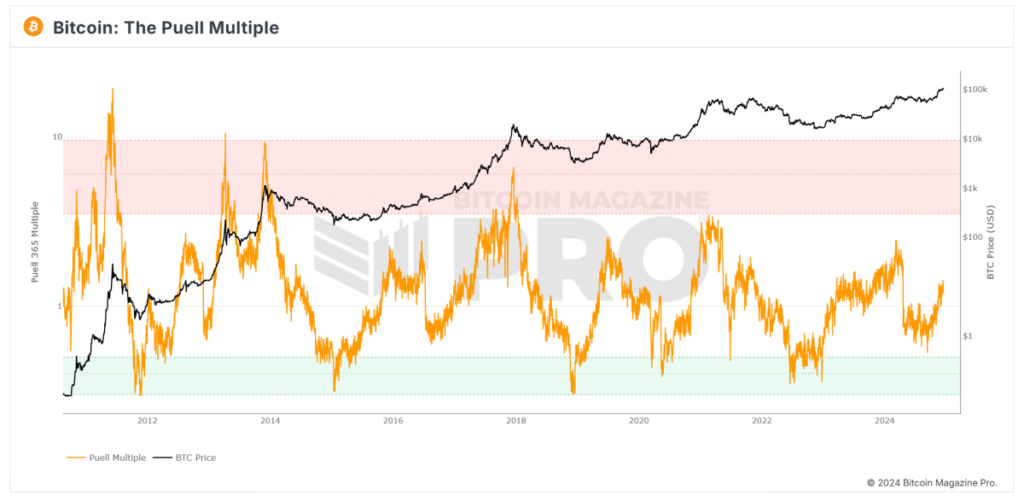

In the world of Bitcoin investing, understanding market cycles is crucial for identifying buying opportunities and potential price peaks. One key indicator that has proven reliable over time is the Puell Multiple, created by David Puell. This metric evaluates Bitcoin's valuation by analyzing miner revenue, providing insights into whether Bitcoin is currently undervalued or overvalued compared to its historical averages.

What is the Puell Multiple?

The Puell Multiple is an indicator that compares Bitcoin miners' daily revenue to its long-term average. Miners play a vital role in Bitcoin's economy by selling portions of their BTC rewards to cover operational expenses like energy and hardware. This makes miner revenue a significant factor influencing Bitcoin's price movements.

How is the Puell Multiple Calculated?

The Puell Multiple is calculated using a simple formula:

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By comparing current miner revenues to their yearly average, the Puell Multiple identifies periods of unusually high or low profits for miners, indicating potential market tops or bottoms.

Interpreting the Puell Multiple Chart

The Puell Multiple chart utilizes color-coded zones for easy interpretation:

Red Zone (Overvaluation): When the Puell Multiple enters the red zone (above 3.4), it indicates significantly higher miner revenues, historically coinciding with Bitcoin price peaks and potential overvaluation.

Green Zone (Undervaluation): A drop into the green zone (below 0.5) signals unusually low miner revenues, historically aligning with Bitcoin market bottoms and presenting buying opportunities.

Neutral Zone: When the Puell Multiple fluctuates between these levels, Bitcoin's price tends to remain stable relative to historical averages.

Current Insights and Implications for Investors

Looking at the current Puell Multiple chart:

– The Puell Multiple is trending upward but remains below the red overvaluation zone, suggesting Bitcoin is not overheated.

– The metric is well above the green undervaluation zone, indicating that we are not in a market bottom phase.

For investors, this suggests that Bitcoin is in a mid-market cycle with bullish momentum but without an immediate peak in sight. Monitoring the Puell Multiple closely, especially leading up to Bitcoin's next halving event in 2028, can provide valuable insights into market trends.

Significance of the Puell Multiple for Investors

The Puell Multiple offers a distinct perspective on Bitcoin's market cycles by focusing on miner revenue. For investors:

– It helps identify buying opportunities during undervaluation periods.

– It signals potential market peaks during overvaluation phases.

– It aids in navigating market cycles when combined with other indicators for strategic entry and exit decisions.

Stay informed and ahead of the market by utilizing tools like the Puell Multiple chart on Bitcoin Magazine Pro to enhance your analysis of Bitcoin's valuation trends and make well-informed investment decisions.

Disclaimer: This article serves for informational purposes only and does not offer financial advice. Always conduct thorough research before making investment choices.

Frequently Asked Questions

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. There is no way to recover money that you have invested in precious metals. This includes any loss of investments from theft, fire, flood or other circumstances.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items can be lost because they have real value and have been around for thousands years. They are likely to fetch more today than the price you paid for them in their original form.

You should choose a reputable firm that offers competitive rates. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

Do not open an account unless you're ready to retire. Keep your eyes open for the future.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. The account cannot be withdrawn from until you are 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, your principal (the deposit amount originally made) is not transferable. This means that no matter how much you contribute, you can never take out more than what was initially contributed to this account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule is that your earnings cannot be withheld without income tax. Also, taxes will be due on any earnings you take. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's also assume that you make $10,000 per year from your Roth IRA contributions. Federal income taxes would apply to the earnings. You would be responsible for $3500 This leaves you with $6,500 remaining. Because you can only withdraw what you have initially contributed, this is all you can take out.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

There are two types: Roth IRAs that are traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA allows you to withdraw your entire contribution plus any interest. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal limit, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

How much of your portfolio should be in precious metals?

First, let's define precious metals to answer the question. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them extremely valuable for trading and investing. The most traded precious metal is gold.

There are many other precious metals, such as silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. That said, they do not always move in lockstep with each other. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

The opposite effect happens when the economy is strong. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Since these are scarce, they become more expensive and decrease in value.

Diversifying across precious metals is a great way to maximize your investment returns. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

What are the benefits of having a gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. You can withdraw it at any time, but it is tax-deferred. You control how much you take each year. There are many types and types of IRAs. Some are more suitable for students who wish to save money for college. Others are made for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. However, once they begin withdrawing funds, these earnings are not taxed again. So if you're planning to retire early, this type of account may make sense.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. People who want to invest their money rather than spend it make gold IRA accounts a great option.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This eliminates the need to constantly make deposits. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in times of economic turmoil gold prices tend to remain stable. As a result, it's often considered a good choice when protecting your savings from inflation.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

irs.gov

bbb.org

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

How To

Tips for Investing with Gold

Investing in Gold is a popular investment strategy. This is due to the many benefits of investing in gold. There are many ways to invest gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before buying any type gold, it is important to think about these things.

- First, verify that your country permits gold ownership. If it is, you can move on. Or, you might consider buying gold overseas.

- Second, it is important to know which type of gold coin you are looking for. There are many options for gold coins: yellow, white, and rose.

- The third factor to consider is the price for gold. Start small and move up. It is important to diversify your portfolio whenever you purchase gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Lastly, you should never forget that gold prices change frequently. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: The Puell Multiple: A Powerful Tool for Bitcoin Investors

Sourced From: bitcoinmagazine.com/markets/what-is-the-bitcoin-puell-multiple-indicator-and-how-does-it-work

Published Date: Wed, 18 Dec 2024 16:53:49 GMT