The Avalanche Foundation, a leading institution that supports avalanche initiatives, has recently made an exciting announcement. It plans to invest in meme coins, marking a significant expansion of its investment portfolio. The foundation will utilize funds from its $100 million Culture Catalyst fund, which was launched in 2022. The selection of meme coins will be based on various factors, including the number of holders, liquidity thresholds, and project maturity.

A Comprehensive Move Toward Embracing New Opportunities

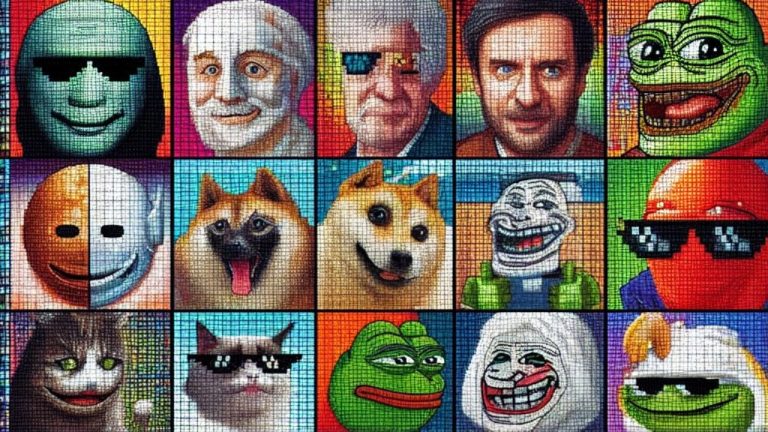

In a recent post, the Avalanche Foundation shared its plans to venture into the world of meme coins. This move represents the foundation's commitment to exploring a broader spectrum of possibilities. By investing in selected meme coins, the institution aims to diversify its portfolio and tap into the potential of these unique digital assets.

The investment in meme coins will be made through the Culture Catalyst fund, which was unveiled during the Avalanche Summit in Barcelona. Initially created to support and nurture creativity, culture, and lifestyle enabled by blockchain technology, the $100 million fund will now be used to purchase meme tokens.

Meme Coins: More Than Just Utility Assets

The Avalanche Foundation acknowledges the growing relevance of meme tokens in today's crypto market. These tokens go beyond their utility value and represent the collective spirit and shared interests of diverse crypto communities. In selecting meme coins for investment, the foundation will consider factors such as the number of holders, liquidity thresholds, project maturity, fair launch principles, and overall social sentiment.

The Changing Perspective on Meme Coins

Emin Gün Sirer, the founder and CEO of Ava Labs, initially had reservations about meme coins. However, his perspective has evolved over time, and he now recognizes their value within the crypto ecosystem. He acknowledges the cultural significance of coins that serve as social signaling mechanisms. Reflecting on this, he stated:

"It took me a while to see the value of memecoins myself. I wasn't happy when Elon was pumping Doge. It also took a while for me to see the value of high-end NFTs. But I now understand the cultural importance of coins that are just social signaling mechanisms."

Thriving Meme Coin Economy

The meme coin economy has experienced remarkable growth in recent times. As of December 9, the market cap of meme coins reached nearly $24 billion. This surge in value highlights the increasing popularity and potential of meme coins within the crypto space.

What are your thoughts on the Avalanche Foundation's foray into meme coins? Share your opinions in the comments section below.

Frequently Asked Questions

Can I have a gold ETF in a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

A Individual Retirement Annuity is also possible. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs will not be taxed

What precious metals can you invest in for retirement?

Silver and gold are two of the most valuable precious metals. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: Gold is one the oldest forms currency known to man. It is also extremely safe and stable. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver has been a favorite among investors for years. This is a great choice for people who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It is very durable and resistant against corrosion, much like silver and gold. It is, however, more expensive than its competitors.

Rhodium – Rhodium is used to make catalytic conversions. It is also used for jewelry making. It's also relatively inexpensive compared to other precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also much more affordable. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Do You Need to Open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. If you lose money in your investment, nothing can be done to recover it. This includes losing all your investments due to theft, fire, flood, etc.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items have been around thousands of years and are irreplaceable. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

You won't get any returns until you retire if you open an account. Remember the future.

What should I pay into my Roth IRA

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, your principal (the original deposit amount) cannot be touched. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you take out more than the initial contribution, you must pay tax.

The second rule is that your earnings cannot be withheld without income tax. Withdrawing your earnings will result in you paying taxes. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's say you earn $10,000 each year after contributing. The federal income tax on your earnings would amount to $3,500. The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

Two types of Roth IRAs are available: Roth and traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

irs.gov

investopedia.com

cftc.gov

How To

The best place to buy silver or gold online

First, understand the basics of gold. It is a precious metal that is very similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types currently available: legal tender and bullion. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They cannot be used in currency exchanges. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. The buyer receives 1 gram of gold for every dollar spent.

The next thing you should know when looking to buy gold is where to do it from. There are several options available if your goal is to purchase gold from a dealer. First, your local currency shop is a good place to start. You might also consider going through a reputable online seller like eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers will charge you a 10% to 15% commission for every transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

You can also invest in gold physical. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. Physical gold must be kept safe in an impassible container, such as a vault.

You can either visit a bank, pawnshop or bank to buy gold. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks often charge higher interest rates then pawnshops.

A third way to buy gold? Simply ask someone else! Selling gold is also easy. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

By: Sergio Goschenko

Title: The Avalanche Foundation to Invest in Meme Coins: Expanding Possibilities

Sourced From: news.bitcoin.com/avalanche-foundation-to-hop-onto-the-meme-coin-train-announces-investment-in-selected-projects/

Published Date: Mon, 01 Jan 2024 00:30:58 +0000