Bitcoin’s price movements may steal the spotlight, but the true narrative of BTC lies beneath the surface. Beyond the realm of technical analysis and price speculation, on-chain data unveils a unique perspective on supply, demand, and investor behavior in real-time. Harnessing these insights empowers traders and investors to forecast market trends, track institutional activities, and make informed decisions based on data.

Realized Price & MVRV Z-Score

On-chain data encompasses the publicly accessible transaction records on Bitcoin’s blockchain. In contrast to traditional markets shrouded in mystery, Bitcoin’s transparency allows for immediate analysis of each transaction, wallet movement, and network activity. This data aids investors in identifying significant trends, accumulation zones, and potential price turning points.

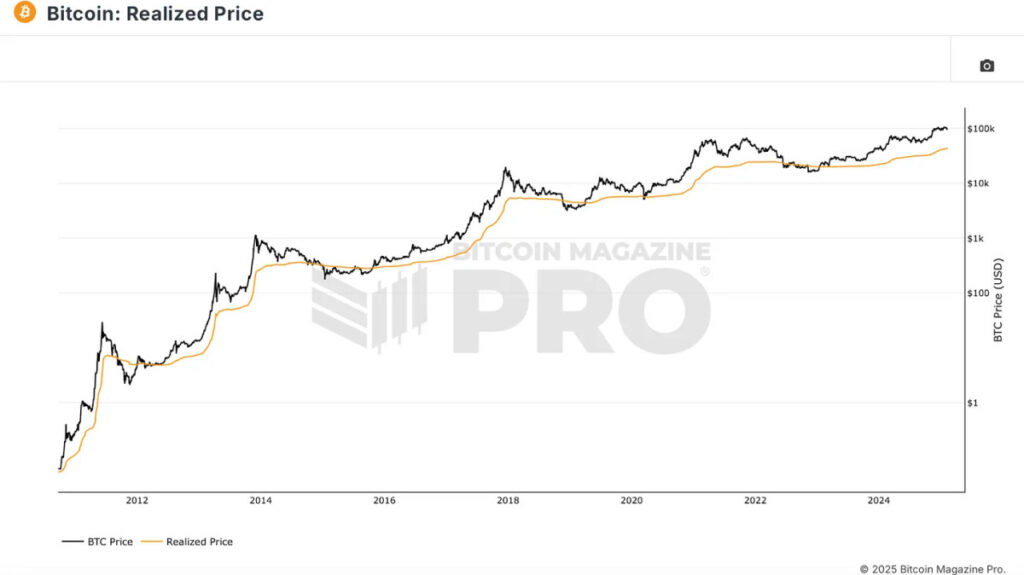

One of the pivotal on-chain metrics is the Realized Price, reflecting the average cost basis of all BTC in circulation. Unlike traditional assets with obscured investor cost bases, Bitcoin offers real-time visibility into whether most holders are at a profit or loss.

Figure 1: The Realized Price illustrates the cost basis for all BTC on the network.

