After a significant drop in Bitcoin's price from over $100,000 to below $80,000 over the course of several weeks, the recent bounce-back has sparked discussions among traders. The question on everyone's mind is whether the Bitcoin bull market is making a genuine comeback or if this is simply a temporary rally within a larger bear market trend.

Bitcoin’s Recent Performance: Bottoming Out or a Pause in the Bull Market?

The recent correction in Bitcoin's price was severe enough to shake investor confidence, yet it managed to maintain the overall long-term trend structure. It appears that Bitcoin may have established a local bottom in the range of $76,000 to $77,000. Additionally, several key metrics are indicating that the recent lows might be solidifying, hinting at potential upward movement in the near future.

Key Metrics Pointing Towards Positive Sentiment

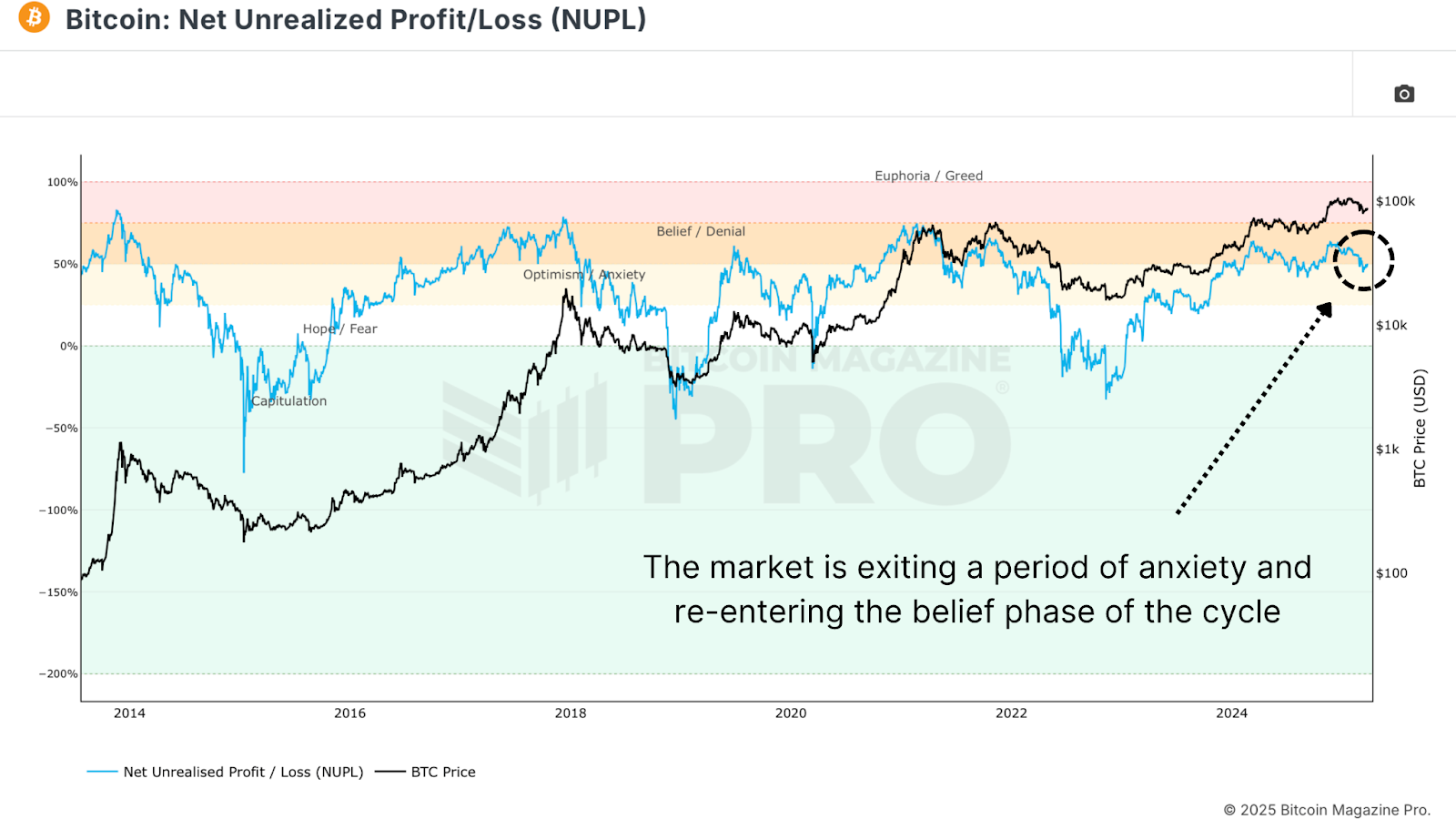

One such metric is the Net Unrealized Profit and Loss (NUPL), which serves as a reliable indicator of market sentiment throughout Bitcoin's various cycles. Following the price decline, the NUPL dropped into the "Anxiety" zone. However, with the recent rebound, the NUPL has now transitioned back into the "Belief" zone, historically associated with higher lows in the market.

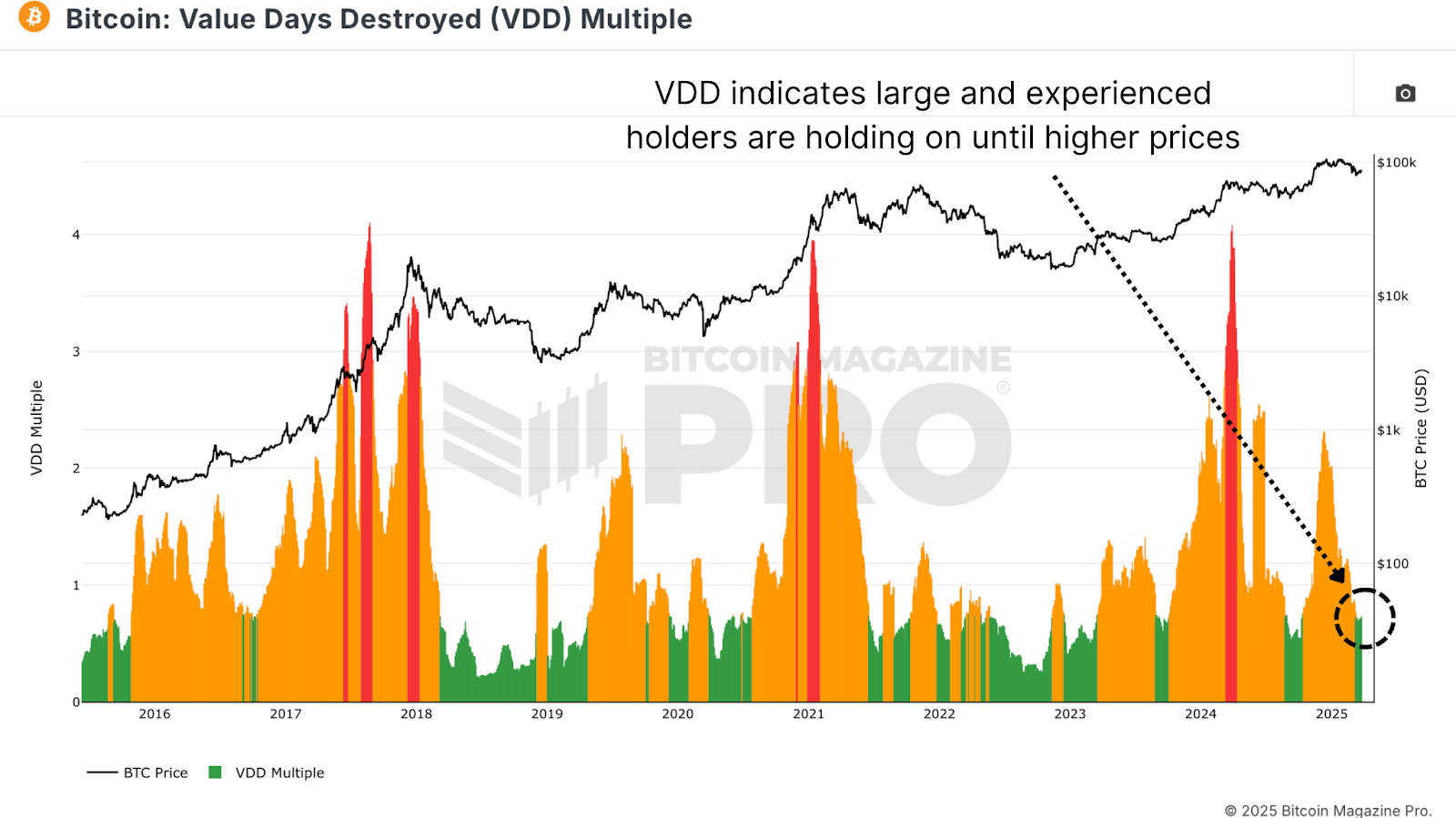

Another metric, the Value Days Destroyed (VDD) Multiple, analyzes Bitcoin spending based on coin age and transaction size compared to previous yearly averages. The current readings suggest that significant, aged coins are not being moved, indicating strong conviction among long-term investors. Similar trends have preceded major price rallies in previous bull cycles.

