As we look ahead to 2025, it's crucial to adopt a methodical and data-driven approach to forecast what lies in store for Bitcoin. By analyzing on-chain data, market cycles, macroeconomic trends, and more, we can move beyond mere speculation and craft a well-informed outlook for the months ahead.

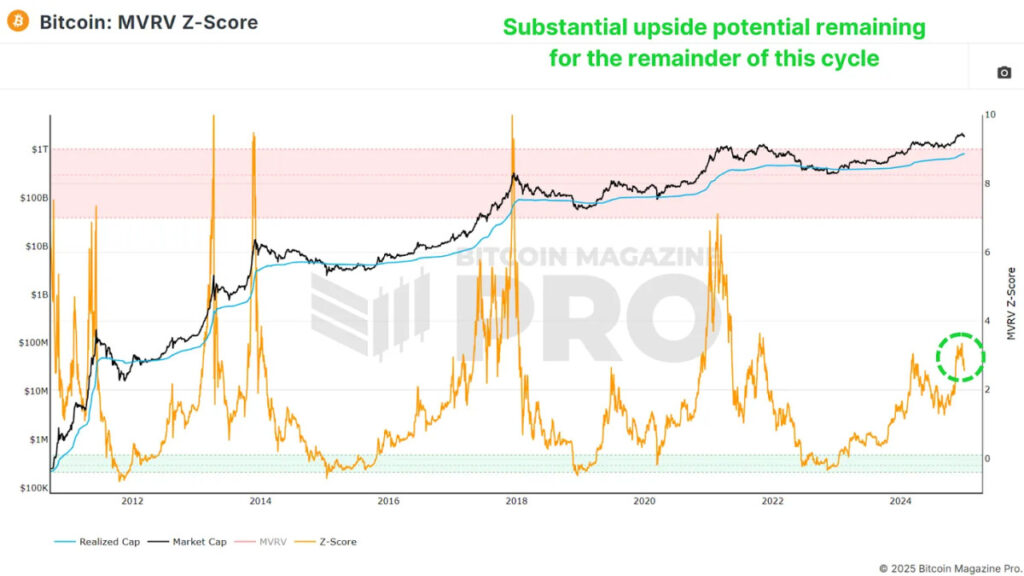

Understanding the MVRV Z-Score

The MVRV Z-Score assesses the relationship between Bitcoin's realized price (the average buying price of all BTC on the network) and its market capitalization. By standardizing this ratio for volatility, we derive the Z-Score, a metric that historically offers valuable insights into market cycles.

Presently, the MVRV Z-Score indicates significant potential for upside growth. While past cycles have witnessed Z-Score values exceeding 7, a value above 6 typically signals overextension, necessitating a closer examination of other metrics to pinpoint a potential market peak. Currently, we find ourselves at levels akin to those of May 2017 when Bitcoin's value was a mere few thousand dollars. Given this historical context, there remains ample room for substantial percentage gains from current levels.

The Pi Cycle Top and Bottom Indicator

Another pivotal metric is the Pi Cycle Top and Bottom indicator, which monitors the 111-day and 350-day moving averages (the latter multiplied by 2). Historically, the convergence of these averages often heralds a Bitcoin price peak within a matter of days.

The increasing separation between these two moving averages suggests a resurgence in bullish momentum. While 2024 witnessed phases of sideways consolidation, the breakout underway indicates Bitcoin's entry into a more robust growth phase that could potentially extend over several months.

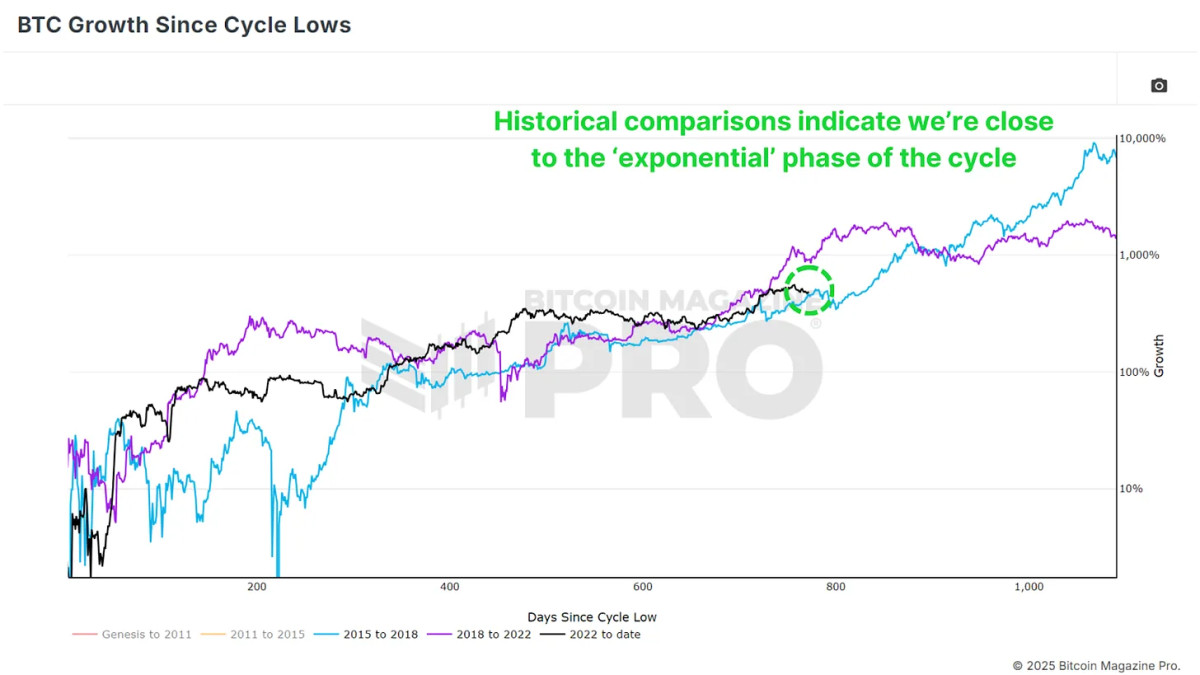

Anticipating Bitcoin's Growth Trajectory

An examination of Bitcoin's historical price movements reveals that cycles typically feature a "post-halving cooldown" lasting 6–12 months before transitioning into a phase of exponential growth. Drawing from past cycles, we are approaching this critical juncture. While we anticipate diminishing returns compared to earlier cycles, substantial gains remain plausible.

