Bullish Sentiment and Technical Analysis

On Friday, the price of bitcoin experienced fluctuations, ranging from $41,937 to $43,347, with a market value of $846 billion. The day's trading activity reached $17.35 billion, indicating increased investor participation and market liquidity as the weekend approached.

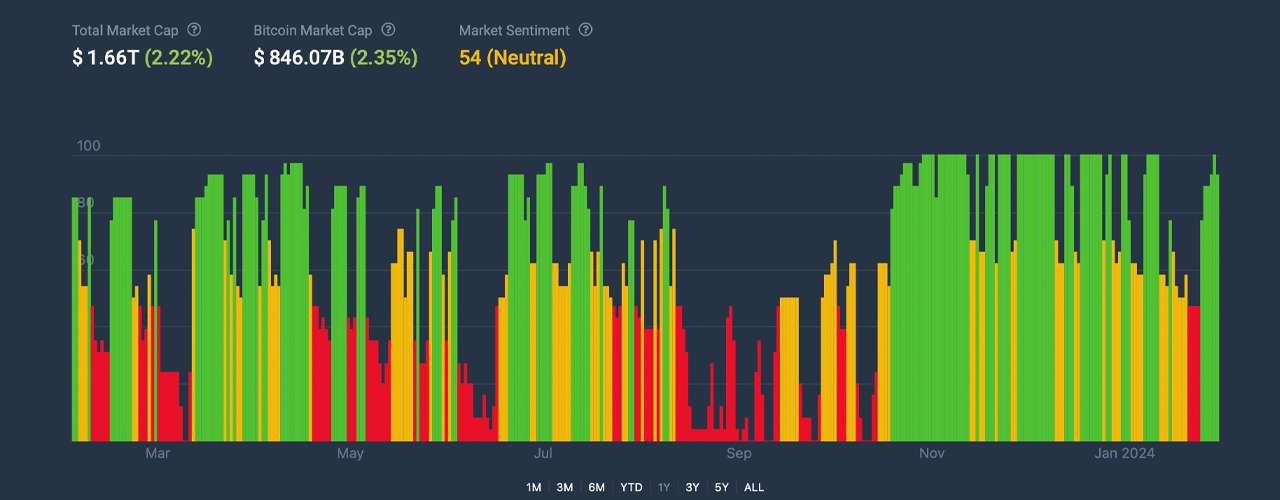

The current sentiment towards bitcoin is balanced, with a sentiment score of 54. This equilibrium reflects cautious optimism among investors, straddling the line between bullish and bearish expectations based on technical analysis. Recent variations in the Crypto Fear and Greed Index (CFGI) support this mood, with oscillations indicating both "greed" and "neutral" levels.

Various market oscillators, including the relative strength index (RSI), Stochastic, and commodity channel index (CCI), portray mixed feelings among market participants. The awesome oscillator hints at a bullish outlook, while the momentum Indicator suggests bearish tendencies, highlighting the polarized sentiment in the market.

Moving averages (MAs) across different time frames consistently suggest bullish prospects, with both simple and exponential moving averages (SMA and EMA) ascending from the 10-day through to the 200-day marker. This pattern indicates solid support for bitcoin's current valuation, despite the day's price swings. The daily chart accentuates a notable price dip following the approval of spot bitcoin exchange-traded funds (ETFs), succeeded by a large downturn and a subsequent effort to rebound.

Resistance near $49,000 has been identified, while prices currently fluctuate between $42,000 and $43,800, signaling a tentative recovery phase without definitive signs of a trend reversal. The hourly chart shows reduced volatility with a slight upward trajectory, while the 4-hour chart offers a more consolidated perspective, displaying a mild upward trend. These resistance levels present potential short-term trading strategies based on breakout or reversal patterns.

