Hello there, fellow crypto enthusiasts! Today, I'm diving into the hot topic of Bitcoin mining centralization in the United States. Buckle up as I unravel the latest insights and risks associated with this trend. Let's explore together!

The U.S. Dominance in Bitcoin Mining

The Rise of U.S. Hashing Power

Picture this: the U.S. now commands a staggering 75.4% of the global hashing power in Bitcoin mining. That's a significant slice of the pie, accounting for about 600 exahashes per second out of the total 796 EH/s worldwide. This newfound dominance is a game-changer, according to a comprehensive study by the Cambridge Centre for Alternative Finance (CCAF).

The Concerns of Centralization

With great power comes great responsibility, right? The burning question on everyone's mind is whether Bitcoin mining is dangerously consolidating in the U.S. What risks does this centralized control pose for the future of this burgeoning digital asset? Let's delve into the details.

The Trump Administration's Pro-Bitcoin Stance

U.S. Vision for Bitcoin Superpower Status

Recently, Howard Lutnick, U.S. Secretary of Commerce and former Cantor Fitzgerald CEO, shed light on the Trump administration's ambitious plan to establish the U.S. as a Bitcoin powerhouse. Drawing parallels between Bitcoin and gold, Lutnick emphasized Bitcoin's limited supply of 21 million coins. He outlined initiatives to supercharge U.S. mining through the Commerce Department's Investment Accelerator, simplifying permits for miners to construct off-grid power facilities. Imagine having your own power plant right beside your data center—talk about a strategic move!

The Downside of Mining Boom: Centralization

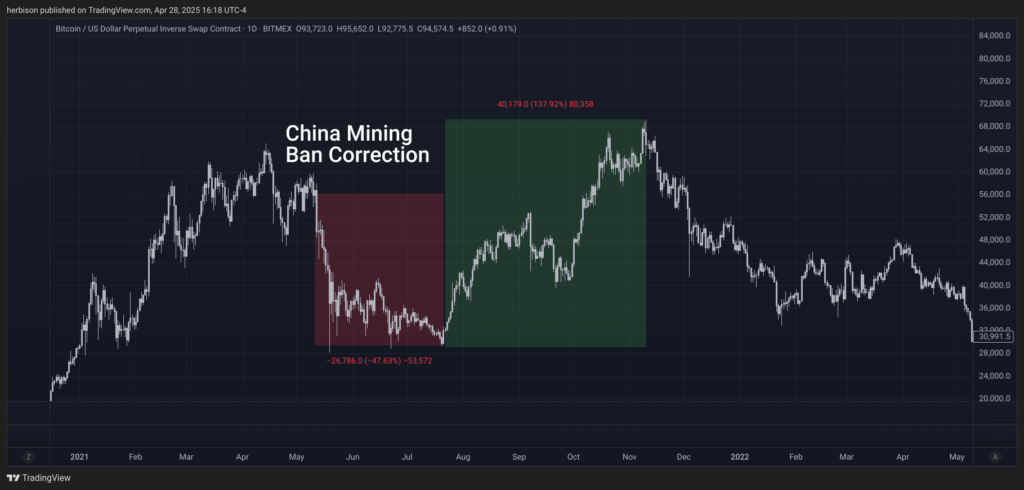

While the U.S. mining surge is a boon for business, the CCAF's study raises valid concerns about centralization. Remember when China held the reins of global Bitcoin mining before its 2021 ban? The subsequent shift of mining operations to the U.S. created a ripple effect in the market, showcasing both resilience and vulnerability. The spotlight is now on the risks associated with U.S. dominance in mining.

Challenges and Opportunities Ahead

Protecting Bitcoin's Decentralized Spirit

As the U.S. tightens its grip on Bitcoin mining, the specter of centralized control looms large. While the current administration embraces Bitcoin, future regimes could exploit this dominance to manipulate the network. The decentralized nature of the U.S. federal system might offer some protection, but vigilance is key to safeguarding Bitcoin's core principles.

