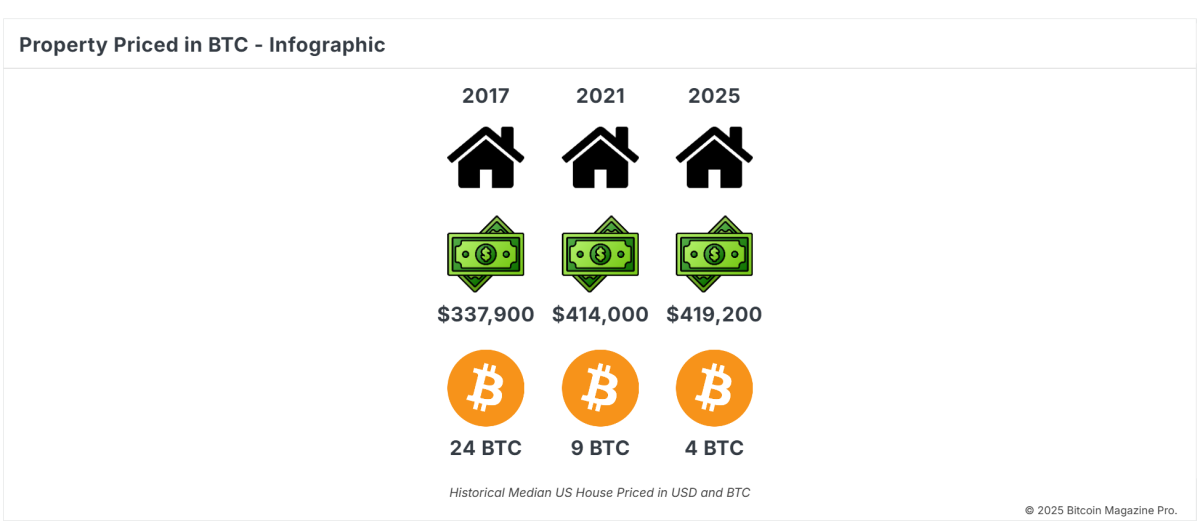

In today’s ever-changing economic landscape, experienced investors are reassessing their portfolios and looking towards Bitcoin as a potential alternative to traditional assets like real estate. With its finite supply and promising growth prospects, Bitcoin presents a compelling argument for forward-thinking investment strategies.

Real Estate: Challenging the Perception of Stability

Real estate has traditionally been seen as a secure way to preserve wealth. However, the housing market is susceptible to systemic risks such as interest rate fluctuations, government interventions, and economic downturns. Additionally, property investments often come with high maintenance costs, taxes, and limited liquidity.

The Emergence of Bitcoin as a Value Store

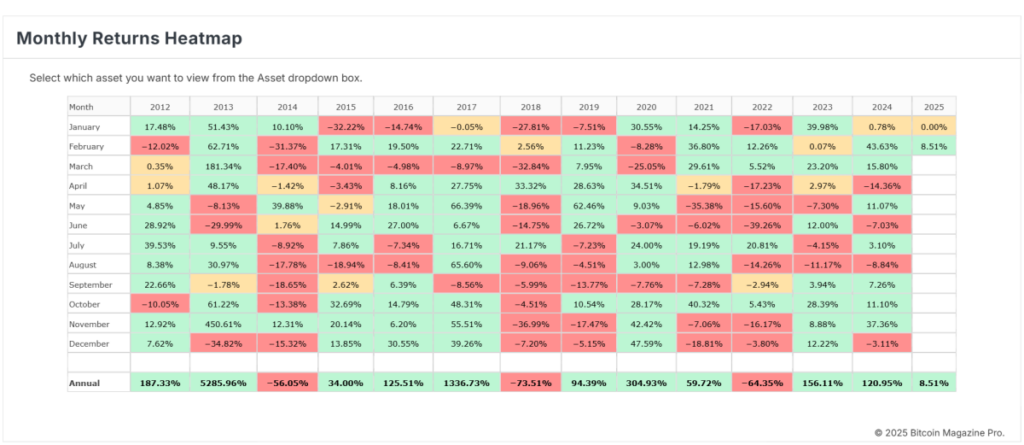

With a capped supply of 21 million coins, Bitcoin has earned the moniker of "digital gold" for the modern era. Over the past decade, Bitcoin has consistently outperformed other asset classes, delivering impressive returns despite its volatility.

