Trump's Strategic Bitcoin Move: A Game Changer

Donald J. Trump recently made a significant move by announcing a strategic Bitcoin stockpile. This decision marked a turning point for Bitcoin, signaling a new era where nations need to consider Bitcoin reserves seriously. The U.S. acquiring Bitcoin for free has put other countries in a tough spot, making Bitcoin mining a matter of national security. Michael Saylor further emphasized the importance of nation-state adoption of Bitcoin as a treasury asset, setting the stage for inevitable changes in the global economic landscape.

The Rise of Institutional Bitcoin Adoption

With nations accumulating Bitcoin, corporations are following suit to stay competitive. The growing Bitcoin reserves of nation-states ensure long-term price appreciation, posing a challenge for dollar-denominated corporate treasuries. Investing in Bitcoin is becoming a baseline requirement for corporations to remain relevant in the evolving financial landscape.

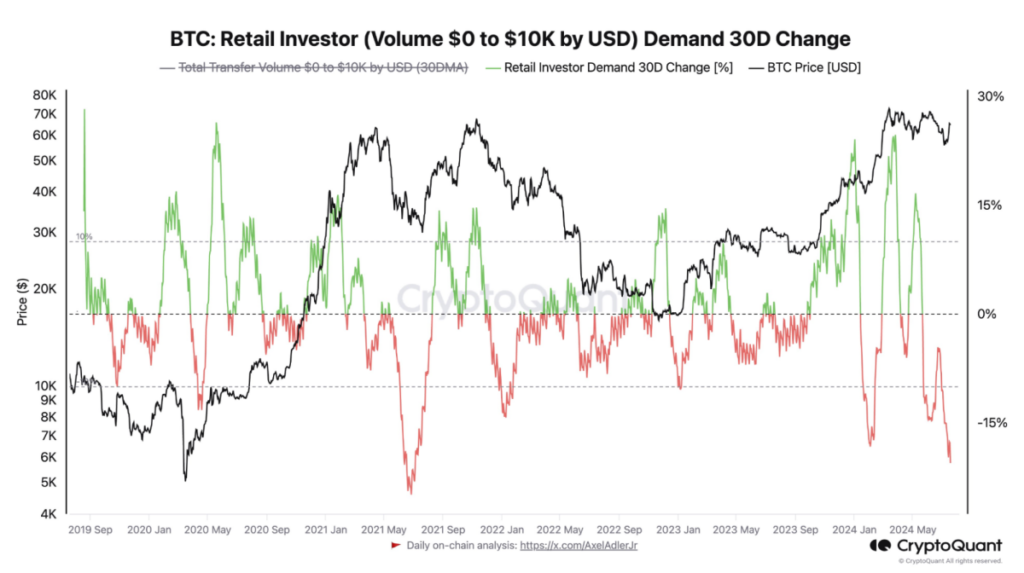

Challenges in Retail Participation

Despite Bitcoin's proximity to its all-time high, retail participation remains low. Retail flow, measured by transaction volume under $10K, is at a three-year low. The Nashville conference highlighted the hesitancy among retail buyers, possibly due to exhaustion or a wait-and-see approach for the next catalyst to drive Bitcoin's price.

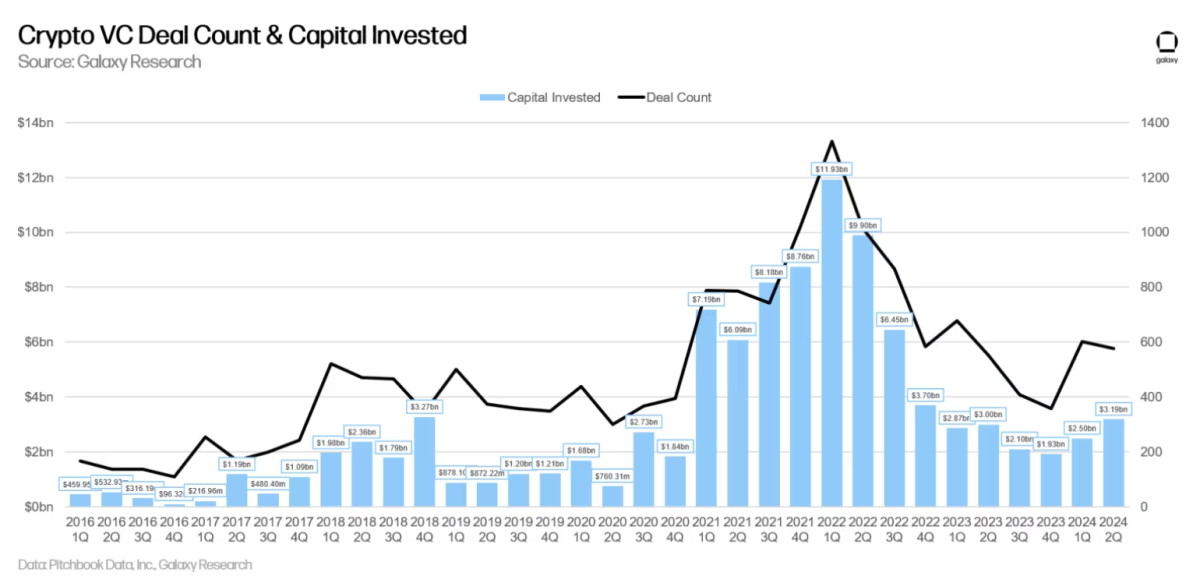

The Evolution of Venture Capital in Bitcoin

The UTXO Alpha Day at the Bitcoin 2024 conference showcased the growing interest in yield-bearing assets within the Bitcoin ecosystem. Venture capitalists are beginning to recognize the potential of Bitcoin investments, although funding in Bitcoin projects still lags behind other crypto sectors. The technical knowledge gap in Bitcoin mechanics among VCs is gradually closing, paving the way for increased Bitcoin investments in the near future.

