Exciting news for cryptocurrency enthusiasts! Bitcoin has skyrocketed to over $117,500 today, bouncing back from a recent low of $114,278. This surge follows President Donald Trump's groundbreaking executive order, opening the doors for cryptocurrencies like Bitcoin to be part of 401(k) retirement accounts.

The Executive Order Impact

Revolutionizing Investment Options

President Trump's executive order signals a new era in investment flexibility. By allowing alternative assets, including digital currencies, in retirement plans, it offers American workers more diverse and potentially lucrative investment opportunities. This move aims to enhance financial security and pave the way for stronger retirement outcomes.

Regulatory Collaboration and Updates

Modernizing Investment Regulations

The order mandates cooperation between key federal agencies to explore necessary regulatory changes. The Department of Labor, Treasury Department, SEC, and other regulators will work together to ensure a smooth transition towards including digital assets in retirement portfolios. This proactive approach highlights the government's commitment to adapting to the evolving financial landscape.

The Road Ahead for Bitcoin

Unleashing a Wave of Institutional Interest

Trump's order has set the stage for a massive influx of capital into Bitcoin and cryptocurrencies. Industry experts predict a significant boost in Bitcoin's value, with the potential for billions of dollars flowing into the market. This policy shift is not just a milestone; it's a game-changer that could reshape the future of investments.

