Bitcoin Takes the Lead in NFT Sales

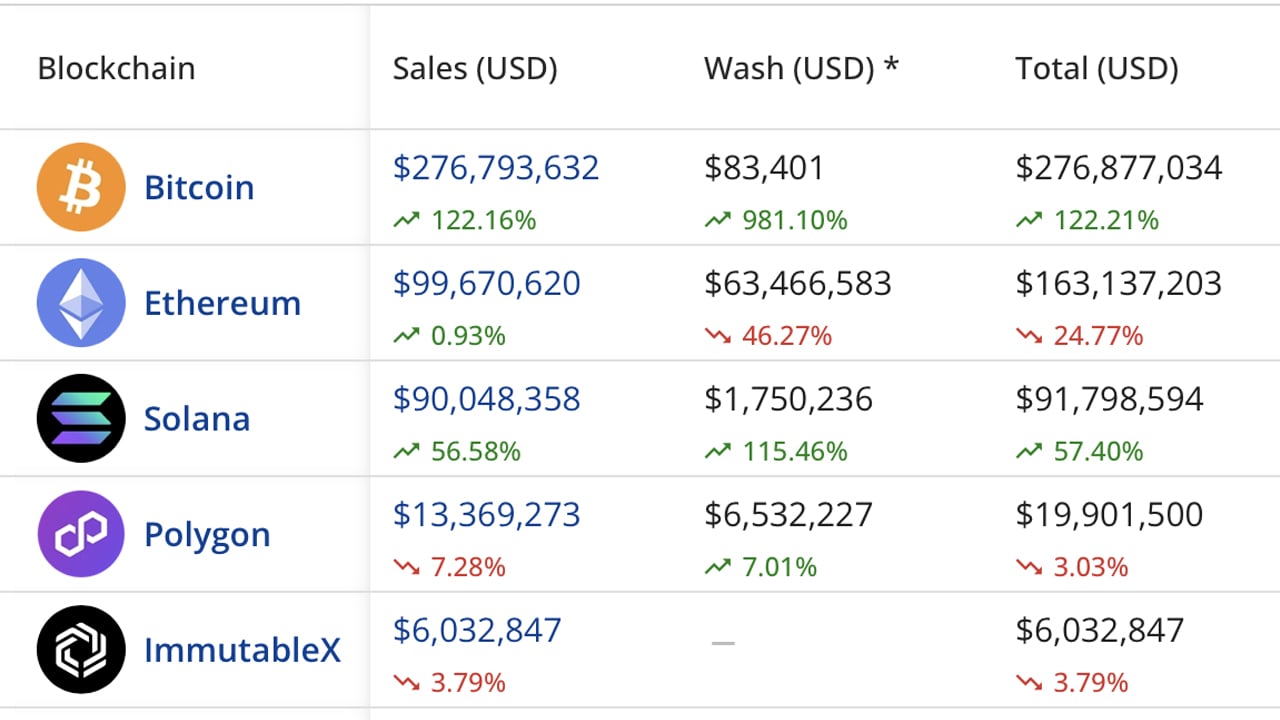

The non-fungible tokens (NFTs) market has experienced a remarkable surge in sales, with a 52.81% increase over the past week, reaching a total of $503.35 million. In this thriving market, Bitcoin has emerged as the frontrunner, generating $276.79 million in sales, surpassing Ethereum's $99.67 million, which previously held the top spot.

Bitcoin Dominates the Weekly NFT Sales

The total NFT sales for the week amounted to $503.35 million, with Bitcoin accounting for more than half of this figure. Bitcoin's sales of $276.79 million represented 54.98% of the total sales for the week. This period also witnessed a significant increase in market activity, with a 199.44% rise in buyers and a 193.20% surge in sellers of NFTs, according to statistics from cryptoslam.io.

Bitcoin's Strong Performance in NFT Sales

Bitcoin demonstrated a notably strong performance in NFT sales, with a 122.16% increase compared to the previous week, totaling $276.79 million. While Ethereum remains significant in the market, it only saw a modest week-over-week growth of 0.93%, amounting to $99.67 million.

Other Cryptocurrencies in the NFT Market

Solana also experienced a substantial rise in NFT sales, reaching $90.04 million, a 56.58% increase from the previous week. However, both Polygon and Immutable X witnessed declines in sales, dropping by 7.28% and 3.79%, respectively, compared to the previous week.

Bitcoin's Growing Influence in the NFT Sector

This week's data highlights Bitcoin's growing influence in the NFT sector. Eight out of the top ten NFT collections, in terms of weekly sales, originated from the Bitcoin blockchain. The leading seven collections are all Bitcoin-based, while the eighth and ninth positions were held by Ethereum's "Matr1x Kuku" and Solana's "Tensorians" compilation, respectively.

