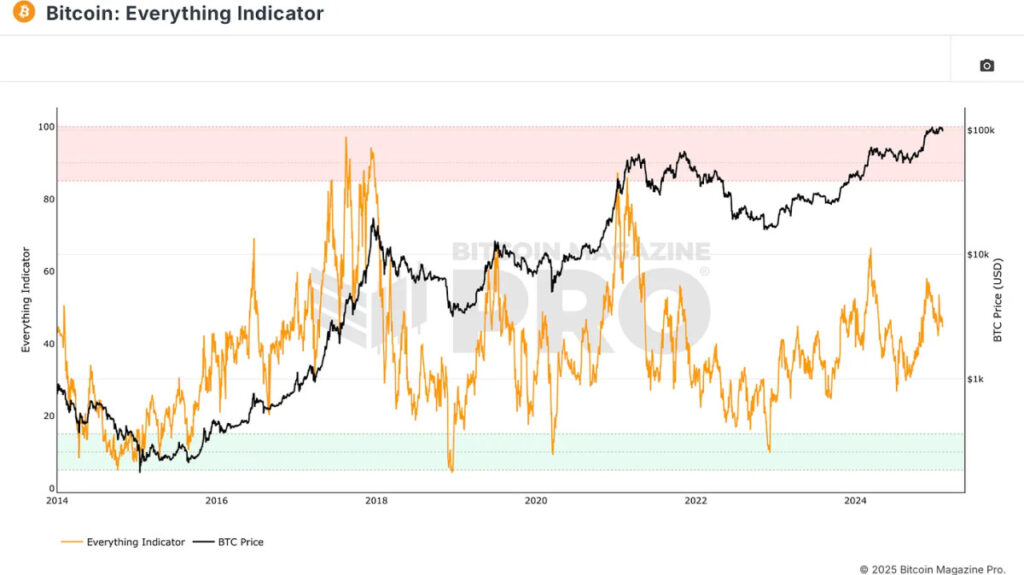

Wouldn’t it be beneficial to have a comprehensive metric to guide our Bitcoin investment decisions? That’s precisely what the Bitcoin Everything Indicator aims to achieve. Recently integrated into Bitcoin Magazine Pro, this indicator consolidates multiple metrics into a unified framework, simplifying Bitcoin analysis and investment decision-making.

Why a Comprehensive Indicator is Essential

Investors and analysts often rely on various metrics like on-chain data, technical analysis, and derivative charts. However, focusing solely on one aspect can result in an incomplete understanding of Bitcoin’s price movements. The Bitcoin Everything Indicator addresses this issue by combining key components into a cohesive metric.

The Core Components of the Bitcoin Everything Indicator

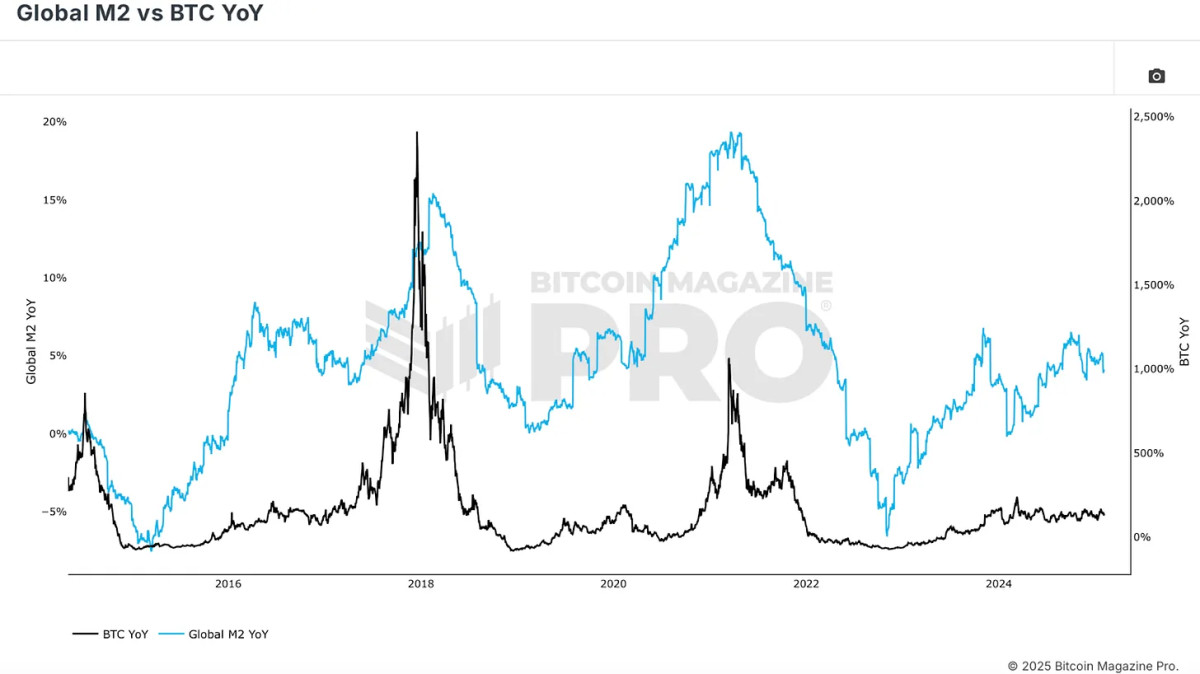

Bitcoin’s price behavior is significantly impacted by global liquidity cycles, making macroeconomic conditions a crucial element of this indicator. The correlation between Bitcoin and broader financial markets, particularly Global M2 money supply, is evident. Generally, when liquidity expands, Bitcoin tends to appreciate.