The Rise of Institutional Adoption

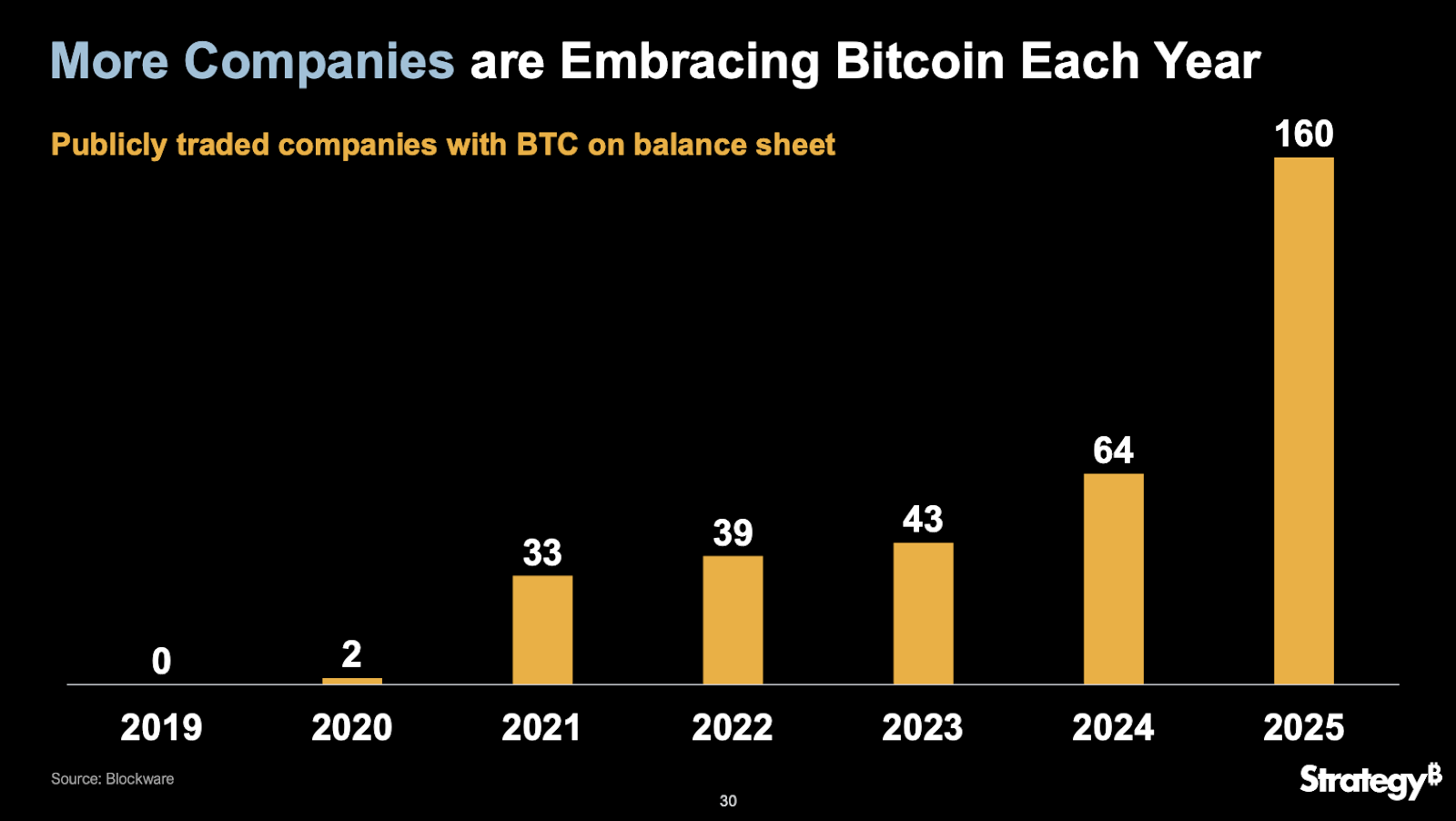

Corporate Bitcoin Holdings on the Rise

Institutions are increasingly recognizing the value of Bitcoin as a strategic asset. The numbers speak for themselves: institutional demand for Bitcoin has been soaring, surpassing even the production by miners. With more companies incorporating Bitcoin into their balance sheets, the trend towards institutional adoption is gaining momentum.

Leaders in the Bitcoin Treasury Race

Meet the Pioneers

Companies like Nakamoto and Twenty One Capital are at the forefront of the corporate Bitcoin treasury movement. With ambitious plans and substantial Bitcoin holdings, they are shaping the landscape of institutional investment. As more corporations join the race, Bitcoin's role as a mainstream asset is becoming increasingly solidified.

Curious to learn more about how this executive order could impact your investment strategy? Stay tuned for updates and expert insights as we navigate this exciting new chapter in the world of finance.

Frequently Asked Questions

How does gold perform as an investment?

The supply and demand for gold affect the price of gold. Interest rates also have an impact on the price of gold.

Because of their limited supply, gold prices can fluctuate. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Can I buy Gold with my Self-Directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. They allow you to speculate on future prices without owning the metal itself. You can only hold physical bullion, which is real silver and gold bars.

Can I have physical gold in my IRA

Gold is money. Not just paper currency. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans now invest in precious metals. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Another reason is that gold has historically outperformed other assets in financial panic periods. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, the liquidity that gold provides is unmatched. This means that you can sell gold anytime, regardless of whether or not another buyer is available. You can buy gold in small amounts because it is so liquid. This allows one to take advantage short-term fluctuations within the gold price.

How is gold taxed within a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules that govern these accounts differ from one state to the next. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you up to April 1st. New York is open until 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

What are the pros & con's of a golden IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. But, this type of investment comes with its own set of disadvantages.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5% and 2.0% per year. Others charge management fees that range from $10 to $50 per month.

You can purchase insurance if you want to keep your money out of a bank. Most insurers require you to own a minimum amount of gold before making a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers limit how many ounces you can keep. Others allow you the freedom to choose your own weight.

Also, you will need to decide if you want to buy physical gold futures contracts or physical gold. Gold futures contracts are more expensive than physical gold. Futures contracts offer flexibility for buying gold. You can set up futures contracts with a fixed expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does offer coverage for natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians are not allowed to sell your assets. Instead, they must hold them as long as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. Also, you should specify how much each month you plan to invest.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will then review your application and mail you a letter of confirmation.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help you find cheaper insurance options to lower your costs.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

bbb.org

cftc.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads. Example. And Risk Metrics

irs.gov

How To

Guidelines for Gold Roth IRA

Starting early is the best way to save for retirement. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. You must contribute enough each year to ensure that you have adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

Save regularly and continue to save over time. If you don't contribute the maximum amount, you will miss any tax benefits.

—————————————————————————————————————————————————————————————-

By: Nik

Title: Trump's Executive Order Boosts Bitcoin to $117K: What It Means for Your Investments

Sourced From: bitcoinmagazine.com/markets/bitcoin-surges-to-117k-as-trump-signs-401k-crypto-order-plans

Published Date: Thu, 07 Aug 2025 19:59:06 +0000