Accumulation Phase by Long-Term Holders

Long-term holders of Bitcoin are currently increasing their supply after taking profits above $100,000. This accumulation phase at lower price levels has historically led to supply shortages and subsequent rapid price increases in the past.

Miner Confidence and Market Trends

The Hash Ribbons Indicator recently signaled a bullish crossover, indicating a short-term hash rate trend surpassing the longer-term average. This alignment has historically coincided with market bottoms and trend reversals, suggesting that miners are optimistic about future price increases.

Despite positive on-chain data, Bitcoin's performance remains closely linked to broader macroeconomic trends and equity markets, particularly the S&P 500. As long as this correlation persists, Bitcoin's price movements will be influenced by global economic conditions and investor sentiment.

Looking Ahead: Bitcoin’s Bull Market Potential

From a data-driven perspective, Bitcoin appears well-positioned for continued growth in its bull cycle. On-chain metrics indicate a strong foundation for the current market environment. Metrics like NUPL and VDD suggest growing confidence among investors, similar to patterns observed during previous bull cycles.

While the current accumulation phase and miner confidence signal positive momentum, external factors such as macroeconomic conditions will also impact Bitcoin's future performance. Market participants should remain cautious, as bull markets require time to develop and stabilize before significant price movements occur.

Although the recent price stabilization around $76,000 to $77,000 is encouraging, traders should be prepared for gradual market developments rather than sudden price surges. Bitcoin's vulnerability to shifts in monetary policy and risk sentiment means that volatility could arise from unexpected events, necessitating a patient and strategic approach to trading.

For more detailed analysis and real-time market insights, consider exploring Bitcoin Magazine Pro for comprehensive coverage of the Bitcoin market.

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. It is essential to conduct thorough research before making any investment decisions.

This article was originally published on Bitcoin Magazine and authored by Matt Crosby.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments based on the price of gold. They let you speculate on future price without having to own the metal. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

How much gold do you need in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. For a small start, $5k to $10k is a good range. As you grow, you can move into an office and rent out desks. This way, you don't have to worry about paying rent all at once. Only one month's rent is required.

It's also important to determine what type business you'll run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. You may get paid just once every 6 months.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I recommend starting with $1k-$2k of gold and growing from there.

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical gold bullion coins anytime. To invest in gold, you don't need to wait for retirement.

An IRA lets you keep your gold for life. You won't have to pay taxes on your gold investments when you die.

Your gold is passed to your heirs without capital gains tax. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts as a mediator between you, the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. Minimum deposit is $1,000 You'll get a higher rate of interest if you deposit more.

Taxes will be charged on gold you have withdrawn from an IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

You shouldn't take out more then 50% of your total IRA assets annually. You'll be facing severe financial consequences if you do.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

investopedia.com

How To

The best way to buy gold (or silver) online

To buy gold, you must first understand how it works. Gold is a precious metallic similar to Platinum. It's rare and often used to make money due its resistance and durability to corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They can't be exchanged in currency exchange systems. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Each dollar spent by the buyer is worth 1 gram.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are a few options if you wish to buy gold directly from a dealer. You can start by visiting your local coin shop. You can also try going through a reputable website like eBay. You may also be interested in buying gold through private sellers online.

Private sellers are individuals that offer gold at wholesale or retail prices. Private sellers charge a 10% to 15% commission per transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This is a great option for gold investing because you have more control over the item’s price.

The other option is to purchase physical gold. It is easier to store physical gold than paper certificates. But, you still have to take care of it. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks charge higher interest rates than those offered by pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is simple too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Is Bitcoin’s Bull Market Showing Signs of Recovery?

Sourced From: bitcoinmagazine.com/markets/is-bitcoins-bull-market-truly-back

Published Date: Fri, 28 Mar 2025 13:38:05 +0000