Introduction

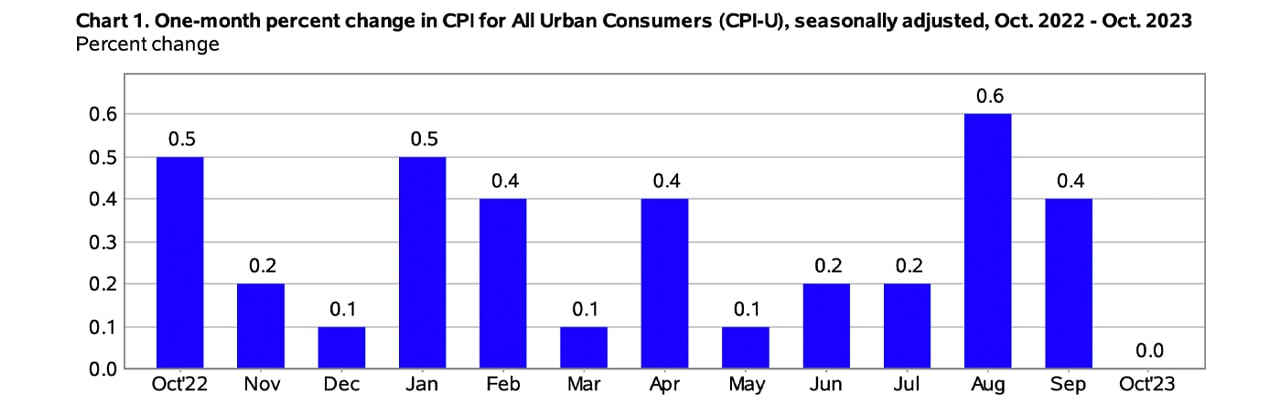

On Tuesday, the U.S. Bureau of Labor Statistics released the October Consumer Price Index for All Urban Consumers (CPI-U), which remained unchanged compared to September's 0.4% increase. The report revealed a steady trend in consumer pricing, with the all-items index rising 3.2% over the past year before seasonal adjustment.

Shelter Index and Gasoline Index

The October CPI report highlighted a noteworthy development in the housing market. While the gasoline index experienced a significant 5% drop, the shelter index continued to rise. As a result, the overall seasonally adjusted index remained unchanged for the month. Additionally, the broader energy index decreased by 2.5%, contributing to the stabilization of consumer prices.

Food Index

The U.S. Labor Department reported a modest 0.3% increase in the food index for October, following a 0.2% rise in September. The cost of food at home mirrored this increase, while expenses for food consumed away from home rose slightly higher, at 0.4%.

12-Month Period Comparison

Looking at the 12-month period ending in October, the all-items index showed a deceleration in its rise, increasing by 3.2% compared to the previous year's 3.7%. During this period, the energy index decreased by 4.5%, while the food index increased by 3.3%. Following the release of the report, the Dow Jones Industrial Average and the Russell 2000 Index showed mixed reactions in the U.S. stock market.

Cryptocurrency Market

The cryptocurrency market also experienced mixed sentiments after the report's release. The overall crypto market value decreased by 0.84% in the last 24 hours, with bitcoin (BTC) and ethereum (ETH) declining by 0.69% and 0.6% respectively. However, the precious metals market saw growth, with gold prices increasing by 0.6% and silver surging by over 2%.

Uncertainty and the U.S. Federal Reserve

Following the announcement of the CPI report, investors remained uncertain about the U.S. Federal Reserve's next steps. The yield on the 10-year U.S. Treasury note currently stands at a reduced rate of 4.457%. Jeffrey Roach, Chief Economist at LPL Financial, stated that despite the deceleration, the Fed is likely to maintain a hawkish stance and emphasize its commitment to bringing inflation down to the long-run 2% target.

Conclusion

The October CPI report revealed a balanced scenario in which the rise in housing costs offset the drop in gasoline prices. The overall consumer price index remained steady, reflecting the stabilization of prices in various sectors. However, market reactions in both the stock market and the cryptocurrency market varied. The uncertainty surrounding the U.S. Federal Reserve's future actions added to the mixed sentiments among investors.

What are your thoughts on the October CPI release? Share your opinions in the comments section below.

Frequently Asked Questions

What is the value of a gold IRA

There are many benefits to a gold IRA. It can be used to diversify portfolios and is an investment vehicle. You control how much money goes into each account and when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best part is that you don't need special skills to invest in gold IRAs. These IRAs are available at all banks and brokerage houses. Withdrawals are made automatically without having to worry about fees or penalties.

There are, however, some drawbacks. Gold has always been volatile. Understanding why you invest in gold is crucial. Are you looking for growth or safety? Is it for security or long-term planning? Only after you have this information will you make an informed decision.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. A single ounce isn't enough to cover all of your needs. You may need several ounces, depending on what you intend to do with your precious gold.

You don't have to buy a lot of gold if your goal is to sell it. You can even manage with one ounce. These funds won't allow you to purchase anything else.

How much tax is gold subject to in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It's not considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

Gold can be used as collateral for loans. Lenders will seek the highest return on your assets when you borrow against them. This often means selling gold. There's no guarantee that the lender will do this. They may just keep it. Or, they may decide to resell the item themselves. Either way you will lose potential profit.

You should not lend against your gold if it is intended to be used as collateral. It is better to leave it alone.

What Does Gold Do as an Investment Option?

Gold's price fluctuates depending on the supply and demand. Interest rates are also a factor.

Due to limited supplies, gold prices are subject to volatility. Physical gold is not always in stock.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement account

finance.yahoo.com

cftc.gov

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was universally accepted due to its purity and divisibility, beauty, scarcity, and durability. Because of its intrinsic value, it was also widely traded. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

The United States started issuing American coins in the 1860s made of 90% copper and 10% zinc. This led to a decline in demand for foreign currencies, which caused their price to increase. The price of gold dropped because the United States began to mint large quantities of gold coins. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do this, they decided that some of their excess gold would be sold back to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. After World War I, however, many European countries started using paper money to replace gold. Since then, the price of gold has increased significantly. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Steady CPI in October Balances Housing Costs Against Gasoline Prices; Market and Crypto Reactions Vary

Sourced From: news.bitcoin.com/octobers-inflation-report-shelter-prices-up-gasoline-plummets-mixed-market-reactions-follow/

Published Date: Tue, 14 Nov 2023 16:30:17 +0000