Notable NFT Sales

The most expensive NFT sale this week came from the Ethereum blockchain, with Fidenza #985 fetching $277K. Close behind was a Bitcoin-based NFT, an Ordinal inscription of a Van Gogh painting, which garnered $263K. Other notable sales originated from Solana, Avalanche, Cardano, and Polygon. The trend of inscription-based collectibles has made a significant impact on the crypto industry.

Bitcoin's Consistent Outperformance of Ethereum in NFT Sales

Throughout November and the first two weeks of December, Bitcoin has consistently outperformed Ethereum in NFT sales. This trend is relatively rare in this domain. The uptick in NFT sales and Bitcoin's latest lead signify the growing popularity and value of NFTs in the market.

What are your thoughts on the surge in NFT sales and Bitcoin's dominance? Share your opinions in the comments section below.

Frequently Asked Questions

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts think this could change quickly. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also point out that gold is becoming popular because of its perceived value and potential return.

Here are some things to consider if you're considering investing in gold.

- Consider first whether you will need the money to save for retirement. It is possible to save for retirement while still investing your gold savings. However, you can still save for retirement without putting your savings into gold.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each offers varying levels of flexibility and security.

- Keep in mind that gold may not be as secure as a bank deposit. Losing your gold coins could result in you never being able to retrieve them.

So, if you're thinking about buying gold, make sure you do your research first. You should also ensure that you do everything you can to protect your gold.

What precious metal should I invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has been considered a safe investment, it is not always the most lucrative. Gold may not be right for you if you want quick profits. If patience and time are your priorities, silver is the best investment.

Gold is the best investment if you aren't looking to get rich quick. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

How much should your IRA include precious metals

It is important to remember that precious metals can be a good investment for anyone. You don’t need to have a lot of money to invest. You can actually make money without spending a lot on gold or silver investments.

You might also be interested in buying physical coins, such bullion rounds or bars. Stocks in companies that produce precious materials could be purchased. Or, you might want to take advantage of an IRA rollover program offered by your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices rise with time, which is a different to traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

What are the fees associated with an IRA for gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes account maintenance and any investment costs.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

In addition, most providers charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% per year. However, these rates are typically waived if you use a broker like TD Ameritrade.

How much is gold taxed under a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules governing these accounts vary by state. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you to delay withdrawals until April 1. New York offers a waiting period of up to 70 1/2 years. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. If you want to start small, then $5k-$10k would be great. As you grow, it is possible to rent desks or office space. This way, you don't have to worry about paying rent all at once. You just pay per month.

Consider what type of business your company will be running. In my case, we charge clients between $1000-2000/month, depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. You might get paid only once every six months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I recommend starting with $1k-$2k in gold and working my way up.

What are the pros & con's of a golden IRA?

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. There are some disadvantages to this investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. Most insurers require you to own a minimum amount of gold before making a claim. Insurance that covers losses upto $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers limit how many ounces you can keep. Others let you choose your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. Physical gold is more costly than gold futures. Futures contracts offer flexibility for buying gold. They allow you to set up a contract with a specific expiration date.

You also need to decide the type and level of insurance coverage you want. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. It does include coverage for damage due to natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Insurance doesn't cover storage costs. Banks charge between $25 and $40 per month for safekeeping.

A qualified custodian is required to help you open a Gold IRA. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians can't sell assets. Instead, they must maintain them for as long a time as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. The plan should also include information about how much you are willing to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. After receiving your application, the company will review it and mail you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. Financial planners are experts at investing and can help you determine which type of IRA is best for you. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement funds

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Investing gold vs. stocks

Gold investing as an investment vehicle can seem extremely risky these days. This is because many people believe that gold investment is no longer profitable. This belief is due to the fact that many people see gold prices dropping because of the global economy. They fear that investing in gold will result in a loss of money. In reality, however there are still many significant benefits to gold investing. Let's take a look at some of the benefits.

One of the oldest currencies known to man is gold. Its use can be traced back to thousands of years ago. It was used all around the world as a reserve of value. It is still used as a payment method by South Africa and other countries.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. So, although gold prices have declined in recent years, the cost of producing it has not changed.

You should also consider the amount of your intended purchase when considering whether you should buy or not. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. But, if your goal is to make long-term investments in gold, this might be worth considering. You can profit if you sell your gold at a higher price than you bought it.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We strongly recommend that you research all available options before making any decisions. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Surge in NFT Sales: Bitcoin Outperforms Ethereum in Thriving Market

Sourced From: news.bitcoin.com/nft-sales-soar-to-over-500m-bitcoin-leads-with-unprecedented-growth/

Published Date: Sat, 16 Dec 2023 17:00:17 +0000