Merchant loyalty programs have long been a staple in the business world, offering incentives for customers to return and spend more. Traditional loyalty programs often rely on fiat currencies, such as credit cards, to drive customer engagement. However, with the rise of Bitcoin, there is a new opportunity to revolutionize the way merchant loyalty programs operate.

The Evolution of Loyalty Programs on Fiat Standard

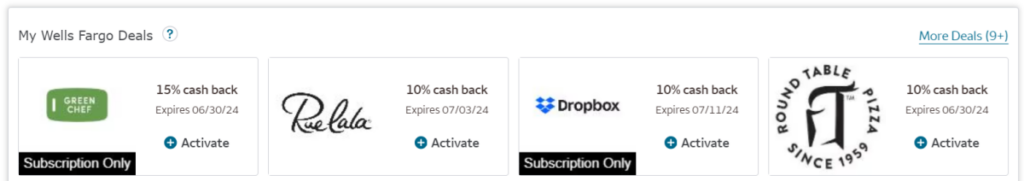

Having spent the last decade at Mastercard in San Francisco, I have witnessed firsthand the power of card-linked offers in driving merchant loyalty. These programs incentivize customers with discounts and deals when they make purchases at participating merchants. The effectiveness of these programs in acquiring new customers, reactivating dormant ones, and increasing spending frequency is undeniable.

Introducing Bitcoin into the Loyalty Landscape

While Bitcoin is primarily seen as a store of value, its potential as a medium of exchange in loyalty programs is often overlooked. By shifting from fiat to Bitcoin rails, businesses can unlock a new realm of possibilities. Bitcoin offers unparalleled efficiency and cost-effectiveness that fiat currencies simply cannot match.

Redefining Costs and Processes

Traditional fiat-based loyalty programs come with a hefty price tag, requiring complex tech infrastructure and a team to manage merchant relationships, offers, and redemptions. With Bitcoin, many of these steps are streamlined. Merchants can easily participate in Bitcoin-based programs, eliminating the need for intermediaries like banks and card processors. Transactions on the Lightning Network are not only cheaper but also more secure, reducing the risk of fraud.

Embracing New Paradigms with Bitcoin

Unlike fiat programs where discounts are applied retroactively, Bitcoin allows for real-time notifications and instant discounts at the point of sale. Technologies like LN Bits enable split payments, offering a seamless experience for both customers and merchants. The flexibility of Bitcoin also allows merchants to adjust offers and budgets on the fly, something that is impossible with traditional fiat systems.

Overcoming Challenges and Seizing Opportunities

While the reach of Bitcoin-based loyalty programs may be limited compared to fiat programs, the unique advantages it offers can attract a valuable segment of customers. By targeting Bitcoin enthusiasts and early adopters, merchants can tap into a loyal and affluent customer base. Additionally, while fiat programs have the advantage of transaction history for targeted marketing, the sheer innovation and cost savings of Bitcoin programs can offset this limitation.

Driving Hyperbitcoinization Through Innovation

As Michael Saylor famously said, "Buy bitcoin, and wait." However, for those in the loyalty business, there is an opportunity to do more than just wait. By embracing Bitcoin and reimagining loyalty programs through its lens, businesses can unlock new revenue streams and provide a more engaging customer experience. The potential for cost savings and novel use cases in the Bitcoin space is vast, and it's up to forward-thinkers to explore and capitalize on these opportunities.

This guest post by John McCabe showcases the transformative power of Bitcoin in redefining merchant loyalty programs. By leveraging Bitcoin's strengths, businesses can stay ahead of the curve and deliver unparalleled value to both customers and merchants.

Frequently Asked Questions

What is a Precious Metal IRA, and how can you get one?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These precious metals are extremely rare and valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Bullion is often used for precious metals. Bullion refers to the actual physical metal itself.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This ensures that you will receive dividends each and every year.

Precious Metal IRAs don’t require paperwork nor have annual fees. You pay only a small percentage of your gains tax. Plus, you can access your funds whenever you like.

What precious metal is best for investing?

Answering this question will depend on your willingness to take some risk and the return you seek. Gold is a traditional haven investment. However, it is not always the most profitable. Gold may not be right for you if you want quick profits. If patience and time are your priorities, silver is the best investment.

If you don't care about getting rich quickly, gold is probably the way to go. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Can I own a gold ETF inside a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow contributions from both the employer and employee. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions to IRAs do not have to be taxable

Should you Invest In Gold For Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. Consider investing in both.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

Most investments have fixed returns, but gold's volatility is what makes it unique. Therefore, its value is subject to change over time.

This doesn't mean that you should not invest in gold. You should just factor the fluctuations into any overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold is much easier to store than bonds and stocks. It can also be carried.

You can always access your gold as long as it is kept safe. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold usually rises when stocks fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. You can easily liquidate your investment, just as with stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Also, don't buy too much at once. Start with a few ounces. Then add more as needed.

It's not about getting rich fast. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

bbb.org

cftc.gov

finance.yahoo.com

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads and Example. Risk Metrics

How To

The best place online to buy silver and gold

First, understand the basics of gold. The precious metal gold is similar to platinum. It is rare and used as money due to its durability and resistance against corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They cannot be used in currency exchanges. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. The buyer receives 1 gram of gold for every dollar spent.

Next, you need to find out where to buy gold. There are several options available if your goal is to purchase gold from a dealer. First, you can visit your local coin store. You might also consider going through a reputable online seller like eBay. You might also consider buying gold from an online private seller.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. That means you would get back less money from a private seller than from a coin shop or eBay. This option can be a good choice for investing in gold because it allows you to control the price.

The other option is to purchase physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. Physical gold must be kept safe in an impassible container, such as a vault.

You can either visit a bank, pawnshop or bank to buy gold. A bank can provide you with a loan to cover the amount you wish to invest in gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks tend to charge higher interest rates, while pawnshops are typically lower.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold can also be done easily. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————-

By: John McCabe

Title: Merging Bitcoin with Merchant Loyalty Programs for Competitive Advantage

Sourced From: bitcoinmagazine.com/business/merchant-loyalty-competitive-advantage-reimagined-through-bitcoin

Published Date: Thu, 11 Jul 2024 18:05:08 GMT