Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Exchange Commission (SEC) that could revolutionize the operational framework of Bitcoin exchange-traded funds (ETFs). The proposal, focused on BlackRock’s iShares Bitcoin Trust (IBIT), aims to introduce "in-kind" bitcoin redemptions, providing a streamlined and cost-effective alternative to the current cash redemption process.

Transforming Operational Framework

Under the proposed system, institutional players known as authorized participants (APs) could exchange ETF shares directly for bitcoin instead of cash. This innovative approach eliminates the need to sell bitcoin for cash redemptions, simplifying the process and reducing operational costs.

Benefits of In-Kind Redemptions

1. Operational Efficiency:

– Simplifies the redemption process and reduces operational steps.

– Streamlines ETF operations, saving time and costs.

2. Tax Advantages:

– By avoiding the sale of bitcoin, it minimizes capital gains distributions, making ETFs more tax-efficient for institutional investors.

3. Market Stability:

– Reduces sell pressure on bitcoin during redemptions, potentially stabilizing the asset’s price.

Evolution of Bitcoin ETF Market

The cash redemption model, in place since January 2024 for spot Bitcoin ETFs, aimed to prevent financial institutions and brokers from directly handling bitcoin. With the market's growth, Nasdaq and BlackRock now see an opportunity to adopt a more efficient in-kind redemption model.

BlackRock’s Bitcoin ETF Leadership

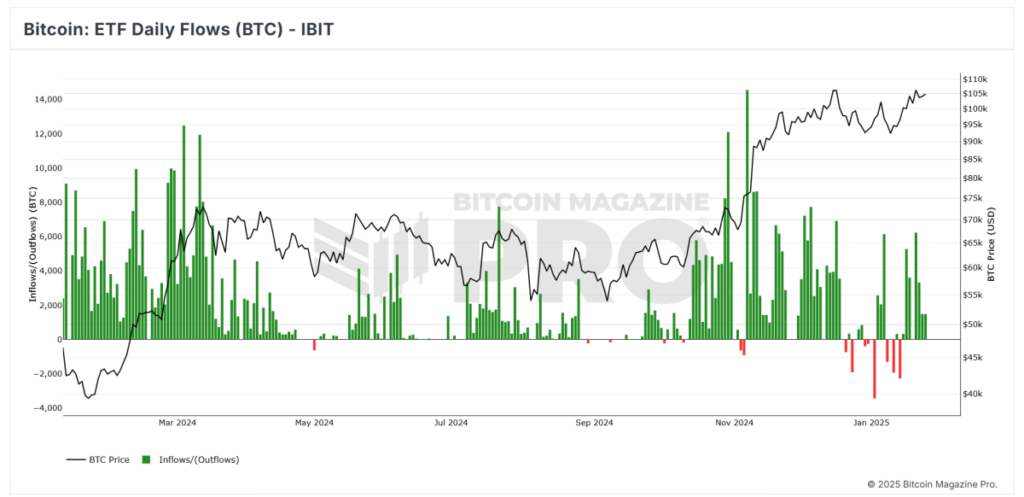

BlackRock’s iShares Bitcoin ETF has garnered over $60 billion in inflows since its 2024 launch, establishing itself as a market leader. The proposal for in-kind redemptions could further boost the appeal of IBIT to institutional investors.

Future Prospects

Nasdaq’s proposal for in-kind redemptions could reshape the Bitcoin ETF market by enhancing efficiency, offering tax advantages, and stabilizing prices. As regulatory support grows and institutional interest increases, the outlook for Bitcoin ETFs appears promising.

Frequently Asked Questions

How does a gold IRA account work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical gold bullion coins anytime. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. Your gold holdings won't be subject to taxes when you pass away.

Your gold is passed to your heirs without capital gains tax. Your gold is not part of your estate and you don't have to include it in the final estate report.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've done that, you'll receive an IRA custody. This company acts like a middleman between the IRS and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 You'll get a higher rate of interest if you deposit more.

