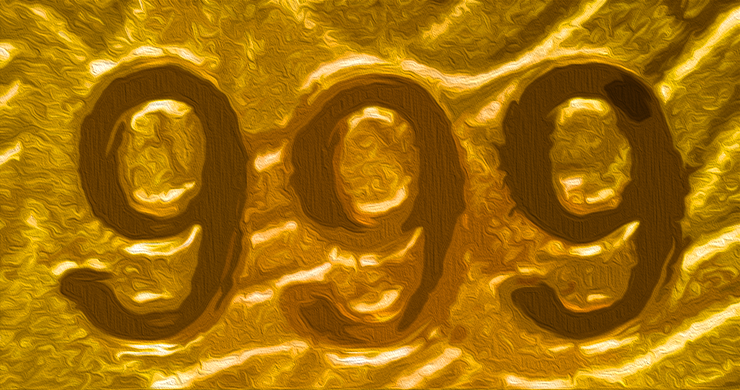

Are you ready for a financial game-changer? Brace yourself as President Trump sets the stage for a groundbreaking shift in the investment landscape. Imagine your 401(k) retirement plan not only embracing traditional assets but also venturing into the exciting realms of cryptocurrency, gold, and private equity. Yes, you heard it right!

Embracing New Investment Horizons

Unlocking Opportunities for Savvy Investors

Today's buzz is all about President Trump's forthcoming executive order, as revealed by the Financial Times. This bold move aims to unleash a wave of potential by allowing 401(k) plans to delve into alternative assets like gold, private equity, and the ever-thrilling world of cryptocurrencies, including the famed bitcoin.

Crafting a New Financial Frontier

A Glimpse into the Future of Savings

Picture this: federal regulators poised to dismantle barriers that have long restricted 401(k) plans from venturing beyond the conventional. Get ready to witness a shift towards including digital assets, precious metals, private loans, infrastructure projects, and even corporate buyout funds in managed funds.

Trump's Vision for Economic Empowerment

Pioneering Financial Prosperity

According to the White House, President Trump's strategic move is a testament to his dedication to securing the financial well-being of everyday Americans. The aim? To revitalize prosperity and redefine how savings are nurtured, all while ensuring a promising economic future for the masses.

- Breaking Down Barriers: President Trump's executive order paves the way for a diversified investment portfolio within 401(k) plans.

- Empowering Investors: Savvy individuals now have the opportunity to explore new horizons in the financial realm.

- Revolutionizing Savings: The move signifies a monumental shift in how Americans perceive and manage their retirement funds.

Seizing Investment Opportunities

Opening Doors to Financial Growth

This strategic maneuver by President Trump not only aligns with his administration's stance on easing bitcoin and crypto regulations but also heralds a new era of investment flexibility. Major investment giants like Blackstone, Apollo, and BlackRock are gearing up to capitalize on this transformative wave.

A Collaborative Financial Landscape

Forging Partnerships for Prosperity

Private investment firms are already gearing up for this monumental shift. Collaborations between industry heavyweights like Blackstone, Apollo, and BlackRock are set to revolutionize the retirement investment landscape, offering a myriad of opportunities for growth and financial prosperity.

Ready to embark on this exhilarating financial journey? Stay tuned as President Trump's visionary move reshapes the investment terrain, offering a wealth of possibilities for seasoned investors and novices alike.

This post President Trump Plans to Open 401(k)s to Bitcoin, Crypto, Gold, and Private Equity: FT first appeared on Bitcoin Magazine.

Frequently Asked Questions

How much of your IRA should include precious metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don't have to be rich to invest in them. In fact, there are many ways to make money from gold and silver investments without spending much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. Also, you could buy shares in companies producing precious metals. Or, you might want to take advantage of an IRA rollover program offered by your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. Although they aren’t stocks, they offer the possibility for long-term gains.

They also tend to appreciate over time, unlike traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How does gold perform as an investment?

Supply and demand determine the gold price. Interest rates are also a factor.

Gold prices are volatile due to their limited supply. There is also a risk in owning gold, as you must store it somewhere.

What are the benefits of having a gold IRA?

It is best to put your retirement money in an Individual Retirement Account (IRA). It is tax-deferred until it's withdrawn. You have complete control over how much you take out each year. There are many types and types of IRAs. Some are better suited for college students. Others are intended for investors seeking higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. But once they start withdrawing funds, those earnings aren't taxed again. This type account may make sense if it is your intention to retire early.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. For people who would rather invest than spend their money, gold IRA accounts are a good option.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. It means that you don’t have to remember to make deposits every month. You could also set up direct debits to never miss a payment.

Finally, gold is one of the safest investment choices available today. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil, gold prices tend not to fluctuate. Gold is a good option for protecting your savings from inflation.

Should You Get Gold?

Gold was a safe investment option for those who were in financial turmoil. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Some experts believe that this could change very soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Consider these things if you are thinking of investing in gold.

- Before you start saving money for retirement, think about whether you really need it. You can save money for retirement even if you don't invest in gold. However, when you retire at age 65, gold can provide additional protection.

- Second, be sure to understand your obligations before you purchase gold. Each type offers varying levels and levels of security.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

Do your research before you buy gold. You should also ensure that you do everything you can to protect your gold.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

finance.yahoo.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

How To

The best way to buy gold (or silver) online

To buy gold, you must first understand how it works. Precious metals like gold are similar to platinum. It is rare and used as money due to its durability and resistance against corrosion. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They aren’t exchangeable in any currency exchange. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Each dollar spent by the buyer is worth 1 gram.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. If you want to purchase gold directly from a dealer, then a few options are available. First off, you can go through your local coin shop. You might also consider going through a reputable online seller like eBay. Finally, you can look into purchasing gold through private sellers online.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers will charge you a 10% to 15% commission for every transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option is often a great one for investors in gold, as it gives you greater control over the item's value.

An alternative option to buying gold is to buy physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. Physical gold must be kept safe in an impassible container, such as a vault.

You can either visit a bank, pawnshop or bank to buy gold. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks charge higher interest rates than those offered by pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is also easy. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————-

By: Oscar Zarraga Perez

Title: President Trump's Bold Move: Revolutionizing 401(k)s with Bitcoin, Crypto, Gold, and Private Equity

Sourced From: bitcoinmagazine.com/news/president-trump-plans-to-open-401ks-to-bitcoin-crypto-gold-and-private-equity-ft

Published Date: Thu, 17 Jul 2025 21:49:05 +0000