Liquidity and Accessibility: A Competitive Edge

Real estate transactions can be time-consuming, expensive, and subject to strict regulations. Selling a property may take months, tying up capital and hindering quick decision-making. On the contrary, Bitcoin provides instant liquidity and can be traded 24/7 on global platforms, offering investors the flexibility to move their assets across borders seamlessly.

Hedging Against Inflation: Bitcoin's Value Proposition

Real estate values often follow inflation trends without significantly outpacing them. In contrast, Bitcoin serves as a hedge against fiat currency devaluation and has shown resilience during periods of inflation. With central banks increasing money supply rapidly, Bitcoin's limited availability shields its value from currency devaluation.

Adaptability for Modern Investors

Contemporary investors prioritize flexibility and global accessibility. Real estate, being localized and illiquid, restricts mobility. Conversely, Bitcoin is decentralized, borderless, and operates independently of traditional financial systems. This feature appeals particularly to tech-savvy, young investors who value autonomy and versatility.

A Vision for the Future: Bitcoin as a Financial Game Changer

Bitcoin represents more than just a speculative asset; it embodies a financial revolution. By embracing Bitcoin, savvy investors position themselves at the forefront of this transformative shift. As Bitcoin gains wider acceptance, its value as a robust, deflationary asset tailored for the modern economy becomes increasingly evident.

While real estate has long been a staple in investment portfolios, Bitcoin presents a disruptive alternative that aligns with the evolving global economy’s demands. For investors looking to safeguard their wealth, hedge against inflation, and leverage innovative technology, Bitcoin emerges as the preferred asset. The question shifts from "Why Bitcoin?" to "Why not Bitcoin?"

If you seek more detailed insights and real-time updates, consider exploring Bitcoin Magazine Pro for valuable information on the Bitcoin market.

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

What are the pros and disadvantages of a gold IRA

An Individual Retirement account (IRA) is a better option than regular savings accounts in that interest earned is exempted from tax. An IRA is a good choice for those who want a way to save some money but don’t want the tax. This type of investment has its downsides.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. A penalty fee will be charged if you decide to withdraw funds.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Many insurers require that you own at least one ounce of gold before you can make a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers restrict the amount you can own in gold. Others let you pick your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. Gold futures contracts are more expensive than physical gold. Futures contracts allow you to buy gold with more flexibility. Futures contracts allow you to create a contract with a specified expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. It does include coverage for damage due to natural disasters. If you live in a high-risk area, you may want to add additional coverage.

Apart from insurance, you should consider the costs of storing your precious metals. Insurance doesn't cover storage costs. For safekeeping, banks typically charge $25-40 per month.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians aren't allowed to sell your assets. Instead, they must hold them as long as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. Also, you should specify how much each month you plan to invest.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. After reviewing your application, the company will send you a confirmation mail.

A financial planner is a good idea when opening a gold IRA. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

Should You Open a Precious Metal IRA?

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. You cannot recover any money you have invested. All your investments can be lost due to theft, fire or flood.

This type of loss can be avoided by investing in physical silver and gold coins. These items are timeless and have a lifetime value. These items are worth more today than they were when first produced.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

If you decide to open an account, remember that you won't see any returns until after you retire. Remember the future.

How to open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. You must complete Form 8606 to open an account. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. You must complete this form within 60 days of opening your account. Once this has been completed, you can begin investing. You might also be able to contribute directly from the paycheck through payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, the process is identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. And, you have to make contributions regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can use a precious-metals IRA to purchase gold, silver and palladium. But, you'll only be able to purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is offered by some IRA providers.

There are two main drawbacks to investing through an IRA in precious metallics. First, they are not as liquid or as easy to sell as stocks and bonds. They are therefore more difficult to sell when necessary. Second, they are not able to generate dividends as stocks and bonds. You'll lose your money over time, rather than making it.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

investopedia.com

bbb.org

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

How To

3 Ways to Invest Gold for Retirement

It is important to understand the role of gold in your retirement plan. You can invest in gold through your 401(k), if you have one at work. You might also consider investing in gold outside your workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are the rules for gold investing:

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, deposit cash into your accounts. This will help protect you against inflation and keep your purchasing power high.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. Physical gold coins are easier to sell than certificates. There are no storage fees for physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. Also, diversify your wealth and invest in different assets. This reduces risk and allows you to be more flexible during market volatility.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: The Rise of Bitcoin: A Modern Investment Perspective

Sourced From: bitcoinmagazine.com/markets/why-smart-investors-buy-bitcoin-not-real-estate

Published Date: Tue, 04 Feb 2025 21:16:01 GMT