Are you ready to unlock incredible profits with the Enhanced Bitcoin Everything Indicator? This powerful tool goes beyond traditional metrics to provide you with a comprehensive view of the forces influencing BTC price movements. If you're eager to dive into the Bitcoin market with confidence and precision, this indicator is a game-changer.

Understanding the Bitcoin Everything Indicator

The Comprehensive Approach

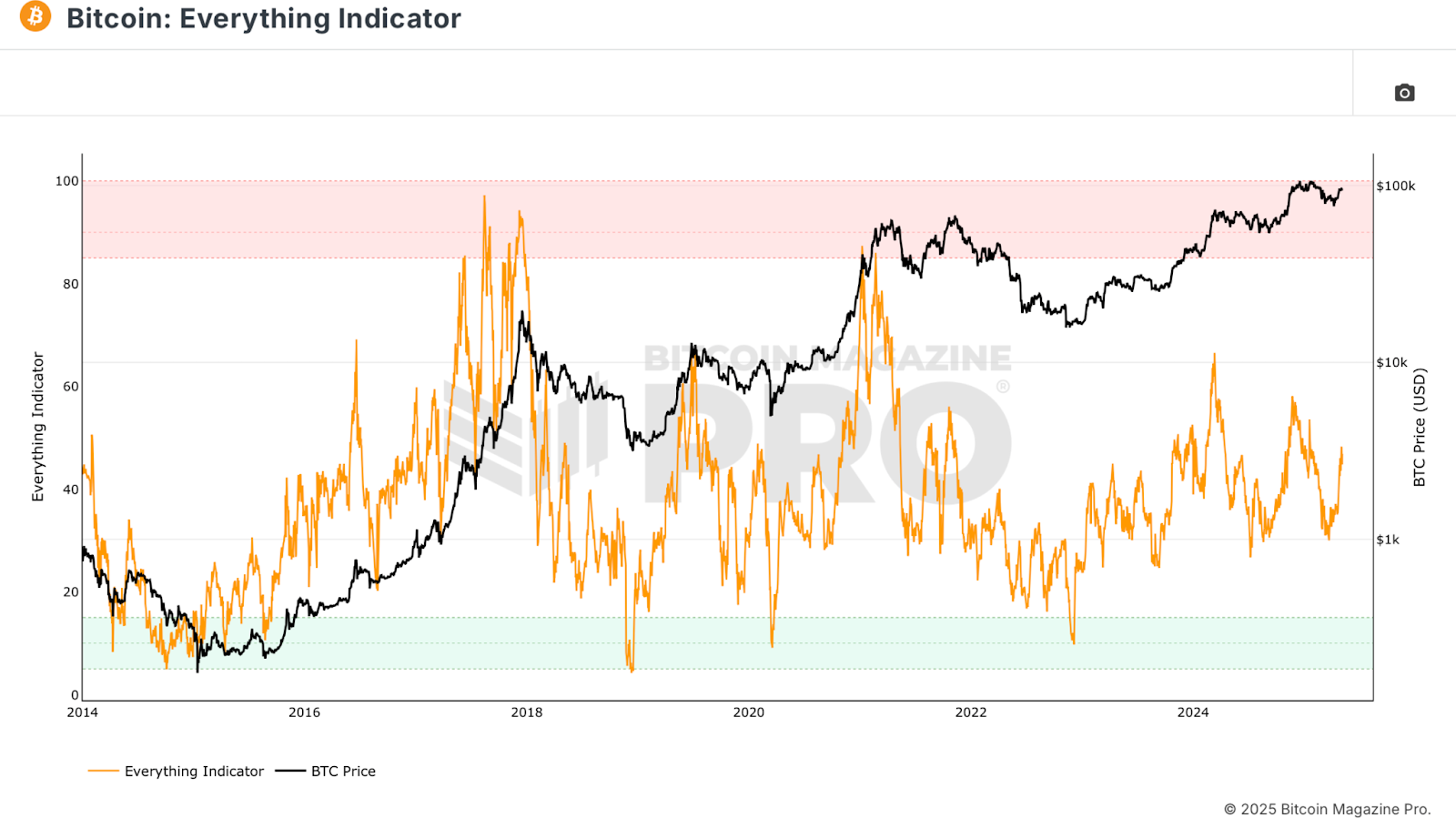

Picture this: the Bitcoin Everything Indicator is like a Swiss Army knife, combining various signals from on-chain metrics, macroeconomics, network data, technical overlays, and mining health. It's an all-in-one tool that captures the essence of Bitcoin market dynamics without relying on a single source. Think of it as a symphony of indicators working together to paint a holistic picture of Bitcoin price trends.