For context, surpassing the previous all-time peak of $20,000 during the 2020 cycle culminated in a peak near $70,000—a threefold increase. Even a conservative 2x or 3x surge from the last peak of $70,000 could propel Bitcoin to reach $140,000–$210,000 in the current cycle.

Macro Economic Factors and Bitcoin's Outlook

Despite challenges in 2024, Bitcoin exhibited resilience, particularly in light of a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY exhibit an inverse relationship, implying that any weakening of the DXY could further bolster Bitcoin's upward trajectory.

Additional macroeconomic indicators, including high-yield credit cycles and the global M2 money supply, point towards a favorable environment for Bitcoin. The anticipated reversal of the money supply contraction observed in 2024 sets the stage for even more conducive conditions.

The Bitcoin Cycle Master Chart, which consolidates various on-chain valuation metrics, indicates that Bitcoin still has significant room for growth before entering an overvalued territory. The upper threshold, presently hovering around $190,000, continues to climb, reinforcing the narrative of sustained upward momentum.

With nearly all data aligning towards a bullish outlook for 2025, the indicators strongly suggest that Bitcoin's prime days may be yet to come, building on the positive momentum witnessed in 2024.

For a more detailed exploration of this subject, consider watching a recent YouTube video titled "Bitcoin 2025 – A Data Driven Outlook."

For comprehensive Bitcoin analysis and access to advanced tools such as live charts, personalized indicator alerts, and detailed industry reports, visit Bitcoin Magazine Pro.

Disclaimer: This article serves as an informational piece and should not be construed as financial advice. Always conduct thorough research before making investment decisions.

Frequently Asked Questions

Should You Open a Precious Metal IRA?

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. You cannot recover any money you have invested. This includes investments that have been damaged by fire, flooding, theft, and so on.

This type of loss can be avoided by investing in physical silver and gold coins. These items have been around thousands of years and are irreplaceable. These items are worth more today than they were when first produced.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Remember that you will not see any returns unless you are retired if you open an Account. So, don't forget about the future!

Should You Buy Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Some experts think that this could change in the near future. According to them, gold prices could soar if there is another financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some things you should consider when considering gold investing.

- Consider first whether you will need the money to save for retirement. It is possible to save for retirement while still investing your gold savings. However, you can still save for retirement without putting your savings into gold.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each offers varying levels of flexibility and security.

- Don't forget that gold does not offer the same safety level as a bank accounts. If you lose your gold coins, you may never recover them.

Do your research before you buy gold. Make sure to protect any gold you already own.

How to open a Precious Metal IRA

First, decide if an Individual Retirement Account is right for you. You must complete Form 8606 to open an account. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be completed within 60 days after opening the account. After this, you are ready to start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Contributions must be made on a regular basis. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. You won't have the ability to trade stocks or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option can be provided by some IRA companies.

However, investing in precious metals via an IRA has two serious drawbacks. First, they are not as liquid or as easy to sell as stocks and bonds. They are therefore more difficult to sell when necessary. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose money over time and not gain it.

Who owns the gold in a Gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

Consult a financial advisor or accountant to determine your options.

What proportion of your portfolio should you have in precious metals

First, let's define precious metals to answer the question. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them highly valuable for both investment and trading. Gold is currently the most widely traded precious metal.

There are many other precious metals, such as silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also not affected by inflation and depression.

In general, prices for precious metals tend increase with the overall marketplace. But they don't always move in tandem with one another. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They become less expensive and have a lower value because they are limited.

You must therefore diversify your investments in precious metals to reap the maximum profits. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

finance.yahoo.com

investopedia.com

cftc.gov

How To

Investing in gold vs. investing in stocks

It might seem risky to invest in gold as an investment vehicle these days. Many people believe that investing in gold is not profitable. This belief is based on the fact that gold prices are being driven down by global economic conditions. They feel that gold investment would cause them to lose money. In reality, however, there are still significant benefits that you can get when investing in gold. Here are some examples.

Gold is the oldest known form of currency. There are records of its use going back thousands of years. It is a valuable store of value that has been used by many people throughout the world. As a means of payment, South Africa and many other countries still rely on it.

The first point to consider when deciding whether or not you should invest in gold is what price you want to pay per gram. If you're interested in buying gold bullion, it is crucial that you decide how much per gram. If you don't know your current market rate, you could always contact a local jeweler and ask them what they think the price is.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. Although gold's price has fallen, its production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. If you plan to do so as long-term investments, it is worth looking into. If you sell your gold for more than you paid, you can make a profit.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend you do your research before making any final decisions. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Bitcoin Price Prediction 2025: A Data-Driven Analysis

Sourced From: bitcoinmagazine.com/markets/2025-bitcoin-outlook-insights-backed-by-metrics-and-market-data

Published Date: Fri, 03 Jan 2025 13:50:00 GMT