The world of cryptocurrencies witnessed a dramatic turn of events due to a misleading report claiming the approval of Blackrock's IShares spot bitcoin exchange-traded fund by the U.S. Securities and Exchange Commission (SEC). This false news led to the liquidation of short positions worth $78.92 million, constituting 57% of the total $136.29 million short positions that were wiped off in the past 24 hours.

The Power of Misinformation on Cryptocurrency Value

In a surprising event on a recent Monday, the cryptocurrency-centric media outlet, Cointelegraph, spread inaccurate information on social media platform X and its Telegram channel. This caused a sudden surge in the value of bitcoin (BTC) by over 10% against the U.S. dollar.

The digital currency experienced a brief high, touching $29,900 per coin, before falling sharply to $28,100 per unit once the report was revealed to be untrue. Despite Cointelegraph's apology, the damage was already done. The market chaos that followed led to the liquidation of short positions worth $78.92 million.

Analysis of Market Liquidations

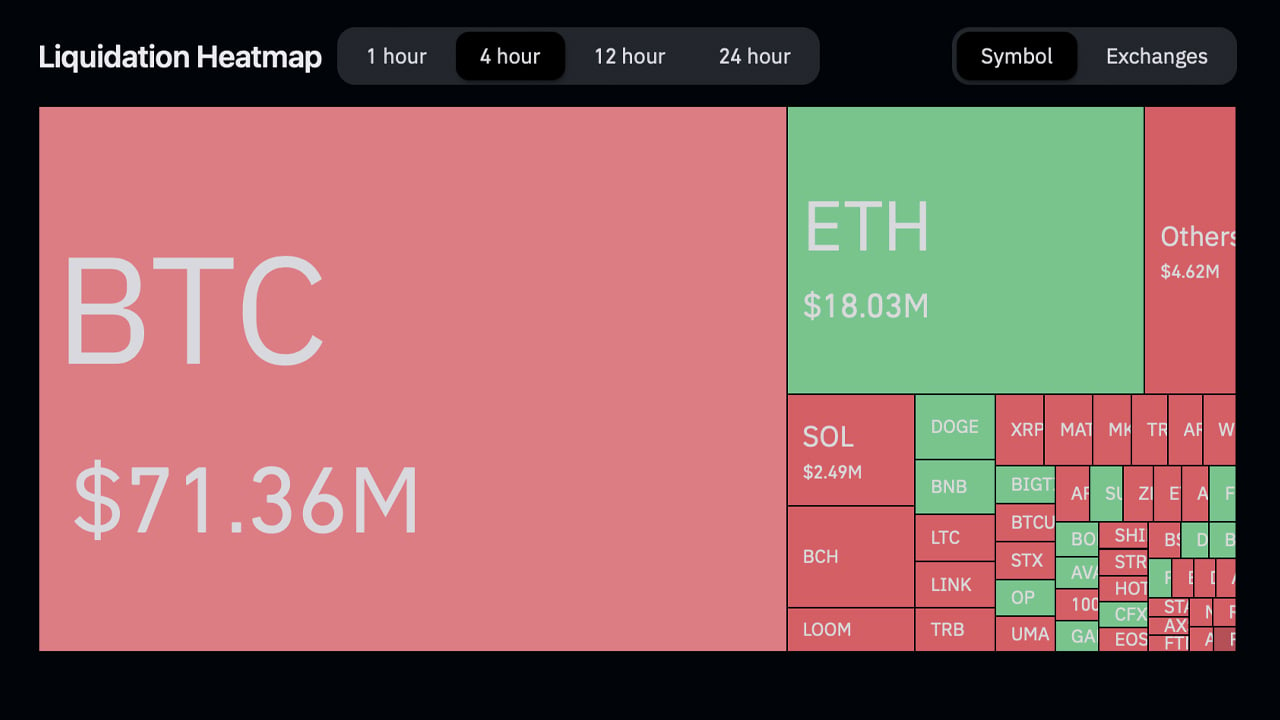

Data released by Coinglass indicates that in the four hours following the spread of the false news, BTC short positions worth $71.36 million were liquidated. Among other cryptocurrencies, Solana (SOL) witnessed liquidation of short positions amounting to $2.49 million.

The liquidated $78.92 million represented a significant 57% of the total short positions cleared out in the last 24 hours. During the same four-hour window, Ethereum (ETH) long positions exceeding $18 million were also liquidated.

Impact of the False News on Bitfinex Positions

The exposure of the misleading news had a profound impact on Bitfinex. Short positions on Bitfinex plummeted drastically, while long positions experienced a surge before the news was verified as false. Following the confirmation of the news, long positions on Bitfinex have shown a downward trend.

The Aftermath of Misinformation: Liquidation of Traders

The spread of the erroneous news led to numerous traders being liquidated, potentially dampening the speculation surrounding the actual decision. The most significant liquidations affected BTC, ETH, XRP, BNB, and SOL.

The incident underscores the volatility of the cryptocurrency market and the role that misinformation can play in shaping market dynamics. It is a stern reminder to traders and investors to tread cautiously and base their decisions on verified information.

Frequently Asked Questions

How does gold perform as an investment?

The supply and the demand for gold determine how much gold is worth. Interest rates are also a factor.

Gold prices are volatile due to their limited supply. Additionally, physical gold can be volatile because it must be stored somewhere.

Is it possible to hold a gold ETF within a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

You can also get an Individual Retirement Annuity, or IRA. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs don't have to be taxable

Is gold a good choice for an investment IRA?

If you are looking for a way to save money, gold is a great investment. You can also diversify your portfolio by investing in gold. But gold is not all that it seems.

It has been used throughout history as currency and it is still a very popular method of payment. It is sometimes called the “oldest currency in the world”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It's hard to find and very rare, making it extremely valuable.

The supply-demand relationship determines the gold price. The strength of the economy means people spend more, and so, there is less demand for gold. This results in gold prices rising.

On the flipside, people may save cash rather than spend it when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why investing in gold makes sense for individuals and businesses. If you invest in gold, you'll benefit whenever the economy grows.

Also, your investments will earn you interest which can help increase your wealth. Additionally, you won't lose cash if the gold price falls.

What are some of the benefits of a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You have complete control over how much you take out each year. There are many types to choose from when it comes to IRAs. Some are better suited for people who want to save for college expenses. Some are for investors who seek higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. But once they start withdrawing funds, those earnings aren't taxed again. This type account may make sense if it is your intention to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. People who want to invest their money rather than spend it make gold IRA accounts a great option.

Another benefit to owning IRA gold is the ability to withdraw automatically. This eliminates the need to constantly make deposits. To ensure that you never miss a payment, you could set up direct debits.

Gold is one of today's most safest investments. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil, gold prices tend to stay relatively stable. It is therefore a great choice for protecting your savings against inflation.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

finance.yahoo.com

cftc.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads. Example. And Risk Metrics

bbb.org

How To

How to Hold Physical Gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. But, this approach comes with risks. These companies may not survive the next few years. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

Another option is to purchase physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easy to see how many gold you have. You will receive a receipt detailing exactly what you paid. You're also less susceptible to theft than investing with stocks.

However, there are some disadvantages too. You won't get the bank's interest rates or investment money. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. Finally, tax man may want to ask where you put your gold.

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Unravelling the Consequences of Misinformation on Bitcoin Market

Sourced From: news.bitcoin.com/wipe-out-fake-sec-approval-report-erases-71m-in-bitcoin-short-positions/

Published Date: Mon, 16 Oct 2023 17:30:18 +0000