Enhancing Signal Frequency

Unlocking More Opportunities

The original Everything Indicator was like a rare comet sighting – accurate but infrequent. Now, with a simple modification involving a moving average, you can amplify the signal frequency without losing the indicator's core essence. It's like upgrading from a telescope to a microscope, zooming in on more actionable insights within shorter time frames.

Implementing the Moving Average Strategy

A New Perspective

Imagine adding a moving average to the Everything Indicator as a signal line. When the indicator crosses above this moving average, it signals a harmonious uptrend across various components. This crossover acts as an early bullish signal, allowing you to enter the market strategically. On the flip side, a crossover below the moving average indicates a potential downturn, prompting a cautious approach.

Maximizing Trading Efficiency

Seizing Opportunities

By shortening the moving average period, you can elevate your trading game to a whole new level. With more frequent signals, you gain better market timing, enhanced accumulation strategies, timely exit cues, and a reduced risk of prolonged downturns. It's like having a personal trading coach guiding you through every market twist and turn.

Embracing the Power of Adaptation

A Path to Success

The Bitcoin Everything Indicator, coupled with moving averages, offers a winning combination of macro insights and real-time signals. It's a versatile tool that caters to both long-term investors seeking validation and active traders craving agility. By customizing these tools to fit your strategy, you're paving the way for smarter, more profitable trades.

Take Your Trading to the Next Level

Ready to revolutionize your trading approach? Dive deeper into Bitcoin Magazine Pro's suite of indicators and explore the endless possibilities. Tweak, adjust, experiment – the more you fine-tune these tools to align with your goals, the more potent and intuitive they become. It's time to elevate your trading game and ride the wave of success!

Frequently Asked Questions

How much gold should you have in your portfolio?

The amount you make will depend on the amount of capital you have. Start small with $5k-10k. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. You only pay one month.

It's also important to determine what type business you'll run. In my case, we charge clients between $1000-2000/month, depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. This means that you may only be paid once every six months.

You need to determine what kind or income you want before you decide how much of it you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

Is gold a good investment IRA?

Any person looking to save money is well-served by gold. You can diversify your portfolio with gold. But gold has more to it than meets the eyes.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

But unlike paper currencies, which governments create, gold is mined out of the earth. It's hard to find and very rare, making it extremely valuable.

The supply and demand for gold determine the price of gold. If the economy is strong, people will spend more money which means less people can mine gold. This results in gold prices rising.

On the flip side, people save cash for emergencies and don't spend it. This results in more gold being produced, which drives down its value.

This is why investing in gold makes sense for individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Also, your investments will earn you interest which can help increase your wealth. In addition, you won’t lose any money if gold falls in value.

Can the government take your gold?

Because you have it, the government can't take it. It is yours because you worked hard for it. It belongs exclusively to you. This rule may not apply to all cases. Your gold could be taken away if your crime was fraud against federal government. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's not legal – WSJ

forbes.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

How To

How to Keep Physical Gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

The alternative is to buy physical gold. You'll need to open a bank account, buy gold online from a trusted seller, or open an online bullion trading account. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It's also easy to see how many gold you have. The receipt will show exactly what you paid. You'll also know if taxes were not paid. You have less risk of theft when investing in stocks.

However, there can be some downsides. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, tax man may want to ask where you put your gold.

BullionVault.com is the best website to learn about gold purchases in an IRA.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: The Ultimate Guide to Maximizing Profits with the Bitcoin Everything Indicator

Sourced From: bitcoinmagazine.com/markets/bitcoin-everything-indicator-profits

Published Date: Fri, 09 May 2025 13:12:27 +0000