DISCLAIMER: This article dives into the author's insights on Nakamoto's innovative strategy and its potential impact. It offers forward-looking analysis and does not represent Nakamoto's official stance. Please note that Nakamoto's approach may evolve before finalization. The analysis draws from public data, early moves, and emerging trends observed so far.

Unveiling a New Era: Bitcoin Treasury Strategy Goes Global

Let's embark on a journey into the Nakamoto strategy, reshaping the landscape of Bitcoin investments. Instead of treating Bitcoin as a mere asset, Nakamoto leverages it to construct a dynamic, globally interconnected capital framework.

Diving deeper than just hoarding BTC, Nakamoto establishes Bitcoin as a core value layer. By coupling it with public equity, Nakamoto strategically injects capital into promising, smaller public firms. The aim? To enhance exposure, widen market reach, and nurture a decentralized, Bitcoin-centric financial ecosystem.

Seeding Success: Exemplary Bitcoin Treasury Companies

Witness the success stories initiated by UTXO Management in seeding notable Bitcoin treasury companies:

- Metaplanet (TSE: 3350) – Japan's top-performing public Bitcoin company, boasting 13,350 BTC.

- The Smarter Web Company (AQUIS: SWC) – A UK web services firm that surged over 100x post-IPO.

- The Blockchain Group (Euronext: ALTBG) – Europe's pioneer Bitcoin treasury company with a remarkable 1000% BTC yield in 2025.

With a robust capital base exceeding $750 million, Nakamoto is set to expand this strategy globally, venturing into different markets and exchanges, empowering one Bitcoin treasury company at a time.

As Bitcoin becomes the global capital benchmark, strategies outperforming Bitcoin grow in significance. Nakamoto's model aims not just to retain value in BTC but to magnify it. Companies consistently surpassing Bitcoin through disciplined BTC strategies are poised to attract significant investor interest, seeking returns beyond Bitcoin's standard.

Demystifying the Nakamoto Strategy

Market Access Unleashed

The Nakamoto strategy's core insight? Market access limitations are as crucial as Bitcoin itself. Institutional capital faces hurdles in directly handling Bitcoin in many regions. However, these entities can invest in public equities that hold Bitcoin—a gateway Nakamoto capitalizes on.

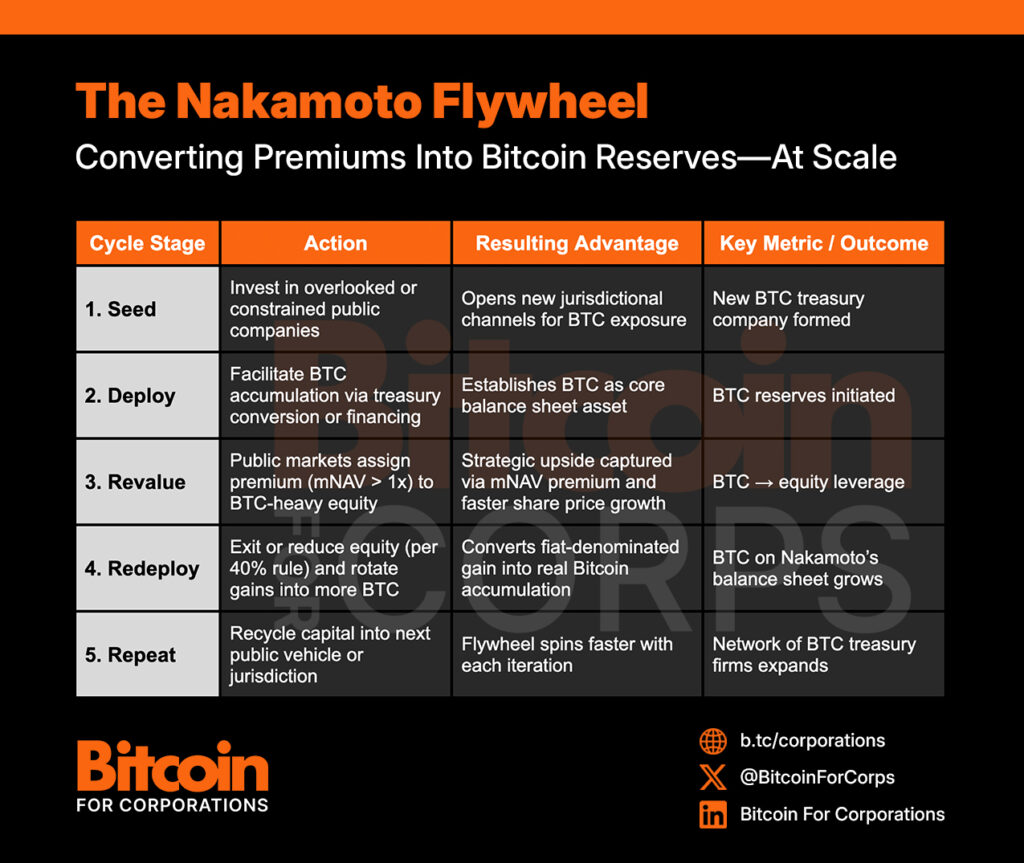

Here's how Nakamoto's approach unfolds:

- Nurturing Bitcoin Treasury Companies: Establishing entities in regions where Bitcoin access is restricted, amplifying Bitcoin presence.

