Hey there, fellow crypto enthusiasts! If you've been following Bitcoin's rollercoaster ride, you know that it's been a wild journey lately. But have you ever considered looking at Bitcoin through a different lens, like Gold, to get a clearer picture of where we are in the market cycle? Let's dive in and explore how Bitcoin's relationship with Gold might just hold the key to understanding the current bear market.

The Critical Turning Point: Bitcoin Enters Bear Market Territory

Measuring Bitcoin Against Gold: A Fresh Perspective

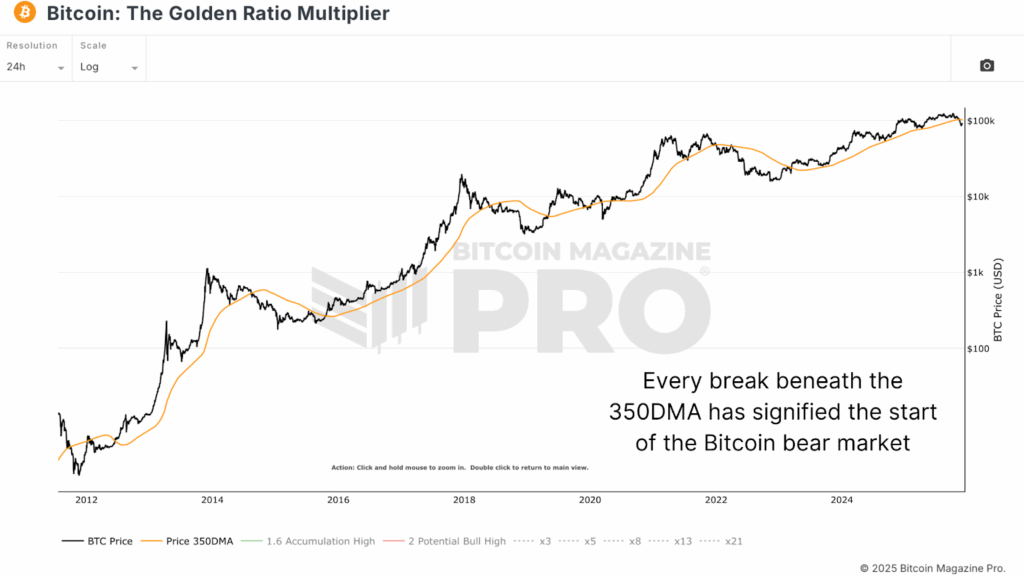

When Bitcoin slipped below the 350-day moving average, crossing the $100,000 mark, it officially signaled the start of the bear market. This shift was further confirmed as Bitcoin fell by about 20%, sparking concerns among investors. Traditionally, dropping below The Golden Ratio Multiplier moving average has been an indicator of Bitcoin entering a bear cycle. However, things get more intriguing when we compare Bitcoin's performance against Gold instead of USD.

The Bitcoin versus Gold comparison paints a different story compared to the USD chart. While Bitcoin hit its peak in December 2024 and has since plummeted by over 50%, the USD valuation peaked in October 2025, considerably lower than the previous year's highs. This disparity hints that Bitcoin might have been in a bear market much longer than commonly perceived. By analyzing past Bitcoin bear cycles in terms of Gold, we can spot trends indicating that the current downward trend might be nearing crucial support levels.

Fibonacci Retracement Levels: Unveiling Precise Patterns

Mapping Fibonacci Levels Across Cycles

Instead of solely relying on percentage drawdowns and timeframes, we can achieve greater accuracy by using Fibonacci retracement levels across various cycles. These levels reveal significant points of confluence that can guide our understanding of Bitcoin's market movements.

- The 2015-2018 cycle hit the bear market bottom at the 0.618 Fibonacci level, equivalent to around 2.56 ounces of Gold per Bitcoin.

- Transitioning to the 2018-2022 cycle, the bear market bottom nearly aligned with the 0.5 level, approximately 9.74 ounces of Gold per Bitcoin.

- Currently, the 0.618 Fibonacci level sits at about 22.81 ounces of Gold per Bitcoin, while the 0.5 level is around 19.07 ounces. Bitcoin's current price action hovers near the midpoint of these levels, representing a potential accumulation zone.

Multiple Fibonacci levels from different cycles converge to provide additional insights. The 0.786 level from the current cycle corresponds to roughly 21.05 ounces of Gold, translating to a Bitcoin price of around $89,160. Combining these insights, we can anticipate that Bitcoin might find support in the range of $67,000 to $80,000, based on historical Fibonacci retracement levels.

