The Conditions for a Bull Run

Bull runs are similar to wildfires. They require specific conditions to ignite and spread. Just like a wildfire needs a prolonged dry period, high temperatures, and strong winds, a bull run in the Bitcoin market also needs a combination of factors.

Bitcoin halvings create a scarcity of new supply, which can be compared to a period of no rain. They also generate increased interest and speculation in the market, akin to high temperatures. However, for a bull run to truly take off, there needs to be a catalyst event, comparable to the high winds that fuel a wildfire.

The Winds of Change: The Bitcoin ESG Narrative

Currently, the winds of change blowing through the Bitcoin market are centered around the ESG (Environmental, Social, and Governance) narrative. The ESG narrative refers to the consideration of environmental and sustainability factors when making investment decisions.

When the first major ESG Investment Committee publicly backs Bitcoin for ESG reasons, it will serve as the ignition event that powers the next bull run.

The Problem of ESG Investors

According to a report by PwC, ESG-focused institutional investment is projected to reach 33.9 trillion dollars by 2026. However, there is a significant problem for ESG investors – the demand for solid ESG investment opportunities exceeds the available supply.

Many ESG investors struggle to find attractive ESG investments, with 30% stating that they face difficulties in this regard. This creates an opportunity for Bitcoin to address this problem and fulfill the demand for ESG investments.

The Opportunity for Bitcoin

The narrative around Bitcoin and ESG started shifting in 2023. Several key events, including reports from reputable organizations, concluded that Bitcoin is a net positive as an ESG asset. This change in narrative has the potential to create the high winds needed for a bull run.

The Information Asymmetry

Currently, there is an information asymmetry in the market. While the narrative around Bitcoin and ESG has changed based on new data, many ESG investors are unaware of this shift. They still believe the old narrative that Bitcoin is net negative for the environment.

As more ESG investors gain access to the new data and become aware of the positive ESG case for Bitcoin, the information asymmetry will be blown away by the high winds of the new Bitcoin ESG narrative.

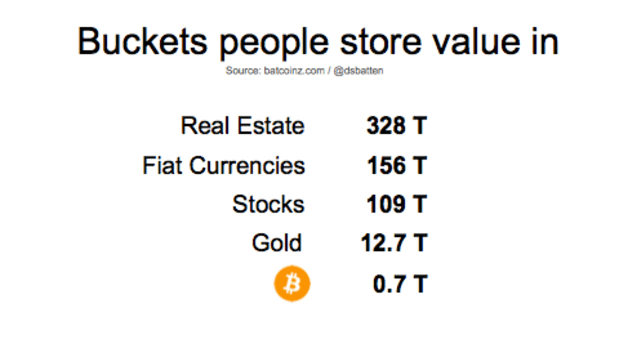

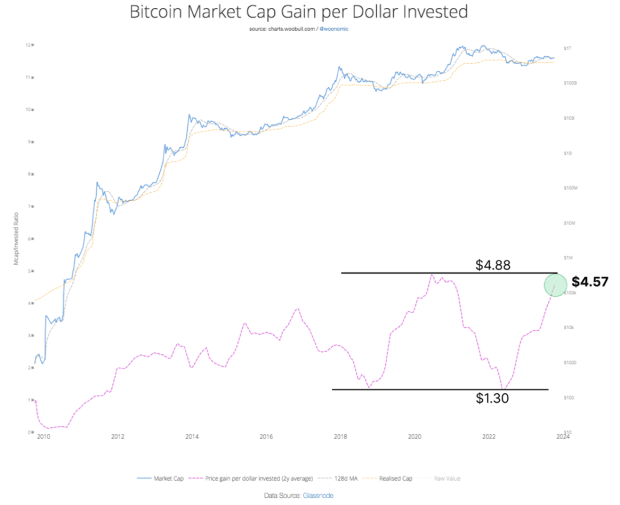

The Potential Impact on Bitcoin's Market Cap

Willy Woo's analysis suggests that if ESG investors deploy a percentage of their Assets Under Management (AUM) into Bitcoin, it could significantly impact Bitcoin's market cap.

For example, if 1% of ESG funds AUM is invested in Bitcoin, its market cap could increase to $2.26 trillion, more than triple its current value. If 2.5% of ESG funds AUM is deployed into Bitcoin, the market cap could reach $3.87 trillion, more than five times the current market cap.

