Bitcoin's synergy with the financial advisory industry is an underexplored area that merits attention. The wealth management sector, financial advisors, and family offices collectively control trillions of dollars of capital. To put this into perspective, consider some 2023 estimates:

- Family offices manage $15 trillion in assets

- The Wealth Management Industry oversees $100 trillion in assets

- The Global Wealth Management Industry controls $103 trillion in assets

A Deep-Dive into the Wealth Management Industry

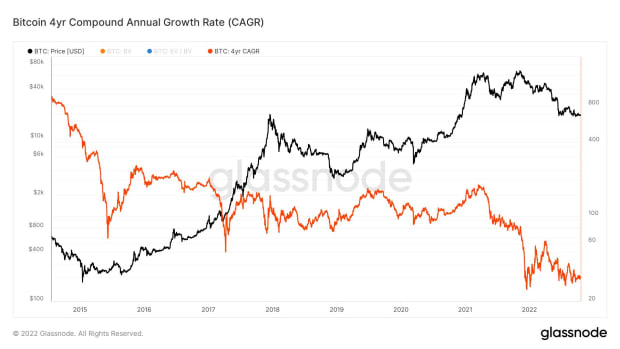

This capital control is colossal, and as a former financial advisor, I can attest to the fact that the wealth management sector is fraught with misaligned incentives. This is particularly evident in the industry's interaction with Bitcoin as an asset class. The industry's relationship with Bitcoin has been somewhat askew since Bitcoin's emergence, but this could be on the verge of a transformation.

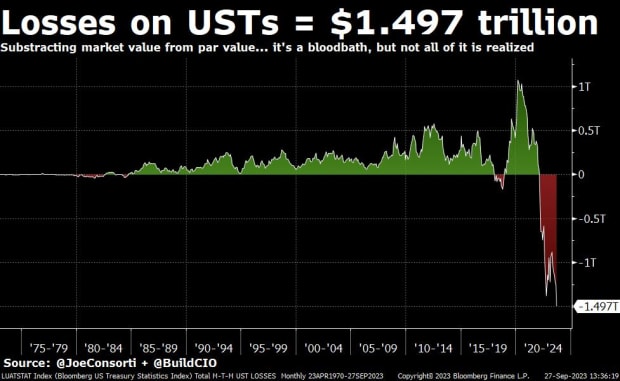

Many consider the "risk-free rate" as the universal touchstone against which all investments should be weighed. This rate typically refers to the current yield of the 10-year treasury bond. However, to those well-versed in Bitcoin, the concept of a risk-free rate might seem ludicrous. The actual rate is heavily manipulated and controlled by non-elected entities, which results in a global economy making investment decisions based on a deceptive benchmark.

Understanding the Inflation Rate and the Wealth Management Industry

Another misunderstood concept in the wealth management industry is the Consumer Price Index (CPI), largely seen as the current rate of inflation. Many Bitcoin enthusiasts have been arguing for over a decade that this figure is heavily manipulated. Considering alternatives such as the increase in M2 money supply or the Chapwood Index could provide a more accurate measure of inflation.

Combining these two misconceptions could potentially lead to the most disastrous economic situation we have ever faced. If the artificial benchmark is 4.77%, and the actual inflation rate is closer to 15%, it implies that almost all investments are yielding negatively in real terms. This is the problem that Bitcoin can solve. Managing $100 trillion in assets without this knowledge is a frightening bubble that could burst if discovered too late.

The Role of Fiduciary Responsibility in the Investment Advisory Industry

The concept of "fiduciary responsibility" underpins the investment advisory industry. A fiduciary is an individual or organization that acts on behalf of another person or persons, prioritizing their clients' interests over their own. However, this term is often misused or misunderstood, leading to it being unenforced or disrespected. This is where the relationship between the wealth management industry and Bitcoin becomes particularly intriguing.

At present, investment advisors have misaligned incentives regarding Bitcoin. However, I believe that the approval of a spot ETF in the US could trigger a significant shift in attitudes. If financial advisors want to offer their clients exposure to Bitcoin, they often have to direct their clients' money to a separate broker, exchange, or custodian.

Unlocking the Potential of Bitcoin ETFs in Wealth Management

While it's widely accepted that owning shares of a spot Bitcoin ETF isn't the same as owning Bitcoin, a spot Bitcoin ETF approval by Blackrock, the world's most extensive capital manager, would bring legitimate Bitcoin exposure to the entire wealth management industry.

Spot ETF Bitcoin exposure aligns with the incentives of investment advisors. They could offer access to clients in the same way they allocate to equities or mutual funds. The Bitcoin exposure would be displayed within a client's portfolio.

Once the Spot ETF gets approved, it will start to infiltrate the existing models the wealth management industry relies on. Gradually, the Spot ETF may start to become a part of the capital allocation of the world. Bitcoin is a hedge against centralized money printing, sovereign credit default, and the entire fiat currency system. Thus, the Bitcoin Spot ETF could become a must-have asset in every client's portfolio.

Frequently Asked Questions

What is a Precious Metal IRA (IRA)?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These precious metals are extremely rare and valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Precious metals often refer to themselves as “bullion.” Bullion is the physical metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

You can invest directly in bullion with a precious metal IRA instead of buying shares of stock. You'll get dividends each year.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. Instead, you only pay a small percentage on your gains. Plus, you get free access to your funds whenever you want.

What are the fees associated with an IRA for gold?

$6 per month is the Individual Retirement Account Fee (IRA). This fee includes account maintenance fees as well as any investment costs related to your selected investments.

Diversifying your portfolio may require you to pay additional fees. The type of IRA you choose will determine the fees. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Many providers also charge annual management fees. These fees are usually between 0% and 1%. The average rate for a year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Is it possible to hold a gold ETF within a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

A Individual Retirement Annuity (IRA), is also available. An IRA allows for you to make regular income payments during your life. Contributions made to IRAs are not taxable.

What is the tax on gold in an IRA

The fair value of gold sold to determines the price at which tax is due. You don't have tax to pay when you buy or sell gold. It isn't considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

Loans can be secured with gold. Lenders look for the highest return when you borrow against assets. This often means selling gold. There's no guarantee that the lender will do this. They might keep it. They may decide to resell it. In either case, you risk losing potential profits.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. It is better to leave it alone.

How much of your IRA should include precious metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't have to be rich to invest in them. You can actually make money without spending a lot on gold or silver investments.

You might also be interested in buying physical coins, such bullion rounds or bars. You could also buy shares in companies that produce precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You can still get benefits from precious metals regardless of what choice you make. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices are more volatile than traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

Who holds the gold in a gold IRA?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

To find out what options you have, consult an accountant or financial planner.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads. Example. And Risk Metrics

finance.yahoo.com

cftc.gov

irs.gov

How To

How to Buy Physical Gold in An IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. But this investment method has many risks as there is no guarantee of survival. There is always the chance of them losing their money due to fluctuations of the gold price.

You can also buy gold directly. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easy to see how many gold you have. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. You are also less likely to be robbed than investing in stocks.

However, there are some disadvantages too. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, the taxman may ask you about where you have put your gold.

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————-

By: Dillon Healy

Title: Revolutionizing Financial Advisory with Bitcoin: A New Dawn

Sourced From: bitcoinmagazine.com/markets/after-an-etf-you-just-need-to-orange-pill-financial-advisors

Published Date: Thu, 19 Oct 2023 15:45:00 GMT