JPMorgan's Optimistic Bitcoin Price Outlook

Global investment bank JPMorgan recently provided insight into the cryptocurrency market, specifically addressing the recent bitcoin selloff. The price of BTC plummeted from over $47,000 before the approval of the spot bitcoin exchange-traded fund (ETF) to below $39,000 this week.

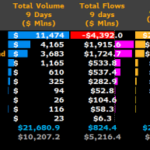

One significant factor contributing to the bitcoin selloff is the substantial outflows from Grayscale's bitcoin trust (GBTC). Following the approval of the U.S. Securities and Exchange Commission (SEC) on January 10, GBTC converted into a spot bitcoin ETF. Since January 12, GBTC has experienced a decrease of 114,367.39 BTC, equivalent to $4.77 billion based on BTC exchange rates as of January 27.

JPMorgan strategist Nikolaos Panigirtzoglou commented on Thursday that approximately $4.3 billion has already been withdrawn from GBTC, indicating that most of the profit-taking has already occurred. As a result, he believes that the downward pressure on bitcoin from this specific channel should now be largely behind us.

Panigirtzoglou previously predicted that $3 billion would exit GBTC, building on his earlier estimate that up to $3 billion had been invested in GBTC through the secondary market in 2023 to take advantage of the discount to NAV. He explained that as this $3 billion leaves the bitcoin space through profit-taking from GBTC, it puts downward pressure on bitcoin's price.

John Todaro, an analyst at Needham, shares a similar view, noting that Thursday saw one of the lowest days in net outflows from GBTC and the third consecutive day of declining outflows. This could potentially indicate the beginning of a slowdown in redemptions. Todaro also stated that two significant drivers of selling, namely outflows driven by the FTX estate and arbitrage funds, are nearly complete.

Kenneth Worthington, another JPMorgan analyst, expressed a different perspective, stating that the anticipated catalyst of bitcoin ETFs may disappoint market participants. As a result, the investment bank downgraded the stock of Coinbase (Nasdaq: COIN) from Neutral to Underweight.

Overall, JPMorgan remains cautiously optimistic about the future of bitcoin, with Panigirtzoglou's analysis suggesting that the worst of the downward pressure from GBTC profit-taking is likely behind us. However, it is important to continue monitoring market trends and developments to gain a comprehensive understanding of bitcoin's price trajectory.

What are your thoughts on JPMorgan analyst Nikolaos Panigirtzoglou's assessment of bitcoin's price? Share your opinions in the comments section below.

Frequently Asked Questions

What are some of the benefits of a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. You can withdraw it at any time, but it is tax-deferred. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better for those who want to save money for college. Others are designed for investors looking for higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. This type account may make sense if it is your intention to retire early.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who want to invest their money rather than spend it make gold IRA accounts a great option.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This means that you don't need to worry about making monthly deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold remains one of the best investment options today. It is not tied to any country so its value tends stay steady. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

Who holds the gold in a gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Should You Buy Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Some experts think that this could change in the near future. They believe gold prices could increase dramatically if there is another global financial crises.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save for retirement while still investing your gold savings. However, you can still save for retirement without putting your savings into gold.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each type offers varying levels and levels of security.

- Remember that gold is not as safe as a bank account. It is possible to lose your gold coins.

If you are thinking of buying gold, do your research. If you already have gold, make sure you protect it.

What precious metal is best for investing?

This depends on what risk you are willing take and what kind of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. You might not want to invest in gold if you're looking for quick returns. Silver is a better investment if you have patience and the time to do it.

If you don’t want to be rich fast, gold might be the right choice. Silver might be a better investment option if steady returns are desired over a long period of time.

How much gold should you have in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. It's only one monthly payment.

Also, you need to think about the type of business that you are going to run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. You should also consider the expected income from each client when you do this type of thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. This means that you may only be paid once every six months.

You need to determine what kind or income you want before you decide how much of it you will need.

I recommend starting with $1k-$2k of gold and growing from there.

Are gold investments a good idea for an IRA?

Gold is an excellent investment for any person who wants to save money. It can be used to diversify your portfolio. But gold is not all that it seems.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply and demand factors determine how much gold is worth. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. Gold's value rises as a result.

On the flipside, people may save cash rather than spend it when the economy slows. This means that more gold is produced, which reduces its value.

It is this reason that gold investing makes sense for businesses and individuals. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

In addition to earning interest on your investments, this will allow you to grow your wealth. In addition, you won’t lose any money if gold falls in value.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

irs.gov

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

How To

Tips to Invest in Gold

Investing in Gold remains one of the most preferred investment strategies. Because investing in gold has many benefits. There are many options for investing in gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

Before buying any type gold, it is important to think about these things.

- First, make sure you check if your country allows you own gold. If your country allows you to own gold, then you are allowed to proceed. If not, you may want to consider purchasing gold from overseas.

- The second is to decide which kind of gold coin it is you want. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, you should take into consideration the price of gold. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- Remember that gold prices are subject to change regularly. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

By: Kevin Helms

Title: JPMorgan Anticipates Relief for Bitcoin as Grayscale Profit-Taking Subsides

Sourced From: news.bitcoin.com/jpmorgan-sees-downward-pressure-easing-for-bitcoin-as-grayscale-profit-taking-fades/

Published Date: Sun, 28 Jan 2024 00:30:17 +0000