The Emergence of Bitcoin Layer 2 Solutions

Bitcoin Layer 2 solutions took center stage at the Nashville conference, with prominent projects like Grail introducing innovative rollup protocols. The focus on Layer 2 solutions signals a shift towards scalability and efficiency in the Bitcoin ecosystem. The conference highlighted the importance of bridging traditional investors with on-chain Bitcoin capital through various innovative approaches.

The Future of Bitcoin Mining

Bitcoin mining is undergoing a transformation, shifting towards AI and high-performance computing (HPC) to boost profitability. Miners are exploring new revenue streams beyond traditional mining operations. The commoditization of blockspace and the rise of AI-focused mining strategies are reshaping the mining industry, with a renewed focus on capital allocation and technological advancements.

Lightning Network's Resilience

While Lightning Network took a backseat at the conference, its significance in Bitcoin's scalability cannot be overlooked. Lightning's trustless and efficient transactions on Bitcoin offer a compelling case for capital allocators. The ongoing development of Lightning Network and its integration with Bitcoin-native assets are poised to drive adoption and innovation in the Bitcoin space.

User-Centric Governance in Bitcoin

Matt Corallo's insights at the conference shed light on the essence of Bitcoin's governance, emphasizing the role of users in shaping the protocol. Bitcoin's consensus among users defines its core principles, highlighting the importance of user-centric decision-making in the development of the network. The conference underscored the need for educational content and improved user experience to drive mainstream Bitcoin adoption.

Overall, the Nashville Bitcoin conference provided valuable insights into the evolving landscape of Bitcoin, from institutional adoption to technological advancements. The event served as a platform for industry leaders, investors, and enthusiasts to explore the future potential of Bitcoin and its transformative impact on the global economy.

Frequently Asked Questions

Is gold a good investment IRA option?

Any person looking to save money is well-served by gold. It can be used to diversify your portfolio. But gold is not all that it seems.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply-demand relationship determines the gold price. When the economy is strong, people tend to spend more money, which means fewer people mine gold. The value of gold rises as a consequence.

The flip side is that people tend to save money when the economy slows. This leads to more gold being produced which decreases its value.

This is why it makes sense to invest in gold for individuals and companies. You will benefit from economic growth if you invest in gold.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

How much should you have of gold in your portfolio

The amount that you want to invest will dictate how much money it takes. For a small start, $5k to $10k is a good range. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. Rent is only paid per month.

Also, you need to think about the type of business that you are going to run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. So you might only get paid once every 6 months or so.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

What should I pay into my Roth IRA

Roth IRAs can be used to save taxes on your retirement funds. These accounts are not allowed to be withdrawn before the age of 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, your principal (the deposit amount originally made) is not transferable. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. So, when you withdraw, you'll pay taxes on those earnings. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's also assume that you make $10,000 per year from your Roth IRA contributions. On the earnings, you would be responsible for $3,500 federal income taxes. So you would only have $6,500 left. Since you're limited to taking out only what you initially contributed, that's all you could take out.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

Two types of Roth IRAs are available: Roth and traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs won't let you deduct your contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal amount, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

How much should precious metals make up your portfolio?

This question can only be answered if we first know what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them highly valuable for both investment and trading. The most traded precious metal is gold.

However, many other types of precious metals exist, including silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is not affected by inflation or deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. However, the prices of precious metals do not always move in sync with one another. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. Because they are rare, they become more pricey and lose value.

You must therefore diversify your investments in precious metals to reap the maximum profits. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. To open the account, complete Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. You must complete this form within 60 days of opening your account. After this, you are ready to start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, the process will look identical to an existing IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS says you must be 18 years old and have earned income. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. And, you have to make contributions regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. This means you won't be allowed to trade shares of stock or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option may be offered by some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. They aren't as liquid as bonds or stocks. It is therefore harder to sell them when required. Second, they don't generate dividends like stocks and bonds. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Should You Buy or Sell Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts think this could change quickly. They believe gold prices could increase dramatically if there is another global financial crises.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. You can save for retirement and not invest your savings in gold. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each offers varying levels of flexibility and security.

- Keep in mind that gold may not be as secure as a bank deposit. You may lose your gold coins and never be able to recover them.

So, if you're thinking about buying gold, make sure you do your research first. You should also ensure that you do everything you can to protect your gold.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

cftc.gov

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. It is best to start saving for retirement as soon you can (typically at age 50). It is essential to save enough money each year in order to maintain a steady growth rate.

Additionally, tax-free opportunities like a traditional 401k or SEP IRA are available. These savings vehicles let you make contributions and not pay taxes until the earnings are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

Save regularly and continue to save over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————-

By: Guillaume

Title: Insights from Nashville Bitcoin Conference: A Comprehensive Review

Sourced From: bitcoinmagazine.com/industry-events/post-nashville-event-recap-a-bitcoin-vc-perspective-the-good-the-bad-and-the-bullish-

Published Date: Wed, 31 Jul 2024 16:46:39 GMT