Adapting to Changing Tides

Despite the risks, there's hope on the horizon. Deepening Bitcoin adoption globally could thwart attempts at censorship, as widespread usage strengthens the network's resilience. By learning from past challenges and staying ahead of potential threats, the Bitcoin community can weather any storm that comes its way.

Embracing Bitcoin's Future

Charting the Path Forward

With the U.S. wielding a substantial share of Bitcoin's hashing power, the industry faces a pivotal moment. Should we strive for global diversification or embrace America's mining dominance? As we navigate this evolving landscape, one thing remains clear: Bitcoin's resilience hinges on a united front against centralized control. Let's stand together to ensure Bitcoin's sovereignty endures, no matter what challenges lie ahead.

Are you ready to shape the future of Bitcoin mining? Join me on this thrilling journey as we navigate the ever-changing crypto terrain together!

Frequently Asked Questions

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. To open the account, complete Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be completed within 60 days after opening the account. Once this has been completed, you can begin investing. You can also choose to pay your salary directly by making a payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. The process for an ordinary IRA will not be affected.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS stipulates that you must have earned income and be at least 18-years old. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. You must also contribute regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, you can't purchase physical bullion. This means you won't be allowed to trade shares of stock or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option may be offered by some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they don't have the same liquidity as stocks or bonds. This makes them harder to sell when needed. They don't yield dividends like bonds and stocks. You'll lose your money over time, rather than making it.

Should You Invest Gold in Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you are unsure which option to choose, consider investing in both options.

In addition to being a safe investment, gold also offers potential returns. It is a good choice for retirees.

Gold is more volatile than most other investments. Therefore, its value is subject to change over time.

This doesn't mean that you should not invest in gold. You should just factor the fluctuations into any overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Unlike stocks and bonds, gold is easier to store. It's also portable.

You can always access your gold if it is stored in a secure place. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold rises in the face of a falling stock market.

Gold investment has another advantage: You can sell it anytime. As with stocks, your position can be liquidated whenever you require cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Don't buy too many at once. Start with a few ounces. Next, add more as required.

Don't expect to be rich overnight. It is to create enough wealth that you no longer have to depend on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

What Is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These precious metals are extremely rare and valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are sometimes called “bullion.” Bullion refers only to the actual metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This ensures that you will receive dividends each and every year.

Precious Metal IRAs don’t require paperwork nor have annual fees. Instead, your gains are subject to a small tax. Additionally, you have access to your funds at no cost whenever you need them.

Who holds the gold in a gold IRA?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Should You Get Gold?

In the past, gold was considered a haven for investors during economic turmoil. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

This could be changing, according to some experts. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some things you should consider when considering gold investing.

- Before you start saving money for retirement, think about whether you really need it. You can save for retirement and not invest your savings in gold. However, you can still save for retirement without putting your savings into gold.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each account offers different levels of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. It is possible to lose your gold coins.

So, if you're thinking about buying gold, make sure you do your research first. Protect your gold if you already have it.

What is the tax on gold in Roth IRAs?

The tax on an investment account is based on its current value, not what you originally paid. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

Each state has its own rules regarding these accounts. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York offers a waiting period of up to 70 1/2 years. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

How does gold perform as an investment?

Supply and demand determine the gold price. Interest rates also have an impact on the price of gold.

Due to limited supplies, gold prices are subject to volatility. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

cftc.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads and Example. Risk Metrics

How To

The growing trend of gold IRAs

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Owners of the gold IRA can use it to invest in physical bars and bullion gold. It is a tax-free investment that can be used to grow wealth and offers an alternative investment option to those who are concerned about stocks or bonds.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also benefit from physical gold's unique properties, such as durability and portability.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

This means that investors who are looking for financial safety and security are becoming more interested in the gold IRA.

—————————————————————————————————————————————————————————————-

By: Juan Galt

Title: Is Bitcoin Mining Centralization in the U.S. a Blessing or a Curse?

Sourced From: bitcoinmagazine.com/takes/bitcoin-mining-centralization-in-the-u-s-a-new-risk-for-the-industry

Published Date: Mon, 28 Apr 2025 20:48:01 +0000