- Bitcoin Deployment Tactics: Strategically infusing BTC through various financing methods, like PIPEs or warrants.

- Unlocking Market Revaluation: Fostering equities that may trade above their BTC holdings' value, promoting mNAV expansion.

- Capital Recycling: Engaging in a cycle to reinvest in new ventures or more BTC, fostering growth.

The Nakamoto Flywheel illustrates how public market equity premiums evolve into long-term Bitcoin reserves, a cycle amplifying Bitcoin value with each iteration—strengthening global balance sheets.

Mastering Mechanics: The Value Multiplier

Harnessing mNAV Arbitrage and Premium Capture

Nakamoto thrives by capitalizing on public market dynamics and Bitcoin access constraints, utilizing mNAV (multiple of Net Asset Value) arbitrage. By investing in Bitcoin treasury companies where compliant BTC exposure avenues are scarce, Nakamoto triggers equity appreciation, boosting Bitcoin's market value acquired initially at spot rates.

BTC Yield: The Performance Key

Shifting from traditional metrics, Nakamoto gauges success in Bitcoin terms, particularly via BTC Yield—reflecting the compounding benefit of a treasury company increasing its Bitcoin reserves faster than issuing equity. This enforces alignment with Bitcoin-centric value creation.

Nakamoto also monitors look-through BTC ownership, its proportional BTC claim across portfolio firms—a secondary KPI ensuring all equity moves align with Bitcoin benchmarks.

While most Bitcoin-treasury firms rely on equity issuance to boost BTC-per-share, Nakamoto adopts the mNAV² strategy, compounding holdings sans dilution. This involves:

- Seeding at Intrinsic Value: Launching/investing in a Bitcoin treasury firm at or near 1× mNAV, pricing equity in line with net Bitcoin holdings.

- Unlocking the Premium: Rerating the company in public markets, creating an mNAV premium due to scarcity or strategic positioning.

- Dilution-Free Recycling: Reinvesting appreciated equity into new ventures or more BTC without new shares, fostering BTC-per-share growth efficiently.

Amid intensifying competition among listed treasury entities, firms excelling in non-dilutive BTC-per-share expansion are likely to thrive. mNAV² is Nakamoto’s playbook essence, turning balance-sheet efficiency into a competitive advantage.

Filling the Institutional Gap

Jurisdictional barriers hinder institutional Bitcoin ownership directly, but investing in public equities holding BTC resolves this. Nakamoto addresses this asymmetry by sowing compliant public vehicles for institutional Bitcoin exposure.

Public Markets: A Strategic Playground

Operating in public markets grants Nakamoto transparency, liquidity, and efficient capital recycling, enabling swift expansion into new landscapes. This approach, unlike private market setups, supports scalability, visibility, and real-time regulatory adherence.

The 40% Rule: Bitcoin's Strategic Anchor

Nakamoto adheres to the Investment Company Act of 1940's 40% securities cap, mandating a ceiling on public equity holdings. This rule necessitates:

- Trimming equity stakes as valuations surge to comply with the 40% limit.

- Redirecting gains into Bitcoin, intensifying BTC accumulation.

- Adopting innovative structures like Bitcoin-denominated convertible notes to manage this cap efficiently.

This rule fuels capital discipline and strategic Bitcoin reinvestment, shaping Nakamoto’s journey. As Nakamoto's balance sheet expands, so does its capacity to hold larger equity shares—always with Bitcoin as the core asset.

Strategic Tools: Bitcoin-Denominated Convertible Notes

To ensure compliance and mitigate volatility exposure, Nakamoto may leverage Bitcoin-denominated convertible notes in future ventures. These instruments offer flexibility in structuring exposure, securing investment values while retaining equity conversion options.

Here's why this setup is advantageous:

- Regulatory Shield: Delaying security classification by staging conversion, preserving headroom under the 40 Act.

- Gradual Entry and Exit: Incremental note conversion aligns exposure with evolving balance sheet capacity, minimizing market impact.

Models like those embraced by The Blockchain Group and H100 showcase the promise of Bitcoin-denominated convertibles. If expanded thoughtfully, these notes could redefine Nakamoto’s strategy, aligning capital tactics with compliance and performance.

Addressing Critics: Deciphering Nakamoto's Strategy

Navigating Tax Complexities

Tax intricacies linked to Bitcoin transfers prompt concerns. Nakamoto sidesteps direct BTC transfers, opting for equity-based mechanisms to avoid immediate tax implications, such as PIPEs, warrants, and joint ventures.