Bearish Indicators and Market Caution

Despite bitcoin's show of resilience, several indicators hint at underlying market caution. The significant price drop highlighted in the daily chart, followed by a hesitant recovery, suggests vulnerability to more sell-offs and the absence of a definitive bullish reversal. Mixed signals from oscillators, particularly the contrasting sell signal from the momentum indicator, reflect investor uncertainty and a divided market sentiment. The neutral RSI, coupled with resistance levels that capped the day's gains, underscores the challenges ahead for BTC.

Register your email here to receive weekly price analysis updates directly to your inbox.

What are your thoughts on bitcoin's market action on Friday? Share your opinions in the comments section below.

Frequently Asked Questions

What does gold do as an investment?

The supply and demand for gold affect the price of gold. It is also affected negatively by interest rates.

Due to their limited supply, gold prices fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

What Should Your IRA Include in Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. You don’t need to have a lot of money to invest. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. Stocks in companies that produce precious materials could be purchased. You might also want to use an IRA rollover program offered through your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. These metals are not stocks, but they can still provide long-term growth.

Their prices are more volatile than traditional investments. If you decide to sell your investment, you will likely make more than with traditional investments.

How can I withdraw from a Precious metal IRA?

First, decide if it is possible to withdraw funds from an IRA. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

A taxable brokerage account is a better option than an IRA if you are prepared to pay a penalty for early withdrawals. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars are easier to store than individual coins. But, each coin must be counted separately. You can track their value by keeping individual coins.

Some prefer to store their coins in a vault. Others prefer to place them in safe deposit boxes. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

How much are gold IRA fees?

$6 per month is the Individual Retirement Account Fee (IRA). This includes account maintenance and any investment costs.

Diversifying your portfolio may require you to pay additional fees. These fees will vary depending upon the type of IRA chosen. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

In addition, most providers charge annual management fees. These fees range between 0% and 1 percent. The average rate for a year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Can I hold physical gold in my IRA?

Not just paper money or coins, gold is money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

Another reason is that gold has historically outperformed other assets in financial panic periods. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During turbulent market conditions gold was one of few assets that outperformed stock prices.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, gold provides liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows you to take advantage of short-term fluctuations in the gold market.

Is the government allowed to take your gold

Your gold is yours, so the government cannot confiscate it. You earned it through hard work. It belongs to your. But, this rule is not universal. If you are convicted of fraud against the federal government, your gold can be forfeit. If you owe taxes, your precious metals could be taken away. You can keep your gold even if your taxes are not paid.

How to open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. To open the account, complete Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form must be submitted within 60 days of the account opening. Once this is done, you can start investing. You can also contribute directly to your paycheck via payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS says you must be 18 years old and have earned income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. However, you can't purchase physical bullion. This means you won’t be able to trade stocks and bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option can be provided by some IRA companies.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they're not as liquid as stocks or bonds. It's also more difficult to sell them when they are needed. Second, they don’t produce dividends like stocks or bonds. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

How To

The best way online to buy gold or silver

You must first understand the workings of gold before you can purchase it. Gold is a precious metal similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They can't be exchanged in currency exchange systems. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. Each dollar spent earns the buyer 1 gram gold.

The next thing you should know when looking to buy gold is where to do it from. There are several options available if your goal is to purchase gold from a dealer. First, your local currency shop is a good place to start. You can also try going through a reputable website like eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. You pay a commission fee between 10% and 15% for each transaction when you sell gold through private sellers. That means you would get back less money from a private seller than from a coin shop or eBay. This is a great option for gold investing because you have more control over the item’s price.

The other option is to purchase physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

When buying gold on your own, you can visit a bank or a pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks tend to charge higher interest rates, while pawnshops are typically lower.

The final option is to ask someone to buy your gold! Selling gold can also be done easily. Contact a company such as GoldMoney.com, and you can set up a simple account and start receiving payments immediately.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: The Market Action of Bitcoin on Friday: Bullish or Bearish?

Sourced From: news.bitcoin.com/bitcoin-technical-analysis-btcs-price-resilience-holds-steady-amidst-market-fluctuations/

Published Date: Fri, 02 Feb 2024 13:11:09 +0000