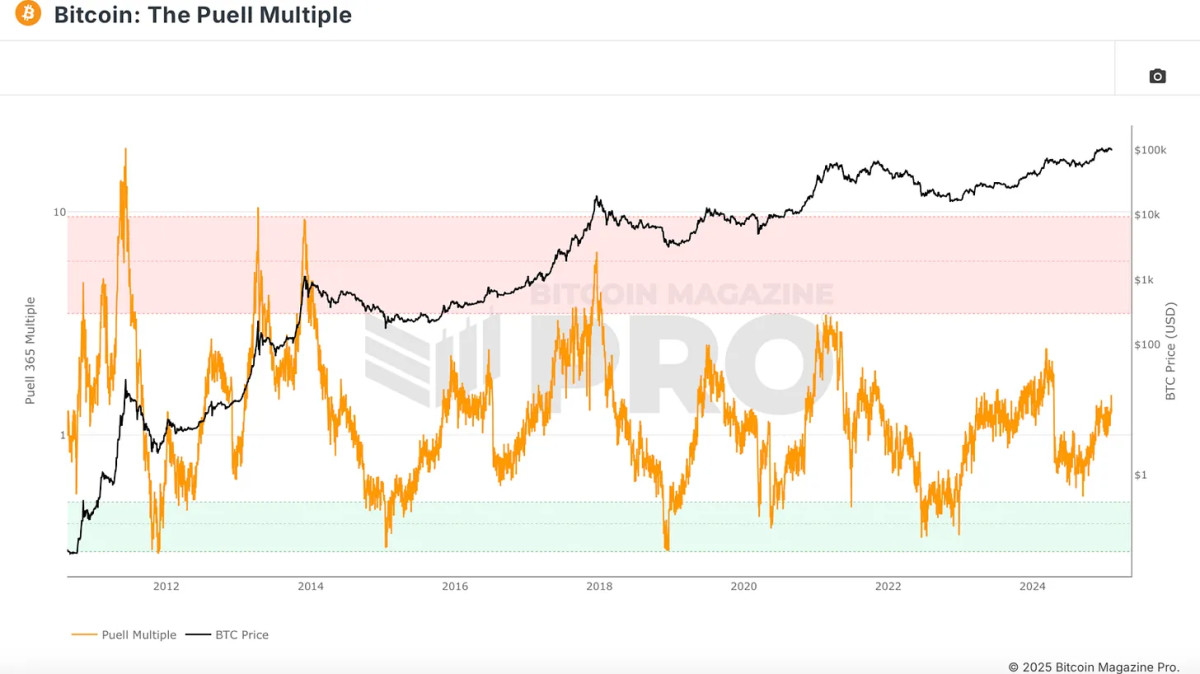

Fundamental factors such as Bitcoin’s halving cycles and miner strength also play vital roles in its valuation. While halvings reduce new Bitcoin supply, their impact on price appreciation has diminished due to over 94% of Bitcoin’s total supply being in circulation. Nevertheless, miner profitability remains essential. The Puell Multiple, which measures miner revenue relative to historical averages, offers insights into market cycles. Historically, strong miner profitability indicates a favorable position for Bitcoin.

On-chain indicators help evaluate Bitcoin’s supply and demand dynamics. For example, the MVRV Z-Score compares Bitcoin’s market cap to its realized cap, identifying accumulation and distribution zones to determine if Bitcoin is overvalued or undervalued.

Another critical on-chain metric is the Spent Output Profit Ratio (SOPR), which analyzes the profitability of spent coins. High profits signal a market peak, while substantial losses indicate a market bottom.

The Bitcoin Crosby Ratio is a technical metric that assesses Bitcoin’s price action to determine overextended or discounted conditions, ensuring that market sentiment and momentum are considered in the Bitcoin Everything Indicator.

Network usage provides insights into Bitcoin’s strength. The Active Address Sentiment Indicator measures the percentage change in active addresses over 28 days, confirming bullish trends with rising active addresses and signaling price weakness with stagnant or declining addresses.

How the Bitcoin Everything Indicator Functions

By amalgamating these diverse metrics, the Bitcoin Everything Indicator ensures that no single factor is overly emphasized. Unlike models that rely heavily on specific signals, this indicator distributes influence evenly across various categories, preventing overfitting and enabling adaptability to changing market conditions.

