Renowned author of Rich Dad Poor Dad, Robert Kiyosaki, has expressed grave concerns about the rapid increase in the national debt of the United States. Over a short period, the national debt has skyrocketed by a trillion dollars, causing Kiyosaki to sound the alarm. In light of this, he strongly advises investors to diversify their portfolios by including bitcoin, gold, and silver. Kiyosaki's conviction in his own advice is evident as he recently increased his personal bitcoin holdings. Other critics of the fiscal policies of the U.S. government have also voiced their concerns about the mounting national debt, highlighting the potential negative impact on both the U.S. economy and the value of the U.S. dollar.

Robert Kiyosaki's Concerns about the National Debt

Robert Kiyosaki, the co-author of the highly acclaimed book Rich Dad Poor Dad, has once again emphasized the importance of investing in bitcoin. This reaffirms his optimistic outlook on cryptocurrencies while underscoring his ongoing concerns about the U.S. economy and the stability of the U.S. dollar. Rich Dad Poor Dad, co-authored by Kiyosaki and Sharon Lechter, has remained on the New York Times Best Seller List for an impressive six years. With over 32 million copies sold across 109 countries and translated into 51 languages, it has undoubtedly made a significant impact.

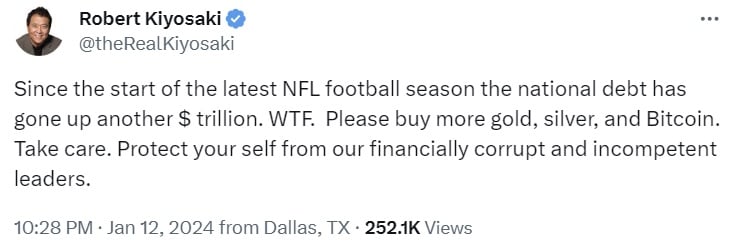

Kiyosaki expressed his frustration on the social media platform X, stating that the national debt has surged by another trillion dollars since the commencement of the National Football League (NFL) season. He passionately urged investors to protect themselves by investing in gold, silver, and bitcoin to shield against the financial corruption and incompetence demonstrated by our leaders. According to the Treasury Department, the current national debt stands at $34.06 trillion, reflecting a staggering increase of $1.02 trillion since September 18th of the previous year.

Besides Kiyosaki, numerous experts have also raised concerns about the U.S. national debt. Notably, economist and gold enthusiast Peter Schiff voiced his thoughts on January 2nd on X, predicting that the U.S. national debt would witness a record-breaking surge in 2024. He questioned whether there would be a sovereign debt or dollar crisis before the year concludes, emphasizing that the national debt grew by the last trillion in less than three months and two weeks. Schiff further warned that at this rate, the national debt would increase by over $1 trillion per quarter, which could have dire consequences if a recession were to occur.

Moody's, in November of the previous year, downgraded the U.S. credit rating to "negative" due to mounting deficits and debt burdens. In accordance with these concerns, U.S. Senator Rand Paul highlighted the dangers of unchecked government spending, stating that it jeopardizes the very existence of the dollar. Paul expressed his worry by pointing out that the nation borrowed a staggering trillion dollars in just three months. Additionally, billionaire "Bond King" Jeffrey Gundlach echoed these concerns in October of the previous year, stating that the future of the U.S. dollar and the potential for uncontrollable inflation hinges on bringing the budget and spending under control.

Do you share Robert Kiyosaki's concerns regarding the rapid rise of the U.S. national debt? Let us know in the comments section below.

Frequently Asked Questions

How Does Gold Perform as an Investment?

The supply and demand for gold affect the price of gold. It is also affected by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

How do you withdraw from an IRA that holds precious metals?

First decide if your IRA account allows you to withdraw funds. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. This option will require you to pay taxes on the amount that you withdraw.

Next, figure out how much money will be taken out of your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before you choose one, weigh the pros and cons.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. You will need to count each coin individually. However, you can easily track the value of individual coins by storing them in separate containers.

Some people like to keep their coins in vaults. Some prefer to keep them in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

How much money should my Roth IRA be funded?

Roth IRAs can be used to save taxes on your retirement funds. These accounts cannot be withdrawn until you turn 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, your principal (the deposit amount originally made) is not transferable. This means that you can't take out more money than you originally contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule is that you cannot withdraw your earnings without paying income taxes. So, when you withdraw, you'll pay taxes on those earnings. Let's assume that you contribute $5,000 each year to your Roth IRA. In addition, let's assume you earn $10,000 per year after contributing. This would mean that you would have to pay $3,500 in federal income tax. That leaves you with only $6,500 left. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. In addition, 50% of your earnings will be subject to tax again (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types of Roth IRAs: Traditional and Roth. Traditional IRAs allow you to deduct pretax contributions from your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You can withdraw as much as you want from a traditional IRA.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. Unlike a traditional IRA, there is no minimum withdrawal requirement. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

irs.gov

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was universally accepted and loved for its beauty, durability, purity and divisibility. Aside from its inherent value, it could be traded internationally. There was no international standard for measuring gold at that time, so different weights and measures were used around the world. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This led to a decline in demand for foreign currencies, which caused their price to increase. The price of gold dropped because the United States began to mint large quantities of gold coins. The U.S. government was unable to pay its debts due to too much money being in circulation. They sold some of their excess gold to Europe to pay off the debt.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The gold price has gone up significantly in the years since. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Robert Kiyosaki Raises Alarm on Ballooning National Debt — Urges Investors to Buy Bitcoin

Sourced From: news.bitcoin.com/robert-kiyosaki-raises-alarm-on-ballooning-national-debt-urges-investors-to-buy-bitcoin/

Published Date: Mon, 15 Jan 2024 02:30:51 +0000