedented scale.

Wall Street Integration: With the SEC and financial regulators now pro-crypto, major banks can enter the space, offering Bitcoin custody, lending, and structured products to their clients.

Government Adoption: The concept of a national digital asset stockpile hints at a future where the U.S. Treasury could hold Bitcoin as a reserve asset, solidifying its status as digital gold.

The End of Crypto Winters?

If history were to repeat itself, Bitcoin would continue its ascent through 2025 before facing a significant pullback in 2026. However, Hougan suggests this time may be different. While he acknowledges the risk of speculative excess and leverage-driven bubbles, he argues that the sheer scale of institutional adoption will prevent the kind of prolonged bear markets seen in the past.

This is a crucial distinction. In previous cycles, Bitcoin lacked a strong base of value-oriented investors. Today, with ETFs making it easier for pensions, hedge funds, and sovereign wealth funds to allocate to Bitcoin, the asset is no longer solely dependent on retail enthusiasm. The result? Corrections may still occur, but they will likely be shallower and shorter-lived.

What Comes Next?

Bitcoin has already crossed the $100,000 mark, and projections from industry leaders, including BlackRock CEO Larry Fink, suggest it could reach $700,000 in the coming years. If Trump’s policies accelerate institutional adoption, the typical four-year pattern could be replaced by a more traditional asset-class growth trajectory—akin to how gold responded to the end of the gold standard in the 1970s.

While risks remain—including unforeseen regulatory reversals and excessive leverage—the direction of travel is clear: Bitcoin is becoming a mainstream financial asset. If the four-year cycle was driven by Bitcoin’s infancy and speculative nature, its maturation may render such cycles obsolete.

Conclusion

For over a decade, investors have used the four-year cycle as a roadmap for Bitcoin’s market movements. But Trump’s Executive Order could be the defining moment that disrupts this pattern, replacing it with a more sustained and institutionally-driven growth phase. As Wall Street, corporations, and even governments increasingly embrace Bitcoin, the question is no longer if crypto winter will come in 2026—but rather if it will come at all.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough independent research before making investment decisions.

Frequently Asked Questions

How Much of Your IRA Should Include Precious Metals?

You should remember that precious metals are not only for the wealthy. You don't need to be rich to make an investment in precious metals. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. You could also buy shares in companies that produce precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And unlike traditional investments, they tend to increase in value over time. If you decide to sell your investment, you will likely make more than with traditional investments.

Should You Invest Gold in Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you're unsure about which option to choose then consider investing in both.

In addition to being a safe investment, gold also offers potential returns. Retirees will find it an attractive investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. This causes its value to fluctuate over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit of gold is that it's a tangible asset. Unlike stocks and bonds, gold is easier to store. It can also be carried.

You can always access gold as long your place it safe. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold tends to rise when the stock markets fall.

Investing in gold has another advantage: you can sell it anytime you want. As with stocks, your position can be liquidated whenever you require cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start with just a few drops. You can add more as you need.

Remember, the goal here isn't to get rich quickly. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Are gold investments a good idea for an IRA?

For anyone who wants to save some money, gold can be a good investment. It's also a great way to diversify your portfolio. But there is more to gold than meets the eye.

It has been used throughout the history of currency and remains a popular payment method. It's often referred to as “the world's oldest currency.”

Gold is not created by governments, but it is extracted from the earth. This makes it highly valuable as it is hard and rare to produce.

The supply and demand factors determine how much gold is worth. The economy that is strong tends to be more affluent, which means there are less gold miners. This results in gold prices rising.

The flip side is that people tend to save money when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why it makes sense to invest in gold for individuals and companies. You'll reap the benefits of investing in gold when the economy grows.

Additionally, you'll earn interest on your investments which will help you grow your wealth. Additionally, you won't lose cash if the gold price falls.

What is a Precious Metal IRA (IRA)?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These are “precious metals” because they are hard to find, and therefore very valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Precious metals are often referred to as “bullion.” Bullion refers actually to the metal.

Bullion can be bought via various channels, such as online retailers, large coin dealers and grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. You'll get dividends each year.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. Instead, you pay a small percentage tax on the gains. Plus, you can access your funds whenever you like.

What is the best precious metal to invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. If you are looking for quick profits, gold might not be the right investment. If you have the patience to wait, then you might consider investing in silver.

Gold is the best investment if you aren't looking to get rich quick. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

irs.gov

cftc.gov

bbb.org

How To

How to Hold Physical Gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. But, this approach comes with risks. These companies may not survive the next few years. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

The alternative is to buy physical gold. You will need to either open an online or bank account or simply buy gold from a reliable seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It is also easier to check how much gold you have stored. You will receive a receipt detailing exactly what you paid. You're also less susceptible to theft than investing with stocks.

There are also some drawbacks. You won't be able to benefit from investment funds or interest rates offered by banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, the taxman might want to know where your gold has been placed!

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: The Impact of Trump’s Executive Order on Bitcoin’s Four-Year Cycle

Sourced From: bitcoinmagazine.com/markets/will-trumps-executive-order-break-bitcoins-four-year-market-cycle-

Published Date: Thu, 30 Jan 2025 17:24:24 GMT