Even without considering the positive feedback loop created by institutional investors, a 2.5% ESG deployment could potentially drive the Bitcoin price to around $193,000 during a 2026 bear market.

The Ignition Event

The growing winds of the ESG narrative change are evident in recent events and discussions surrounding Bitcoin. The idea of Bitcoin as an ESG asset is gaining traction, and the time has come for this concept to take center stage.

As more data and evidence support the positive ESG case for Bitcoin, it is expected that ESG Investment Committees will start deploying a percentage of their AUM into Bitcoin. This will serve as the ignition event that will fuel the next bull run.

ESG = NGU

ESG adoption of Bitcoin has the potential to transform Bitcoin into the world's first Greenhouse Negative industry without relying on offsets. This means that Bitcoin mining could help reduce methane emissions from landfills. If this goal is achieved by 2026, it is highly likely that ESG investors will deploy a significant percentage of their AUM into Bitcoin.

Conclusion

The narrative around Bitcoin and ESG is changing rapidly. The information asymmetry among ESG investors is slowly being dissolved by the winds of change. As ESG Investment Committees start backing Bitcoin for ESG reasons and deploying a portion of their AUM into Bitcoin, the next bull run will be ignited.

Bitcoin's potential to address the demand for solid ESG investments and its ability to contribute to renewable energy and methane emissions reduction make it an attractive asset for ESG investors. The future looks promising for Bitcoin as it enters a new era driven by the power of the ESG narrative.

Frequently Asked Questions

How is gold taxed within a Roth IRA

The tax on an investment account is based on its current value, not what you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

Each state has its own rules regarding these accounts. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you up to April 1st. New York offers a waiting period of up to 70 1/2 years. To avoid penalties, plan ahead so you can take distributions at the right time.

How much should precious metals be included in your portfolio?

This question can only be answered if we first know what precious metals are. Precious metals refer to elements with a very high value relative other commodities. This makes them very valuable in terms of trading and investment. Today, gold is the most commonly traded precious metal.

But, there are other types of precious metals available, including platinum and silver. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It also remains relatively unaffected by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. However, the prices of precious metals do not always move in sync with one another. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They become less expensive and have a lower value because they are limited.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Either way, you'll need to weigh the pros and cons of each before choosing one.

Bullion bars, for example, require less space as you're not dealing with individual coins. But you will have to count each coin separately. However, you can easily track the value of individual coins by storing them in separate containers.

Some people like to keep their coins in vaults. Some people prefer to store their coins safely in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

What is the tax on gold in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. You don't have tax to pay when you buy or sell gold. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Gold can be used as collateral for loans. When you borrow against your assets, lenders try to find the highest return possible. Selling gold is usually the best option. It's not guaranteed that the lender will do it. They might just hold onto it. Or, they may decide to resell the item themselves. You lose potential profits in either case.

You should not lend against your gold if it is intended to be used as collateral. If you don't plan to use it as collateral, it is better to let it be.

What precious metal should I invest in?

This question depends on how risky you are willing to take, and what return you want. Gold is a traditional haven investment. However, it is not always the most profitable. For example, if your goal is to make quick money, gold may not suit you. Silver is a better investment if you have patience and the time to do it.

If you don't care about getting rich quickly, gold is probably the way to go. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

bbb.org

How To

The best way to buy gold (or silver) online

First, understand the basics of gold. Gold is a precious metal similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They aren't circulated in any currency exchange systems. For example, a person who buys $100 worth or gold gets 100 grams. This gold has a $100 price. For every dollar spent, the buyer gets 1 gram of Gold.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are several options available if your goal is to purchase gold from a dealer. First off, you can go through your local coin shop. Another option is to go through a reputable site like eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers will charge you a 10% to 15% commission for every transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This option is often a great choice for investing gold as it allows you more control over its price.

You can also invest in gold physical. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. Physical gold must be kept safe in an impassible container, such as a vault.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks charge higher interest rates than those offered by pawn shops.

You can also ask for help to purchase gold. Selling gold is simple too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————-

By: Daniel Batten

Title: Why The New ESG Narrative About Bitcoin Will Power The Next Bull Run

Sourced From: bitcoinmagazine.com/markets/why-the-new-esg-narrative-about-bitcoin-will-power-the-next-bull-run

Published Date: Fri, 01 Dec 2023 17:00:00 GMT