Renowned author Robert Kiyosaki, known for his book Rich Dad Poor Dad, has recently recommended buying bitcoin exchange-traded funds (ETFs). In light of the slowing global economy and the expected printing of trillions of "fake dollars" by the U.S. Treasury and Federal Reserve, Kiyosaki urges investors to take immediate action and not be caught off guard like most Americans.

Robert Kiyosaki's Perspective on Bitcoin ETFs

Robert Kiyosaki, co-author of the popular book Rich Dad Poor Dad, suggests that investors who prefer a more indirect approach to investing in bitcoin should consider buying bitcoin exchange-traded funds (ETFs). Rich Dad Poor Dad, co-authored by Kiyosaki and Sharon Lechter, has remained on the New York Times Best Seller List for over six years and has sold more than 32 million copies worldwide in over 51 languages and 109 countries.

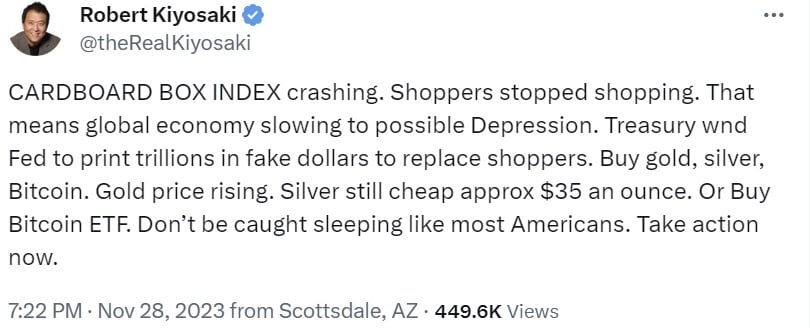

Kiyosaki recently expressed concern about the Cardboard Box Index, an indicator used by some investors to assess consumer goods production. According to Kiyosaki, this index is currently crashing, suggesting a potential global economic downturn that could lead to a depression. He anticipates that the Treasury and Federal Reserve will respond to this situation by printing trillions of "fake dollars."

In response to these concerns, Kiyosaki reaffirmed his usual recommendations of investing in gold, silver, and bitcoin. He pointed out the increasing price of gold and the relatively low cost of silver. Additionally, he suggested considering bitcoin ETFs as an alternative investment. Above all, Kiyosaki emphasized the importance of taking immediate action and implementing proactive measures to avoid being caught off guard.

This is not the first time Kiyosaki has warned about a potential depression. In July, he predicted an upcoming depression, and in February, he cautioned about a possible major crash, stating that a depression could occur. Kiyosaki even projected that by 2025, gold would reach $5,000, silver $500, and bitcoin $500,000. He based these predictions on his belief that faith in the U.S. dollar will diminish, referring to it as "fake money." Kiyosaki considers gold and silver as "God's money," while he sees bitcoin as "people's money."

Kiyosaki did not specify the exact type of bitcoin ETFs he recommends. In the U.S., there are currently futures bitcoin ETFs available, but a spot bitcoin ETF has not yet been approved by the U.S. Securities and Exchange Commission (SEC). Recently, SEC Chairman Gary Gensler mentioned that the regulator is evaluating eight to ten spot bitcoin ETF applications. On a related note, a former president of the New York Stock Exchange (NYSE) predicted that the crypto industry would experience a significant influx of funds with the introduction of spot bitcoin ETFs. Additionally, Microstrategy chairman Michael Saylor expects the demand for bitcoin to double after the halving and the approval of spot bitcoin ETFs.

What are your thoughts on Robert Kiyosaki's advice? Feel free to share your opinions in the comments section below.

Frequently Asked Questions

How is gold taxed by Roth IRA?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

Each state has its own rules regarding these accounts. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. In Massachusetts, you can wait until April 1st. And in New York, you have until age 70 1/2 . To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

What are the benefits of having a gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It will be tax-deferred up until the time you withdraw it. You have total control over how much each year you take out. There are many types of IRAs. Some are better for those who want to save money for college. Others are intended for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. This type of account might be a good choice if your goal is to retire early.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This means that you don't need to worry about making monthly deposits. You could also set up direct debits to never miss a payment.

