The Bitcoin Pi Cycle Top Indicator has achieved legendary status within the Bitcoin community due to its remarkable precision in identifying market cycle peaks. Developed by Philip Swift, Managing Director of Bitcoin Magazine Pro in April 2019, this indicator has consistently timed every Bitcoin cycle high with incredible accuracy, often within a mere three days. Will it continue to showcase its efficacy in this current cycle? Let's delve deeper into its functionality and significance in navigating Bitcoin's market cycles.

Understanding the Pi Cycle Top Indicator

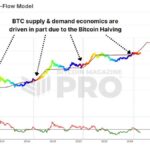

The Pi Cycle Top Indicator is a specialized tool crafted to pinpoint Bitcoin's market cycle tops. It operates by utilizing a combination of two moving averages to predict cycle highs:

- 111-Day Moving Average (111DMA): Represents the short-term price trend.

- 350-Day Moving Average x 2 (350DMA x 2): A multiple of the 350DMA, capturing the long-term trends.

When the 111DMA experiences a sharp rise and crosses over the 350DMA x 2, it historically aligns with Bitcoin's market cycle peak.

The Mathematical Foundation

An intriguing aspect of this indicator is that the ratio of 350 to 111 equates to approximately 3.153, closely resembling Pi (3.142). This numerical correlation not only gives the indicator its name but also underscores the cyclical nature of Bitcoin's price movements over time.

Factors Contributing to its Accuracy

The Pi Cycle Top Indicator has proven highly effective in forecasting the pinnacles of Bitcoin's three most recent market cycles. Its precision in identifying the absolute tops reflects the predictable nature of Bitcoin's cycles during its adoption phase. By signaling when the market reaches an overheated state, as evidenced by the sharp ascent of the 111DMA surpassing the 350DMA x 2, the indicator offers valuable insights for investors.

Utilizing the Indicator for Investment Decisions

For investors, the Pi Cycle Top Indicator serves as a crucial warning signal that the market may be nearing unsustainable levels. Historical data indicates that selling Bitcoin close to the cycle peak following the indicator's alert has been advantageous in maximizing gains and minimizing losses. However, as Bitcoin evolves and becomes more integrated into the global financial landscape, particularly with developments such as Bitcoin ETFs and institutional adoption, the indicator's effectiveness may diminish, remaining most relevant during Bitcoin's early adoption stages.

Looking Ahead

The pivotal question now revolves around the indicator's accuracy in this current cycle. With Bitcoin entering a new phase of adoption and market dynamics, its cyclic patterns may undergo changes. Nonetheless, given its consistent performance over Bitcoin's initial 15 years, the Pi Cycle Top Indicator continues to offer investors a reliable tool for assessing market peaks.

Concluding Remarks

The Pi Cycle Top Indicator stands as a testament to Bitcoin's cyclical behavior and the significance of mathematical models in decoding its price trends. While its track record of accuracy remains unparalleled, only time will reveal whether it can once again forecast Bitcoin's forthcoming market cycle peak. At present, it stands as an invaluable instrument for individuals navigating the exhilarating highs and lows of the Bitcoin market.

Frequently Asked Questions

Can I own a gold ETF inside a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

A traditional IRA allows for contributions from both employer and employee. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions made to IRAs are not taxable.

Who holds the gold in a gold IRA?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

To find out what options you have, consult an accountant or financial planner.

What precious metal is best for investing?

This question depends on how risky you are willing to take, and what return you want. Gold is a traditional haven investment. However, it is not always the most profitable. You might not want to invest in gold if you're looking for quick returns. Silver is a better investment if you have patience and the time to do it.

If you don’t desire to become rich quickly, gold may be your best option. Silver may be a better option for investors who want long-term steady returns.

Can I buy or sell gold from my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. These contracts allow you to speculate on future gold prices without actually owning it. You can only hold physical bullion, which is real silver and gold bars.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads, Example and Risk Metrics

finance.yahoo.com

How To

Tips for Investing Gold

One of the most sought-after investment strategies is investing in gold. This is because there are many benefits if you choose to invest in gold. There are many options for investing in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before you buy any type of gold, there are some things that you should think about.

- First, make sure you check if your country allows you own gold. If the answer is yes, you can go ahead. Or, you might consider buying gold overseas.

- Secondly, you should know what kind of gold coin you want. You can go for yellow gold, white gold, rose gold, etc.

- Third, consider the cost of gold. It is best to begin small and work your ways up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying your portfolio includes stocks, bonds, mutual funds, real estate, commodities, and mutual funds.

- Last but not least, remember that gold prices fluctuate frequently. Keep an eye on current trends.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: The Bitcoin Pi Cycle Top Indicator: A Reliable Tool for Timing Market Cycle Peaks

Sourced From: bitcoinmagazine.com/markets/the-bitcoin-pi-cycle-top-indicator-how-to-accurately-time-market-cycle-peaks

Published Date: Thu, 21 Nov 2024 18:01:32 GMT