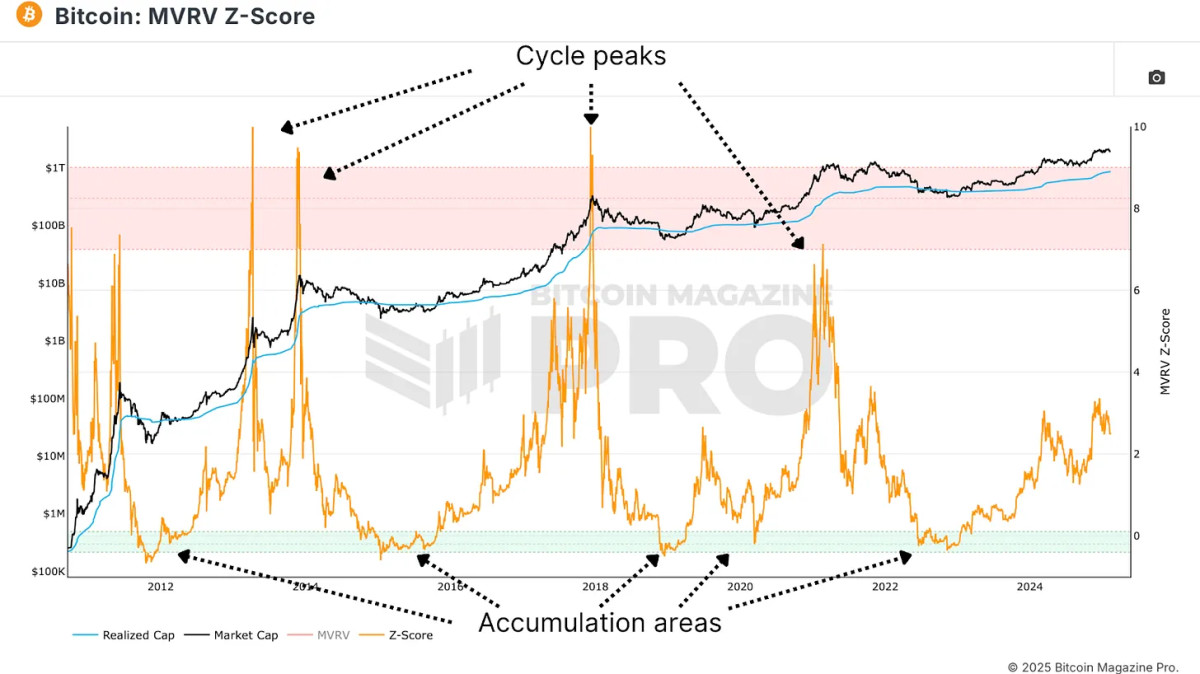

To complement the utility of Realized Price, analysts utilize the MVRV Z-Score, gauging the discrepancy between market value and realized value adjusted for Bitcoin’s volatility. Historically, this indicator has pinpointed optimal buying opportunities in the lower range and potential overvaluation in the red zone.

Figure 2: MVRV Z-Score has a track record of identifying market tops and bottoms.

Monitoring Long-Term Holders

Another critical metric is the 1+ Year HODL Wave, monitoring Bitcoin addresses inactive for at least a year. A rising HODL wave signifies investors opting to hold, diminishing circulating supply and exerting upward pressure on prices. Conversely, a decline indicates profit-taking and potential distribution.

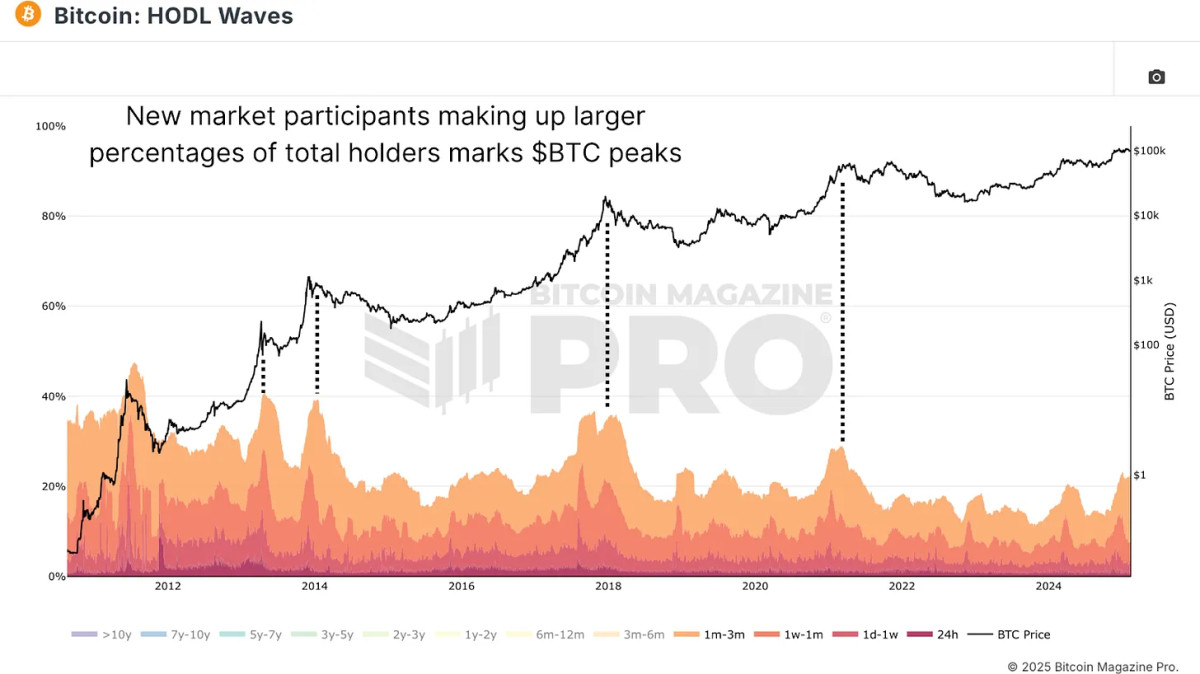

Figure 3: 1+ Year HODL Wave demonstrates the cyclical nature of BTC holders.