Looking Ahead: Is the Bear Market Nearing Its End?

Final Thoughts and Potential Scenarios

Considering Bitcoin's performance against Gold and other assets, it's evident that the bear market has been in play since December 2024, with a significant decline in purchasing power. While precise predictions are challenging, the convergence of data points and Fibonacci levels hints that the bear market could be wrapping up sooner than expected.

For a deeper exploration of this topic, check out our latest YouTube video: Proof This Bitcoin Bear Market May Be OVER Already. Stay informed and stay ahead in the crypto game!

Frequently Asked Questions

How can you withdraw from an IRA of Precious Metals?

First decide if your IRA account allows you to withdraw funds. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, calculate how much money your IRA will allow you to withdraw. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When it's time to make withdrawals from your precious-metal IRA, you'll need a place to keep your coins safe. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars require less space, as they don't contain individual coins. But you will have to count each coin separately. However, keeping individual coins in a separate place allows you to easily track their values.

Some prefer to keep their money in a vault. Some prefer to keep them in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

What precious metals do you have that you can invest in for your retirement?

The best precious metal investments are gold and silver. They are both easy to trade and have been around for years. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: This is the oldest form of currency that man has ever known. It's stable and safe. This makes it a good option to preserve wealth in uncertain times.

Silver: The popularity of silver has always been a concern for investors. It's a great option for those who want stability. Unlike gold, silver tends to go up instead of down.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It's like silver or gold in that it is durable and resistant to corrosion. It's however much more costly than any of its counterparts.

Rhodium: Rhodium is used in catalytic converters. It is also used for jewelry making. It is relatively affordable when compared to other types.

Palladium: Palladium has a similarity to platinum but is more rare. It's also less expensive. This is why it has become a favourite among investors looking for precious metals.

How is gold taxed in an IRA?

The fair market price of gold when it is sold determines the tax due on its sale. You don't pay taxes when you buy gold. It is not income. If you sell it later you will have a taxable profit if the price goes down.

For loans, gold can be used to collateral. Lenders seek to get the best return when you borrow against your assets. In the case of gold, this usually means selling it. The lender might not do this. They may keep it. They might decide that they want to resell it. In either case, you risk losing potential profits.

To avoid losing money, only lend against gold if you intend to use it for collateral. It's better to keep it alone.

Can I purchase gold with my self directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contract are financial instruments that depend on the gold price. They allow you to speculate on future prices without owning the metal itself. However, physical bullion is real gold or silver bars you can hold in your hands.

Should You Get Gold?

Gold was a safe investment option for those who were in financial turmoil. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Experts believe this could change soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some things you should consider when considering gold investing.

- Consider first whether you will need the money to save for retirement. You can save money for retirement even if you don't invest in gold. However, when you retire at age 65, gold can provide additional protection.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each one offers different levels security and flexibility.

- Last but not least, gold doesn't provide the same level security as a savings account. Losing your gold coins could result in you never being able to retrieve them.

Do your research before you buy gold. If you already have gold, make sure you protect it.

What's the advantage of a Gold IRA?

A gold IRA has many benefits. It can be used to diversify portfolios and is an investment vehicle. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This is a great way to make a smooth transition if you want to retire earlier.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are readily available at most banks and brokerages. Withdrawals can happen automatically, without any fees or penalties.

However, there are still some drawbacks. Gold is known for being volatile in the past. It's important to understand the reasons you're considering investing in gold. Is it for growth or safety? Are you looking for growth or insurance? Only when you are clear about the facts will you be able take an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce isn't enough to cover all of your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even live with just one ounce. However, you will not be able buy any other items with those funds.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

cftc.gov

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

How to keep physical gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. However, this method comes with many risks because there's no guarantee that these companies will continue to survive. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

The alternative is to buy physical gold. You can either open an account with a bank, online bullion dealer, or buy gold directly from a seller you trust. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It's also easy to see how many gold you have. You will receive a receipt detailing exactly what you paid. You also have a lower chance of theft than stocks.

However, there are some disadvantages too. You won't get the bank's interest rates or investment money. It won't allow you to diversify any of your holdings. Instead, you'll be stuck with what's been bought. Finally, the tax man might ask questions about where you've put your gold!

BullionVault.com is the best website to learn about gold purchases in an IRA.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Why The Bitcoin Bear Market Is Nearing Its End: A Detailed Analysis

Sourced From: bitcoinmagazine.com/markets/bitcoin-bear-market-almost-finished

Published Date: Fri, 05 Dec 2025 14:16:24 +0000