You'll have to pay taxes if you take your gold out of your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

A small percentage may mean that you don't have to pay taxes. There are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. You'll be facing severe financial consequences if you do.

What is the cost of gold IRA fees

An Individual Retirement Account (IRA) fee is $6 per month. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

To diversify your portfolio you might need to pay additional charges. These fees vary depending on what type of IRA you choose. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Most providers also charge an annual management fee. These fees range from 0% to 1%. The average rate for a year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

Is it a good idea to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. It is impossible to get back money if you lose your investment. This includes any loss of investments from theft, fire, flood or other circumstances.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items have been around thousands of years and are irreplaceable. You would probably get more if you sold them today than you paid when they were first created.

You should choose a reputable firm that offers competitive rates. Consider using a third-party custody company to keep your assets safe and allow you to access them at any time.

Remember that you will not see any returns unless you are retired if you open an Account. Keep your eyes open for the future.

How Much of Your IRA Should Be Made Up Of Precious Metals

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don't have to be rich to invest in them. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You may consider buying physical coins such as bullion bars or rounds. It is possible to also purchase shares in companies that make precious metals. Your retirement plan provider may offer an IRA rollingover program.

Regardless of your choice, you'll still benefit from owning precious metals. Although they aren’t stocks, they offer the possibility for long-term gains.

Their prices rise with time, which is a different to traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Should You Invest Gold in Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. Consider investing in both.

You can earn potential returns on your investment of gold. This makes it a worthwhile choice for retirees.

Gold is more volatile than most other investments. As a result, its value changes over time.

But this doesn't mean you shouldn't invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is less difficult to store than stocks or bonds. It can also be carried.

You can always access your gold if it is stored in a secure place. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold usually rises when the stock market falls.

Gold investment has another advantage: You can sell it anytime. As with stocks, your position can be liquidated whenever you require cash. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Don't purchase too much at once. Start with a few ounces. Add more as you're able.

Remember, the goal here isn't to get rich quickly. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

While gold may not be the best investment, it can be a great addition to any retirement plan.

What Precious Metals Can You Invest in for Retirement?

Gold and silver are the best precious metal investments. They're both easy to buy and sell and have been around forever. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: Gold is one of man's oldest forms of currency. It is stable and very secure. It's a great way to protect wealth in times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. It is an excellent choice for investors who wish to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It's like silver or gold in that it is durable and resistant to corrosion. It is, however, more expensive than its competitors.

Rhodium: The catalytic converters use Rhodium. It is also used for jewelry making. And, it's relatively cheap compared to other types of precious metals.

Palladium: Palladium is similar to platinum, but it's less rare. It's also much more affordable. Investors looking to add precious and rare metals to their portfolios love it for these reasons.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

irs.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

finance.yahoo.com

How To

Investing in gold or stocks

It might seem risky to invest in gold as an investment vehicle these days. Many people believe that investing in gold is not profitable. This belief is due to the fact that many people see gold prices dropping because of the global economy. People believe that investing in gold would result in them losing money. However, investing in gold can still provide significant benefits. Below are some of them.

Gold is the oldest known form of currency. It has been in use for thousands of year. It was used all around the world as a reserve of value. It continues to be used in South Africa, as a way of paying their citizens.

The first point to consider when deciding whether or not you should invest in gold is what price you want to pay per gram. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It is also worth noting that although gold prices have declined recently, the cost of producing gold has increased. Although the price of gold has dropped, production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. It is sensible to avoid buying gold if you are only looking to cover the wedding rings. If you plan to do so as long-term investments, it is worth looking into. If you sell your gold for more than you paid, you can make a profit.

We hope our article has given you a better understanding of gold as an investment tool. We recommend that you investigate all options before making any major decisions. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Nasdaq Proposes Game-Changing In-Kind Redemptions for BlackRock’s Bitcoin ETF

Sourced From: bitcoinmagazine.com/markets/nasdaq-proposes-in-kind-redemptions-for-blackrocks-bitcoin-etf

Published Date: Mon, 27 Jan 2025 14:53:53 GMT