Financial firms are feeling confident that the Securities and Exchange Commission (SEC) will approve spot Bitcoin Exchange-Traded Funds (ETFs) after January 8, 2024, according to Charles Gasparino of Fox Business. Gasparino's post also highlighted that Bitcoin ETF shares will only be purchasable with cash, as the SEC is concerned about the potential for money laundering through ETFs.

Regulatory Concerns Addressed in Meetings

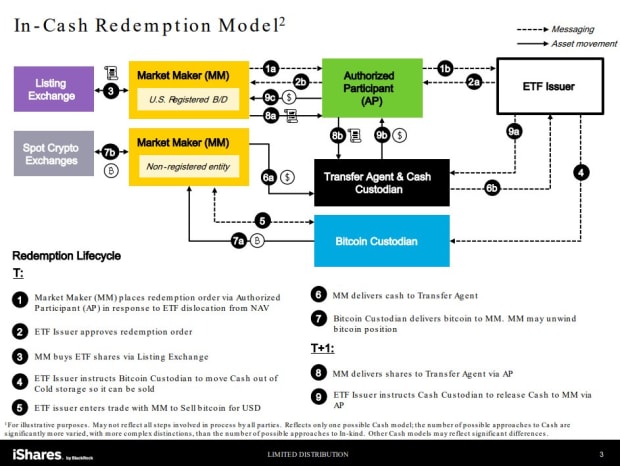

In recent weeks, spot Bitcoin ETF issuers, including BlackRock, have been engaging in discussions with the SEC to finalize the details of their proposed ETFs. One specific topic that the regulator has been focusing on is the choice between in-kind and in-cash creations for ETF shares. Bloomberg senior ETF analyst Eric Balchunas commented on this, stating that the SEC is worried about money laundering through in-kind creations in a spot Bitcoin ETF, which is why they are emphasizing cash creates only.

Earlier this week, BlackRock and other ETF issuers complied with the SEC's requirements and submitted their ETFs for in-cash creations. It is important to note that although the ETFs will hold spot Bitcoin, the process of purchasing shares will be conducted using cash. Investors will provide cash to their chosen ETF issuer, who will then use the funds to acquire spot Bitcoin for the ETF.

"BlackRock has decided to go cash only, settling the debate. In-kind creations will have to wait," stated Balchunas on Monday.

Potential Milestone for Bitcoin Integration

If the SEC approves these proposed Bitcoin ETFs, it would signify a significant milestone in the legitimization and integration of Bitcoin into traditional investment portfolios. Furthermore, it would indicate a shift in regulatory sentiment towards greater acceptance and regulation of Bitcoin.

Although the SEC has not released any official statements regarding these discussions, Gasparino's post has generated interest and optimism within the financial industry. Stakeholders are eagerly awaiting a potential approval around January 8.

Frequently Asked Questions

What is the best way to hold physical gold?

Not only is gold paper currency, but it's also money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans now invest in precious metals. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

Another reason is that gold has historically outperformed other assets in financial panic periods. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. During turbulent market conditions gold was one of few assets that outperformed stock prices.

The best thing about gold investing is the fact that there's virtually no counterparty risk. You still have your shares even if your stock portfolio falls. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold offers liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

How much are gold IRA fees?

The Individual Retirement Account (IRA), fee is $6 per monthly. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

In addition, most providers charge annual management fees. These fees range between 0% and 1 percent. The average rate is.25% each year. These rates are usually waived if you use a broker such as TD Ameritrade.

How much should you have of gold in your portfolio

The amount of capital required will affect the amount you make. If you want to start small, then $5k-$10k would be great. As your business grows, you might consider renting out office space or desks. This will allow you to pay rent monthly, and not worry about it all at once. You just pay per month.

You also need to consider what type of business you will run. In my case, we charge clients between $1000-2000/month, depending on what they order. You should also consider the expected income from each client when you do this type of thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. This means that you may only be paid once every six months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I recommend starting with $1k to $2k of gold, and then growing from there.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

cftc.gov

bbb.org

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

irs.gov

How To

How to Keep Physical Gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. This method is not without risks. There's no guarantee these companies will survive. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

You can also buy gold directly. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easier to see how much gold you've got stored. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. There's also less chance of theft than investing in stocks.

There are also some drawbacks. You won't get the bank's interest rates or investment money. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. The taxman might also ask you questions about where your gold is located.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————-

By: Nik Hoffman

Title: Firms Optimistic about SEC Approval of Spot Bitcoin ETFs, says Fox Business

Sourced From: bitcoinmagazine.com/markets/fox-business-firms-feel-confident-sec-will-approve-spot-bitcoin-etfs-after-january-8

Published Date: Wed, 20 Dec 2023 16:03:12 GMT

Related posts:

Blackrock Outlines Why SEC ‘Must’ Approve Spot Ethereum ETFs

Blackrock Outlines Why SEC ‘Must’ Approve Spot Ethereum ETFs

SEC’s Spot Bitcoin ETF Advice Fuels Hope for Approval — Crypto Industry Views It as ‘Real Progress’

SEC’s Spot Bitcoin ETF Advice Fuels Hope for Approval — Crypto Industry Views It as ‘Real Progress’

SEC Misses Appeal Window against Grayscale’s Spot Bitcoin ETF Decision

SEC Misses Appeal Window against Grayscale’s Spot Bitcoin ETF Decision

Coinbase Expects Spot Bitcoin ETFs to Boost Crypto Market Cap, SEC Approval Possible by Year-End

Coinbase Expects Spot Bitcoin ETFs to Boost Crypto Market Cap, SEC Approval Possible by Year-End