The Shift to Cash Creation Methodology

The Securities and Exchange Commission (SEC) has recently met with potential issuers of spot Bitcoin ETFs. These meetings have resulted in a significant change in the creation process, with issuers now adopting a cash creation methodology instead of the usual "in kind" transfers. While there has been much discussion around this change, it is important to understand that the overall impact on investors will be minimal, but meaningful for the issuers. However, this shift reflects poorly on the SEC as a regulatory body.

Understanding Exchange Traded Funds (ETFs)

Before delving into the implications of cash creation, it is crucial to have a basic understanding of how Exchange Traded Funds (ETFs) operate. ETF issuers work with Authorized Participants (APs), who have the authority to exchange a predetermined amount of the fund's assets (such as stocks, bonds, commodities, etc.) or a defined cash amount, or a combination of both, for a fixed number of ETF shares. In the case of spot Bitcoin ETFs, the traditional "in kind" creation process would involve exchanging 100 Bitcoin for 100,000 ETF shares.

The Process of Cash Creation

With the adoption of cash creation, the Issuer is now required to publish the real-time cash amount needed to acquire the equivalent of 100 Bitcoin as the price of Bitcoin fluctuates. The Issuer is also responsible for purchasing the required Bitcoin or selling it in the case of a redemption. It is important to note that this mechanism applies to all ETFs, and claims that cash creation means the fund is not backed 100% by Bitcoin holdings are incorrect. While there may be a short delay in purchasing the necessary Bitcoin, the longer the delay, the higher the risk for the issuer. If the Issuer needs to pay more than the quoted price, the fund will have a negative cash balance, impacting its performance and ability to grow assets. Conversely, if the Issuer can buy Bitcoin for less than the cash deposited by APs, the fund will have a positive cash balance, potentially improving its performance.

Challenges for Issuers

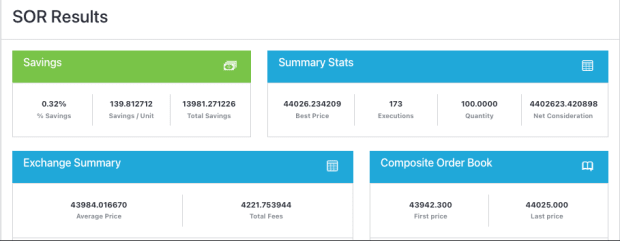

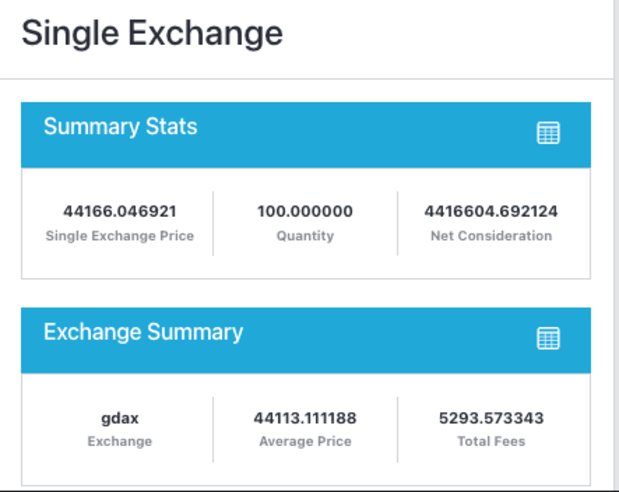

Issuers now face the challenge of balancing the need to quote a tight spread between creation and redemption cash amounts with the ability to trade at or better than the quoted amounts. This requires access to sophisticated technology. For instance, quoting for 100 Bitcoin based on liquidity on Coinbase alone may differ significantly from a strategy that uses multiple regulated U.S. exchanges. The technology hurdle faced by issuers is evident, as the calculation requires traversing numerous market/price level combinations. Traditional financial systems do not encounter such fragmentation in Bitcoin trading.

Variation in Pricing and Costs

Considering the different approaches taken by issuers, there will likely be significant variation in pricing and costs. Issuers with access to superior trading technology will be able to offer tighter spreads and superior performance. Some issuers may choose to trade on a single exchange, while others may opt for over-the-counter trading with market makers or algorithmic trading providers. This variation further emphasizes the importance for investors to research and understand the mechanisms chosen by each issuer.

The Reason Behind the Shift

The SEC's decision to enforce cash creation/redemption instead of "in kind" is primarily due to regulatory restrictions. Authorized Participants, who are broker dealers regulated by the SEC and organizations like FINRA, are not yet approved to trade spot Bitcoin directly. This approval would have been necessary if the process involved "in kind" transfers. While there have been various conspiracy theories surrounding this decision, the simple explanation lies in the regulatory framework.

