Introduction

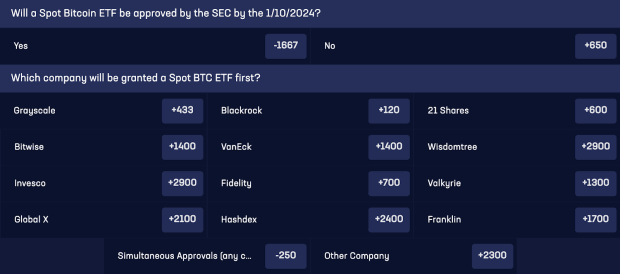

NitroBetting.eu, a leading Bitcoin-exclusive sportsbook, has introduced a groundbreaking prediction market called Bitcoin Spot ETF betting lines. This unique market focuses on the potential approval date of the SEC's Spot ETF and speculation on which ETF sponsor will be the first to receive approval. The published odds indicate that the market believes there is a higher likelihood of the SEC approving a Spot BTC ETF by 1/10/2024, with odds sitting at -1667 for and +650 against.

ETF Sponsors

Currently, the most favored scenario is simultaneous approval for multiple applicants (-250), with Blackrock being the frontrunner for standalone approval (+120). Among all the potential Spot ETF sponsors, Wisdomtree (+2900) and Invesco (+2900) are the least favored according to the Nitrobetting website.

Bitcoin Market Reaction

Although the bitcoin market has responded positively to the potential approval of a Spot ETF, with the price currently trading around $42,000, it remains to be seen if this optimism is justified. The new Spot ETF prediction market offered by NitroBetting.eu may provide investors with greater clarity.

NitroBetting's Statement

In a statement to Bitcoin Magazine, NitroBetting.eu expressed their enthusiasm for offering the first-ever betting lines for the Spot ETF approval event. They invite players to join in and enjoy this historic moment, emphasizing their position at the forefront of the financial evolution driven by Bitcoin. NitroBetting.eu sees this as more than just betting; it is a celebration of Bitcoin's integration into the mainstream and a significant milestone for the entire community.

Participation and Betting Lines

Interested individuals can access the available Bitcoin betting lines on the NitroBetting website. These lines include Spot ETF wagers, 2024 halving price predictions, Bitcoin dominance, and Bitcoin legal tender predictions.

Disclaimer: NitroBetting is a sponsor of Bitcoin Magazine's "The Bitcoin Halving Challenge," a contest where participants can guess the price of bitcoin at the 2024 halving for a chance to win a share of 1 BTC in prizes.

Frequently Asked Questions

Which precious metals are best to invest in retirement?

Gold and silver are the best precious metal investments. They are both easy to trade and have been around for years. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It is very stable and secure. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: The popularity of silver has always been a concern for investors. It is an excellent choice for investors who wish to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinum: This precious metal is also becoming more popular. Like gold and silver, it's very durable and resistant to corrosion. It is however more expensive than its counterparts.

Rhodium – Rhodium is used to make catalytic conversions. It is also used for jewelry making. It is relatively affordable when compared to other types.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also more accessible. This is why it has become a favourite among investors looking for precious metals.

Should you Invest In Gold For Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. If you are unsure of which option to invest in, consider both.

Gold offers potential returns and is therefore a safe investment. Retirement investors will find gold a worthy investment.

Gold is more volatile than most other investments. Its value fluctuates over time.

However, this does not mean that gold should be avoided. It just means that you need to factor in fluctuations to your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is much easier to store than bonds and stocks. It can also be transported.

You can always access your gold as long as it is kept safe. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold rises in the face of a falling stock market.

Another advantage to investing in gold is the ability to sell it whenever you wish. As with stocks, your position can be liquidated whenever you require cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

You shouldn't buy too little at once. Start small, buying only a few ounces. Add more as you're able.

Don't expect to be rich overnight. It is to create enough wealth that you no longer have to depend on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

What are the benefits of a gold IRA

There are many advantages to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You have control over how much money goes into each account.

You can also rollover funds from other retirement accounts to a gold IRA. This allows you to easily transition if your retirement is early.

The best part? You don’t need to have any special skills to invest into gold IRAs. These IRAs are available at all banks and brokerage houses. Withdrawals are made automatically without having to worry about fees or penalties.

There are, however, some drawbacks. The volatility of gold has been a hallmark of its history. So it's essential to understand why you're investing in gold. Is it for growth or safety? Do you want to use it as an insurance strategy or for long-term growth? Only then will you be able make informed decisions.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. One ounce doesn't suffice to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't have to buy a lot of gold if your goal is to sell it. You can even get by with less than one ounce. You won't be capable of buying anything else with these funds.

How Much of Your IRA Should Be Made Up Of Precious Metals

It's important to understand that precious metals aren't only for wealthy people. You don't need to be rich to make an investment in precious metals. You can actually make money without spending a lot on gold or silver investments.

You may consider buying physical coins such as bullion bars or rounds. It is possible to also purchase shares in companies that make precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. These metals are not stocks, but they can still provide long-term growth.

And unlike traditional investments, they tend to increase in value over time. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

How much of your portfolio should you hold in precious metals

This question can only be answered if we first know what precious metals are. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them extremely valuable for trading and investing. Gold is by far the most common precious metal traded today.

There are many other precious metals, such as silver and platinum. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It is not affected by inflation or deflation.

The general trend is for precious metals to increase in price with the overall market. They do not always move in the same direction. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors expect lower interest rate, making bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. They are more rare, so they become more expensive and less valuable.

Diversifying across precious metals is a great way to maximize your investment returns. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

cftc.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example and Risk Metrics

finance.yahoo.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From the ancient days to the early 20th Century, gold was a common currency. It was universally accepted due to its purity and divisibility, beauty, scarcity, and durability. Because of its intrinsic value, it was also widely traded. There were different measures and weights for gold, as there was no standard to measure it. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This caused a drop in foreign currency demand which resulted in an increase of their prices. This was when the United States started minting large quantities of gold coins. The result? Gold prices began to fall. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. To do so, they decided to sell some of the excess gold back to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. After World War I, however, many European countries started using paper money to replace gold. The price of gold rose significantly over the years. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————-

By: Bitcoin Magazine

Title: NitroBetting.eu Launches Bitcoin Spot ETF Betting Lines

Sourced From: bitcoinmagazine.com/business/bitcoin-spot-etf-prediction-market-odds-on-nitrobetting

Published Date: Tue, 19 Dec 2023 14:00:00 GMT