Historical Performance compared to Buy-and-Hold Strategy

The Bitcoin Everything Indicator has shown superior performance compared to a simple buy-and-hold strategy since Bitcoin was valued under $6. By accumulating Bitcoin during oversold conditions and selling during overbought zones, investors utilizing this model would have significantly improved their portfolio performance with lower drawdowns.

For example, this model maintains a 20% drawdown, contrasting with the 60-90% declines historically seen in Bitcoin’s value. This suggests that a well-balanced, data-driven approach can assist investors in making informed decisions with reduced downside risks.

Conclusion

The Bitcoin Everything Indicator streamlines investing by consolidating critical factors influencing Bitcoin’s price action into a single metric. It has historically outperformed buy-and-hold strategies while minimizing risks, making it a valuable tool for both individual and institutional investors.

For detailed Bitcoin analysis and access to advanced features such as live charts, personalized indicator alerts, and comprehensive industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This content serves informational purposes only and should not be construed as financial advice. Always conduct your research before making any investment decisions.

Frequently Asked Questions

How much should precious metals make up your portfolio?

To answer this question we need to first define precious metals. Precious elements are those elements which have a high price relative to other commodities. This makes them extremely valuable for trading and investing. Gold is today the most popular precious metal.

There are however many other types, including silver, and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also unaffected significantly by inflation and Deflation.

The general trend is for precious metals to increase in price with the overall market. But they don't always move in tandem with one another. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. Investors expect lower interest rate, making bonds less appealing investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. Since these are scarce, they become more expensive and decrease in value.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

How do I Withdraw from an IRA with Precious Metals?

First, you must decide if you wish to withdraw money from your IRA account. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option will require you to pay taxes on the amount that you withdraw.

Next, determine how much money you plan to withdraw from your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. You will need to weigh each one before making a decision.

Bullion bars, for example, require less space as you're not dealing with individual coins. You will need to count each coin individually. On the flip side, storing individual coins allows you to easily track their value.

Some prefer to keep their money in a vault. Some prefer to keep them in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

How much money should I put into my Roth IRA?

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. You can't withdraw money from these accounts before you reach the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, your principal (the original deposit amount) cannot be touched. You cannot withdraw more than the original amount you contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule is that your earnings cannot be withheld without income tax. Withdrawing your earnings will result in you paying taxes. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's also say that you earn $10,000 per annum after contributing. You would owe $3,500 in federal income taxes on the earnings. So you would only have $6,500 left. Since you're limited to taking out only what you initially contributed, that's all you could take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs don't allow you deduct contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal requirement, unlike traditional IRAs. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

What are the benefits of having a gold IRA?

You can save money on retirement by putting your money into an Individual Retirement Account. It is tax-deferred until it's withdrawn. You are in complete control of how much you take out each fiscal year. There are many types and types of IRAs. Some are better suited for people who want to save for college expenses. Others are designed for investors looking for higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. However, once they begin withdrawing funds, these earnings are not taxed again. This type account may make sense if it is your intention to retire early.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who want to invest their money rather than spend it make gold IRA accounts a great option.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. This eliminates the need to constantly make deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, the gold investment is among the most reliable. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil, gold prices tend to stay relatively stable. As a result, it's often considered a good choice when protecting your savings from inflation.

Should you Invest In Gold For Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you are unsure which option to choose, consider investing in both options.

Not only is it a safe investment but gold can also provide potential returns. It is a good choice for retirees.

Most investments have fixed returns, but gold's volatility is what makes it unique. Its value fluctuates over time.

This doesn't mean that you should not invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold is its tangible value. Gold is more convenient than bonds or stocks because it can be stored easily. It can also be transported.

You can always access your gold as long as it is kept safe. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold usually rises when the stock market falls.

Another advantage to investing in gold is the ability to sell it whenever you wish. You can easily liquidate your investment, just as with stocks. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Do not buy too much at one time. Start small, buying only a few ounces. You can add more as you need.

Don't expect to be rich overnight. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not legal – WSJ

bbb.org

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Investing In Gold vs. Investing In Stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe gold is no longer financially profitable. This belief stems from the fact that most people see gold prices being driven down by the global economy. They think that they would lose money if they invested in gold. However, investing in gold can still provide significant benefits. Here are some examples.

Gold is the oldest known form of currency. It has been used for thousands of years. It was used all around the world as a reserve of value. It is still used as a payment method by South Africa and other countries.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. It is important to determine the price per gram you are willing and able to pay for gold bullion. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. Although the price of gold has dropped, production costs have not.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. This is not a wise decision if you're looking to invest in long-term assets. You can profit if you sell your gold at a higher price than you bought it.

We hope our article has given you a better understanding of gold as an investment tool. We recommend you do your research before making any final decisions. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Introducing the Bitcoin Everything Indicator

Sourced From: bitcoinmagazine.com/markets/introducing-the-bitcoin-everything-indicator

Published Date: Fri, 07 Feb 2025 13:57:13 GMT