Over the years, Bitcoin enthusiasts have been eagerly anticipating a significant shift in value with the entry of institutional investors. The idea was simple: as companies and large financial entities embraced Bitcoin, the market would witness explosive growth and an extended period of price escalation. However, the actual outcome has proven to be more intricate than initially predicted.

Institutional Accumulation

The involvement of institutions in Bitcoin has seen a notable uptick in recent times, highlighted by substantial acquisitions from major corporations and the launch of Bitcoin Exchange-Traded Funds (ETFs) earlier this year.

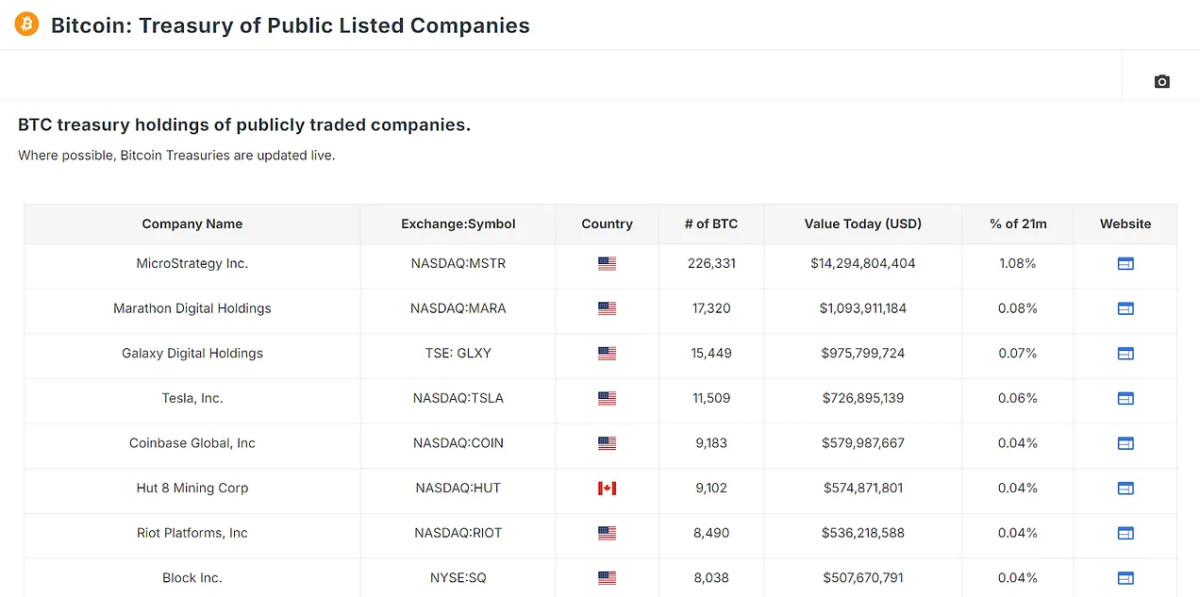

Leading the charge is MicroStrategy, holding over 1% of the total Bitcoin supply. Following suit are other key players such as Marathon Digital, Galaxy Digital, and even Tesla. Additionally, significant holdings are seen in Canadian firms like Hut 8 and Hive, as well as international companies like Nexon in Japan and Phoenix Digital Assets in the UK. The holdings of these entities can be monitored through the new Treasury data charts available on the site.

Collectively, these companies possess over 340,000 bitcoins. Nevertheless, the true game-changer has been the introduction of Bitcoin ETFs. Since their inception, these financial tools have attracted billions of dollars in investments, resulting in the accumulation of over 91,000 bitcoins within a few months. Together, private companies and ETFs control approximately 1.24 million bitcoins, representing about 6.29% of the total circulating supply.

A Look at Bitcoin's Recent Price Movements

To gauge the potential future impact of institutional investment, we can analyze recent Bitcoin price movements post the approval of Bitcoin ETFs in January. Initially trading at around $46,000, Bitcoin witnessed a slight dip shortly after due to a classic "buy the rumor, sell the news" scenario. However, the market swiftly recovered, with Bitcoin's price surging by about 60% within two months.

This surge aligns with institutional investors' accumulation of Bitcoin through ETFs. If this trend persists and institutions continue purchasing at the current or an increased rate, we might observe a sustained bullish momentum in Bitcoin prices. The pivotal factor here is the assumption that these institutional players are long-term holders, unlikely to divest their assets in the near future. This ongoing accumulation would decrease the liquid supply of Bitcoin, necessitating lesser capital inflow to propel prices higher.