Conclusion

The introduction of spot Bitcoin ETFs is a significant step forward for the Bitcoin industry. However, it is essential for investors to research and understand the mechanisms chosen by each issuer, particularly in terms of how they quote and trade the creation and redemption process. Other factors to consider include custodial processes and fees. Ignoring these details could lead to costly decisions. The market will likely see significant variation in pricing and costs between different issuers, making it crucial for investors to make informed choices.

This is a guest post by David Weisberger. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Should you Invest In Gold For Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure which option to choose, consider investing in both options.

Gold offers potential returns and is therefore a safe investment. This makes it a worthwhile choice for retirees.

Gold is more volatile than most other investments. This causes its value to fluctuate over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. This just means you need to account for fluctuations in your overall portfolio.

Another advantage of gold is its tangible nature. Gold is more convenient than bonds or stocks because it can be stored easily. It can also be carried.

You can always access your gold if it is stored in a secure place. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. As gold prices rise in tandem with other commodities it can be a good hedge against rising cost.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold usually rises when the stock market falls.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

Don't purchase too much at once. Start with a few ounces. Then add more as needed.

The goal is not to become rich quick. It is to create enough wealth that you no longer have to depend on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

How Do You Make a Withdrawal from a Precious Metal IRA?

First, decide if it is possible to withdraw funds from an IRA. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, determine how much money you plan to withdraw from your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. You will need to weigh each one before making a decision.

Because you don't have to store individual coins, bullion bars take up less space than other items. But, each coin must be counted separately. However, keeping individual coins in a separate place allows you to easily track their values.

Some people like to keep their coins in vaults. Others prefer to store them in a safe deposit box. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

What proportion of your portfolio should you have in precious metals

This question can only be answered if we first know what precious metals are. Precious elements are those elements which have a high price relative to other commodities. This makes them very valuable in terms of trading and investment. The most traded precious metal is gold.

There are however many other types, including silver, and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is not affected by inflation or deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. This is because investors expect lower interest rates, making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. Since these are scarce, they become more expensive and decrease in value.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

Can I purchase gold with my self directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contract are financial instruments that depend on the gold price. They allow you to speculate on future prices without owning the metal itself. You can only hold physical bullion, which is real silver and gold bars.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. This type of investment has its downsides.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

If you prefer your money to be kept out of a bank, then you will need insurance. Most insurers require you to own a minimum amount of gold before making a claim. Some insurers may require you to have insurance that covers losses up $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers limit how many ounces you can keep. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more expensive than gold futures contracts. Futures contracts, however, allow for greater flexibility in buying gold. They allow you to set up a contract with a specific expiration date.

You also need to decide the type and level of insurance coverage you want. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does offer coverage for natural disasters. If you live in a high-risk area, you may want to add additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Insurance won't cover storage costs. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians don't have the right to sell assets. Instead, they must retain them for as long and as you require.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. Your plan should include information about the investments you want to make, such as stocks, bonds, mutual funds, or real estate. Also, you should specify how much each month you plan to invest.

After filling in the forms, please send them to the provider. Once the company has received your application, they will review it and send you a confirmation email.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

investopedia.com

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was universally accepted due to its purity and divisibility, beauty, scarcity, and durability. In addition, because of its value, it was traded internationally. There were different measures and weights for gold, as there was no standard to measure it. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This led to a decline in demand for foreign currencies, which caused their price to increase. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. Because the U.S. government had too much money coming into circulation, they needed to find a way to pay off some debt. To do so, they decided to sell some of the excess gold back to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. After World War I, however, many European countries started using paper money to replace gold. The price of gold rose significantly over the years. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————-

By: David Weisberger

Title: The Real Implications Of Cash Creation Instead of In Kind

Sourced From: bitcoinmagazine.com/markets/the-real-implications-of-cash-creation-instead-of-in-kind

Published Date: Thu, 04 Jan 2024 18:02:39 GMT

Related posts:

Georgetown Professor Urges SEC to Let Spot Bitcoin ETFs Use In-Kind Creation Method

Georgetown Professor Urges SEC to Let Spot Bitcoin ETFs Use In-Kind Creation Method

SEC’s Spot Bitcoin ETF Advice Fuels Hope for Approval — Crypto Industry Views It as ‘Real Progress’

SEC’s Spot Bitcoin ETF Advice Fuels Hope for Approval — Crypto Industry Views It as ‘Real Progress’

Grayscale Clarifies Investor Tax Implications of a Cash-Created Spot Bitcoin ETF

Grayscale Clarifies Investor Tax Implications of a Cash-Created Spot Bitcoin ETF

UAE Virtual Assets Regulator Confirms Cooperation from Islamic Coin Issuer

UAE Virtual Assets Regulator Confirms Cooperation from Islamic Coin Issuer