HODL Waves visualize Bitcoin ownership distribution across age bands. Focusing on participants of 3 months or less unveils typical retail involvement levels. Peaks in short-term holders often indicate market peaks, while lows signify ideal accumulation opportunities.

Figure 4: HODL Waves can indicate when retail investors are gripped by FOMO.

Spotting Whale Movements

Supply Adjusted Coin Days Destroyed quantifies total BTC moved factored by duration held and standardized against the circulating supply at that time. This metric is invaluable for detecting whale activity and institutional profit-taking. Sudden movements of long-dormant coins frequently signal large holders exiting positions, aligning with major market tops and bottoms historically.

Figure 5: Supply Adjusted CDD illustrates the velocity of BTC transactions.

Realized Gains & Losses

The Spent Output Profit Ratio (SOPR) unveils the profitability of BTC transactions. A SOPR value above 0 indicates profitable Bitcoin movements, while below 0 signifies losses. Monitoring SOPR spikes helps traders identify euphoric profit-taking, while declines often accompany bear market capitulations.

Figure 6: SOPR reflects real-time euphoria and capitulation.

Relying solely on one metric can be misleading. Investors should seek alignment between multiple on-chain indicators to enhance signal accuracy. For instance, confluence between MVRV Z-score, SOPR, and HODL waves historically marks optimal accumulation zones or planned profit-taking.

Bitcoin’s on-chain data unveils a transparent, real-time perspective on market dynamics, equipping investors with an edge in decision-making. By tracking supply trends, investor sentiment, and accumulation/distribution cycles, stakeholders can strategically position themselves for long-term success.

For live data, charts, indicators, and comprehensive research on Bitcoin's price action, visit Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and does not constitute financial advice. Always conduct thorough research before making investment decisions.

Frequently Asked Questions

What are the pros & cons of a Gold IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. There are some disadvantages to this investment.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. A penalty fee will be charged if you decide to withdraw funds.

You will also need to pay fees for managing your IRA. Most banks charge 0.5% to 2.0% per annum. Others charge management fees that range from $10 to $50 per month.

Insurance is necessary if you wish to keep your money safe from the banks. Many insurers require that you own at least one ounce of gold before you can make a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers restrict the amount you can own in gold. Others let you choose your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. The price of physical gold is higher than that of gold futures. Futures contracts allow you to buy gold with more flexibility. You can set up futures contracts with a fixed expiration date.

It is also important to choose the type of insurance coverage that you need. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. The policy does not cover natural disasters. You may consider adding additional coverage if you live in an area at high risk.

You should also consider the cost of storage for your gold. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians cannot sell your assets. Instead, they must hold them as long as you request.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. You should also specify how much you want to invest each month.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. After reviewing your application, the company will send you a confirmation mail.

You should consult a financial planner before opening a Gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

How does a gold IRA account work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

Physical gold bullion coin can be purchased at any time. You don't have to wait until retirement to start investing in gold.

An IRA lets you keep your gold for life. Your gold assets will not be subjected tax upon your death.

Your gold is passed to your heirs without capital gains tax. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). Once you've done so, you'll be given an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custodian can handle all paperwork and submit necessary forms to IRS. This includes filing annual reports.

Once your gold IRA is established, you can purchase gold bullion coins. The minimum deposit required to purchase gold bullion coins is $1,000 You'll get a higher rate of interest if you deposit more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. However, there are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. You could end up with severe financial consequences.

Should You Purchase Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Some experts believe that this could change very soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

Consider these things if you are thinking of investing in gold.

- First, consider whether or not you need the money you're saving for retirement. You can save for retirement and not invest your savings in gold. Gold does offer an extra layer of protection for those who reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each one offers different levels security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. You may lose your gold coins and never be able to recover them.

You should do your research before buying gold. If you already have gold, make sure you protect it.

How is gold taxed within a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

These rules vary from one state to another. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you up to April 1st. And in New York, you have until age 70 1/2 . To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

How much gold should your portfolio contain?

The amount of money you need to make depends on how much capital you are looking for. If you want to start small, then $5k-$10k would be great. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. It's only one monthly payment.

Consider what type of business your company will be running. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. You may get paid just once every 6 months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

investopedia.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

A rising trend in gold IRAs

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

The gold IRA allows owners to invest in physical gold bullion and bars. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

Investors can manage their assets with a gold IRA without worrying about market volatility. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

This means that investors who are looking for financial safety and security are becoming more interested in the gold IRA.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Unlocking Bitcoin's Potential: A Deep Dive into On-Chain Data Insights

Sourced From: bitcoinmagazine.com/markets/mastering-bitcoin-on-chain-data-

Published Date: Tue, 18 Feb 2025 13:59:20 GMT