Evaluating mNAV Premiums and Narrative Risk

Doubts on mNAV premiums' sustainability often arise. Nakamoto stresses BTC Yield over valuation multiples, focusing on BTC accumulation through strategic capital deployment.

Governance and Operational Influence

Questions loom over Nakamoto's influence on supported firms. Nakamoto ensures strategic alignment via governance rights, board seats, and equity stakes, shaping treasury policies while preserving companies' autonomy.

Tackling Market Volatility and Compression Risk

Concerns over mNAV compression, especially in volatility, exist. Nakamoto mitigates this by targeting low-valuation regions with Bitcoin demand, maintaining intrinsic value amid market fluctuations.

Capturing Value in a Bitcoin Model

Extracting value from supported companies prompts queries. Nakamoto thrives on long-term equity stakes, pre-IPO warrants, and equity appreciation tied to BTC-per-share growth, aligning value capture with Bitcoin-centric performance.

Distinguishing from Private Equity Models

Comparisons with private equity models emerge. Nakamoto's transparency, liquidity, and Bitcoin-native accounting set it apart, acting as an infrastructure creator instead of a conventional fund—pioneering institutional Bitcoin access.

Nakamoto's Role vs. Direct Investment

Direct investment versus Nakamoto's role sparks debates. Nakamoto's deal-sourcing prowess in untapped markets, coupled with compliant structures and early demand catalysis, provide a unique value proposition, bridging Bitcoin capital to traditional finance.

Nakamoto's unbeatable edge? Unmatched deal access, enabling transaction structuring ahead of the curve—a privilege most external capital lacks until valuations shift.

Epilogue: Nakamoto's Path to Bitcoin-Centric Capital Markets

The Nakamoto strategy heralds a new era in Bitcoin-centric capital frameworks. By facilitating market access, accelerating public market dynamics, and fostering BTC-per-share accumulation, Nakamoto propels a wave of treasury-first public firms.

With $750 million+ raised, operational triumphs across Tokyo, London, Paris, and a burgeoning listing network, Nakamoto steers towards its vision—bridging capital markets with Bitcoin's rise.

Amidst hurdles barring traditional finance from direct Bitcoin exposure, Nakamoto's model could pave a compliant, scalable path forward. It's more than a capital approach—it's a structural response to Bitcoin's ascendancy in global finance.

Frequently Asked Questions

How does a gold IRA account work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase gold bullion coins in physical form at any moment. You don’t have to wait to begin investing in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold holdings will not be subject to tax when you are gone.

Your heirs will inherit your gold, and not pay capital gains taxes. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

To open a IRA for gold, you must first create an individual retirement plan (IRA). Once you've completed this step, an IRA administrator will be appointed to your account. This company acts like a middleman between the IRS and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required for gold bullion coins purchase is $1,000 You'll get a higher rate of interest if you deposit more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

You may not be required to pay taxes if you take out only a small amount. However, there are some exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

You shouldn't take out more then 50% of your total IRA assets annually. Otherwise, you'll face steep financial consequences.

What does gold do as an investment?

The price of gold fluctuates based on supply and demand. Interest rates can also affect the gold price.

Because of their limited supply, gold prices can fluctuate. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

How much gold should you have in your portfolio?

The amount of capital that you require will determine how much money you can make. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. You only pay one month.

Consider what type of business your company will be running. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. This means that you may only be paid once every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k in gold and working my way up.

What are the benefits of a Gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. It will be tax-deferred up until the time you withdraw it. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better suited for people who want to save for college expenses. Some are for investors who seek higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. These earnings don't get taxed if they withdraw funds. This type account may make sense if it is your intention to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. You won't have the hassle of making deposits each month. To ensure that you never miss a payment, you could set up direct debits.

Finally, gold is one the most secure investment options available. Because it isn't tied to any particular country its value tends be steady. Even in economic turmoil, gold prices tends to remain relatively stable. It is therefore a great choice for protecting your savings against inflation.

How can I withdraw from a Precious metal IRA?

First, decide if it is possible to withdraw funds from an IRA. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before you choose one, weigh the pros and cons.

Bullion bars require less space, as they don't contain individual coins. You will need to count each coin individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some people prefer to keep their coins in a vault. Others prefer to store their coins in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

finance.yahoo.com

How To

Gold Roth IRA guidelines

Starting early is the best way to save for retirement. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. It is important to invest enough money each and every year to ensure you get adequate growth.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. These savings vehicles are great for those who don't have access or can't get employer matching funds.

It's important to save regularly and over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————-

By: Nick Ward

Title: The Nakamoto Strategy: Revolutionizing Bitcoin Investment Across Global Markets

Sourced From: bitcoinmagazine.com/news/nakamoto-seeding-bitcoin-treasury-companies

Published Date: Thu, 03 Jul 2025 10:26:07 +0000