Bitcoin investors are currently experiencing an average profit of $67,000 per individual, marking a significant milestone in the world of cryptocurrency. This surge in profit is just the beginning of what could be a lucrative journey for those involved in the digital currency market.

The Potential of Bitcoin Profit

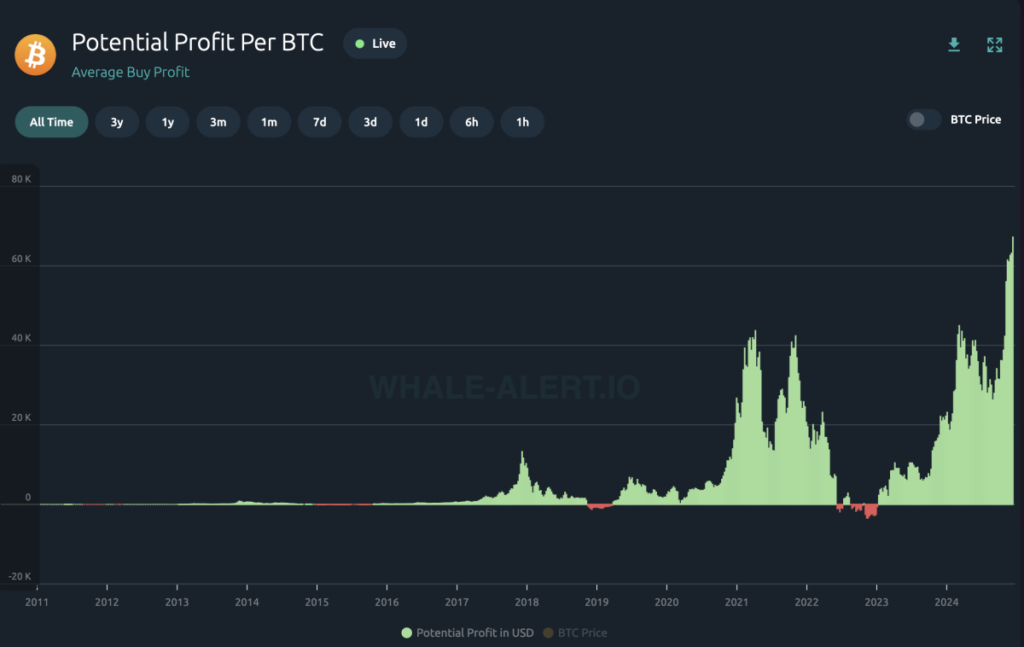

Whale Alert, a prominent source for cryptocurrency data, reports that the average profit per Bitcoin (BTC) has reached an all-time high of $67,088 at the time of this report. This figure highlights the immense potential for profit that Bitcoin holders can achieve by selling their tokens at the right time.

According to Whale Alert's website, the "Potential Profit per Token" graph illustrates the hypothetical profit that holders could earn per token based on specific selling times. This metric provides valuable insights into the profitability of Bitcoin investments and can guide investors in making informed decisions.

Financial Transformation Through Bitcoin

For many individuals, Bitcoin represents a paradigm shift in how wealth is accumulated and managed. Unlike traditional forms of currency, Bitcoin offers a unique opportunity for individuals to witness their savings grow exponentially over time. The average American salary in 2024 is reported to be $62,027, a figure that pales in comparison to the potential profits that Bitcoin can yield.

By investing in Bitcoin, individuals can break free from the cycle of working long hours to earn depreciating currency. Instead, they can watch their wealth appreciate and gain the financial freedom to pursue their aspirations. Whether it's buying a home, funding education, or simply spending more quality time with loved ones, Bitcoin offers a pathway to a more fulfilling and secure future.

The Path to Financial Freedom

Utilizing Bitcoin as a savings vehicle is not just a trend; it is a strategic move towards financial independence. As Bitcoin continues to rise in value, investors have the opportunity to enhance their purchasing power and expand their horizons. By consistently holding onto their Bitcoin reserves (HODL), individuals can safeguard their financial well-being and unlock a world of possibilities.

Looking ahead, Bitcoin's potential for growth remains promising, with forecasts predicting a further increase beyond the current $100,000 price threshold. This upward trajectory opens up new avenues for investors to amplify their wealth and gain more control over how they allocate their time and resources.

Empowering Individuals Through Bitcoin

One of the most empowering aspects of Bitcoin is its inclusivity – anyone, anywhere can participate in this financial revolution. By creating their own Bitcoin reserves and watching them flourish, individuals can take charge of their financial destinies and shape their futures according to their preferences.

In conclusion, Bitcoin has the power to redefine wealth accumulation and financial freedom for individuals worldwide. By embracing Bitcoin as a transformative asset, investors can seize the opportunities it presents and embark on a journey towards a more prosperous and fulfilling life.

Frequently Asked Questions

Is gold a good choice for an investment IRA?

For anyone who wants to save some money, gold can be a good investment. You can also diversify your portfolio by investing in gold. But gold is not all that it seems.

It has been used throughout history as currency and it is still a very popular method of payment. It is often called “the most ancient currency in the universe.”

But unlike paper currencies, which governments create, gold is mined out of the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply and demand factors determine how much gold is worth. The strength of the economy means people spend more, and so, there is less demand for gold. As a result, the value of gold goes up.

The flip side is that people tend to save money when the economy slows. This results in more gold being produced, which drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Your investments will also generate interest, which can help you increase your wealth. Additionally, you won't lose cash if the gold price falls.

How Much of Your IRA Should Include Precious Metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don’t need to have a lot of money to invest. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You might think about buying physical coins such a bullion bar or round. Shares in precious metals-producing companies could be an option. You may also be interested in an IRA transfer program offered by your retirement provider.

Regardless of your choice, you'll still benefit from owning precious metals. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And unlike traditional investments, they tend to increase in value over time. If you decide to sell your investment, you will likely make more than with traditional investments.

Who has the gold in a IRA gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

What is the best precious metal to invest in?

This depends on what risk you are willing take and what kind of return you desire. Gold is a traditional haven investment. However, it is not always the most profitable. Gold may not be right for you if you want quick profits. If you have the patience to wait, then you might consider investing in silver.

If you don't care about getting rich quickly, gold is probably the way to go. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not exactly legal – WSJ

How To

The History of Gold as an Asset

From the beginning of history, gold was a popular currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Due to its value, it was also internationally traded. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. The result was a decrease in foreign currency demand, which led to an increase in their price. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. They sold some of their excess gold to Europe to pay off the debt.

Because most European countries did not trust the U.S. dollar, they started accepting gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The value of gold has significantly increased since then. Even though gold's price fluctuates, it is still one of the most secure investments you could make.

—————————————————————————————————————————————————————————————-

By: Nikolaus Hoffman

Title: Why Bitcoin Investors Are Seeing an Average Profit of $67,000 – And What Lies Ahead

Sourced From: bitcoinmagazine.com/takes/bitcoin-investors-are-now-up-67000-on-average-and-this-is-just-the-start

Published Date: Thu, 19 Dec 2024 21:26:36 GMT