The Money Multiplier Effect: Amplifying the Impact

The accumulation of assets by institutional players holds significant weight. Its potential impact on the market magnifies even further when considering the money multiplier effect. The concept is simple: when a substantial portion of an asset's supply is withdrawn from active circulation, the price of the remaining circulating supply can become more volatile. Each dollar invested can have an amplified impact on the overall market cap.

For Bitcoin, with roughly 25% of its supply being liquid and actively traded, the money multiplier effect can be particularly potent. Assuming a $1 market inflow increase results in a $4 market cap increase (4x money multiplier), institutional ownership of 6.29% of all bitcoins could effectively influence around 25% of the circulating supply.

If institutions were to start liquidating their holdings, the market could witness a substantial downturn, potentially prompting retail holders to follow suit. Conversely, continued buying by these institutions could lead to a significant surge in BTC price, especially if they maintain their positions as long-term holders. This scenario underscores the dual nature of institutional involvement in Bitcoin, gradually evolving to possess a more significant influence on the asset.

Conclusion

Institutional investment in Bitcoin presents both positive and negative facets. It brings legitimacy and capital that could propel Bitcoin prices to unprecedented levels, particularly if these entities remain committed for the long haul. However, the concentration of Bitcoin in the hands of a few institutions could introduce heightened volatility and significant downside risk if these players opt to exit their positions.

For a deeper dive into this subject, consider watching a recent YouTube video on the topic.

Frequently Asked Questions

How much of your IRA should include precious metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don't need to be rich to make an investment in precious metals. In fact, there are many ways to make money from gold and silver investments without spending much money.

You might think about buying physical coins such a bullion bar or round. It is possible to also purchase shares in companies that make precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And unlike traditional investments, they tend to increase in value over time. If you decide to sell your investment, you will likely make more than with traditional investments.

Is it possible to hold a gold ETF within a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

Also available is an Individual Retirement Annuity. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs will not be taxed

How does a gold IRA work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical gold bullion coins anytime. To start investing in gold, it doesn't matter if you are retired.

An IRA lets you keep your gold for life. When you die, your gold assets won't be subjected to taxes.

Your gold is passed to your heirs without capital gains tax. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts as a middleman between you and the IRS.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reporting.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit is $1,000. If you make more, however, you will get a higher interest rate.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

You should avoid taking out more than 50% of your total IRA assets yearly. A violation of this rule can lead to severe financial consequences.

Can I buy Gold with my Self-Directed IRA?

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contract are financial instruments that depend on the gold price. These contracts allow you to speculate on future gold prices without actually owning it. However, physical bullion is real gold or silver bars you can hold in your hands.

Is gold buying a good retirement option?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

The most popular form of investing in gold is through physical bullion bars. But there are many other options for investing in gold. You should research all options thoroughly before making a decision on which option you prefer.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. Owning gold stocks should work well if you need cash flow from your investment.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

How is gold taxed within an IRA?

The tax on the sale of gold is based on its fair market value when sold. Gold is not subject to tax when it's purchased. It's not considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

For loans, gold can be used to collateral. When you borrow against your assets, lenders try to find the highest return possible. For gold, this means selling it. However, there is no guarantee that the lender would do this. They might just hold onto it. They may decide to resell it. The bottom line is that you could lose potential profit in any case.

To avoid losing money, only lend against gold if you intend to use it for collateral. If you don't plan to use it as collateral, it is better to let it be.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

investopedia.com

finance.yahoo.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

How To

The History of Gold as an Asset

From the ancient days to the early 20th Century, gold was a common currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. Because of its intrinsic value, it was also widely traded. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. This led to a decline in demand for foreign currencies, which caused their price to increase. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. They needed to pay off debt because they had too much money coming into circulation. To do so, they decided to sell some of the excess gold back to Europe.

Many European countries began accepting gold in exchange for the dollar because they did not trust it. However, after World War I, many European countries stopped taking gold and began using paper money instead. The price of gold rose significantly over the years. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: The Impact of Institutional Investors on Bitcoin

Sourced From: bitcoinmagazine.com/markets/the-impact-of-institutional-investors-on-bitcoin

Published Date: Fri, 30 Aug 2024 15:45:09 GMT