Finally, gold remains one of the best investment options today. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil, gold prices tend not to fluctuate. It is therefore a great choice for protecting your savings against inflation.

What precious metals do you have that you can invest in for your retirement?

It is gold and silver that are the best precious metal investment. Both are easy to sell and can be bought easily. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one of man's oldest forms of currency. It is very stable and secure. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver is a popular investment choice. This is a great choice for people who want to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinum: A new form of precious metal, platinum is growing in popularity. It is very durable and resistant against corrosion, much like silver and gold. It's however much more costly than any of its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used in jewelry-making. And, it's relatively cheap compared to other types of precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also less expensive. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Who holds the gold in a gold IRA?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

A financial planner or accountant should be consulted to discuss your options.

Is it a good retirement strategy to buy gold?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion is the most popular method of investing in gold. You can also invest in gold in other ways. Research all options carefully and make an informed decision about what you desire from your investments.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. Owning gold stocks should work well if you need cash flow from your investment.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

What is the value of a gold IRA

A gold IRA has many benefits. It is an investment vehicle that can diversify your portfolio. You can control how much money is deposited into each account as well as when it's withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This allows you to easily transition if your retirement is early.

The best part is that you don't need special skills to invest in gold IRAs. They are readily available at most banks and brokerages. Withdrawals can be made instantly without the need to pay fees or penalties.

There are also drawbacks. Gold is historically volatile. So it's essential to understand why you're investing in gold. Are you seeking safety or growth? Is it for insurance purposes or a long-term strategy? Only once you know, that will you be able to make an informed decision.

You might want to buy more gold if you intend to keep your gold IRA for a long time. A single ounce isn't enough to cover all of your needs. You could need several ounces depending on what you plan to do with your gold.

You don't have to buy a lot of gold if your goal is to sell it. Even a single ounce can suffice. These funds won't allow you to purchase anything else.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

finance.yahoo.com

cftc.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads. Example. And Risk Metrics

irs.gov

How To

The History of Gold as an Asset

From the very beginning of time, gold was a currency. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Aside from its inherent value, it could be traded internationally. There was no international standard for measuring gold at that time, so different weights and measures were used around the world. For example in England, a pound sterling equals 24 carats. In France, a livre tournois equals 25. Carats of golden. Germany had one mark which equals 28. Carats.

In the 1860s, the United States began to issue American coins made from 90% copper, 10% Zinc, and 0.942 Fine Gold. This caused a drop in foreign currency demand which resulted in an increase of their prices. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They sold some of their excess gold to Europe to pay off the debt.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The gold price has gone up significantly in the years since. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: Robert Kiyosaki, Author of Rich Dad Poor Dad, Suggests Investing in Bitcoin ETFs

Sourced From: news.bitcoin.com/rich-dad-poor-dad-author-robert-kiyosaki-recommends-buying-bitcoin-etfs/

Published Date: Thu, 30 Nov 2023 02:30:00 +0000

Related posts:

Rich Dad Poor Dad Author Robert Kiyosaki Reveals Why He Keeps Buying Bitcoin

Rich Dad Poor Dad Author Robert Kiyosaki Reveals Why He Keeps Buying Bitcoin

Robert Kiyosaki Breaks Down Rich Dad’s Lesson One: The Importance of Tangible Assets for Lifelong Financial Security

Robert Kiyosaki Breaks Down Rich Dad’s Lesson One: The Importance of Tangible Assets for Lifelong Financial Security

Robert Kiyosaki Urges Investors to Get into Bitcoin and Ditch Fiat Money

Robert Kiyosaki Urges Investors to Get into Bitcoin and Ditch Fiat Money

Robert Kiyosaki: Bitcoin Is Your Best Protection Against Hyperinflation

Robert Kiyosaki: Bitcoin Is Your Best Protection Against Hyperinflation