The recent divergence in U.S. Treasury yields, with short-term yields decreasing while longer-term yields are increasing, has generated significant interest in financial markets. This development offers crucial insights into macroeconomic conditions and potential strategies for Bitcoin investors navigating uncertain times.

Treasury Yield Dynamics

Treasury yields reflect the return investors require to hold U.S. government debt, serving as a vital indicator of the economy and monetary policy expectations. Here's a snapshot of the current scenario:

- Short-term yields falling: Decreasing yields on short-term Treasury bonds, like the 6-month yield, suggest market anticipation of Federal Reserve rate cuts due to economic slowdown risks or lower inflation expectations.

- Long-term yields rising: Conversely, increasing yields on longer-term bonds, such as the 10-year Treasury yield, signal concerns about persistent inflation, fiscal deficits, or higher-term premiums demanded by investors for holding long-duration debt.

This yield disparity often indicates a shifting economic landscape and can prompt investors to adjust their portfolios accordingly.

Significance of Treasury Yields for Bitcoin Investors

Bitcoin, as a non-sovereign, decentralized asset, is particularly sensitive to macroeconomic trends. The prevailing yield environment could impact Bitcoin in several ways:

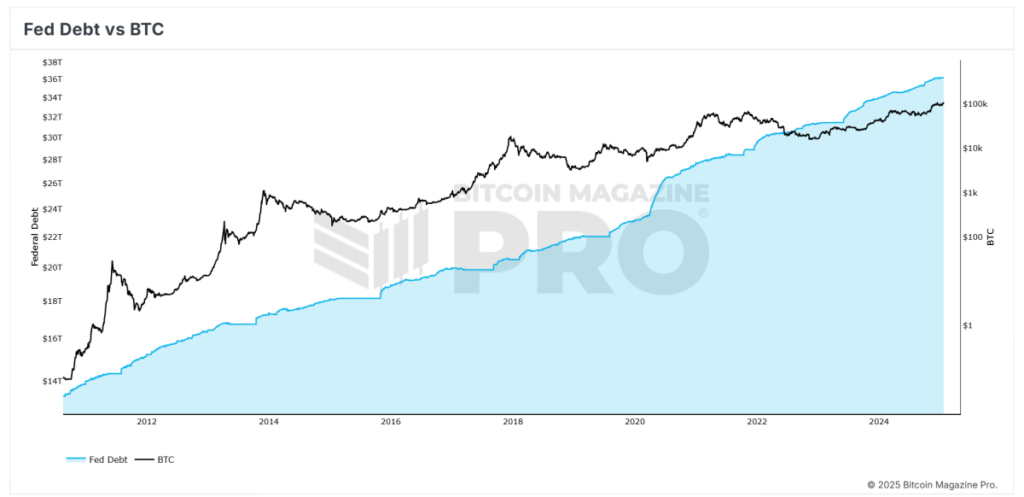

- Inflation Hedge Appeal: Rising long-term yields may signify ongoing inflation worries. Bitcoin, historically viewed as a hedge against inflation and currency devaluation, could become more attractive to investors seeking wealth protection.

- Risk-On Sentiment: Falling short-term yields might indicate looser financial conditions ahead. This could foster a risk-on environment, benefiting assets like Bitcoin as investors pursue higher returns.

- Financial Instability Hedge: Yield divergence, especially leading to an inverted yield curve, could indicate economic instability or recession risks. During such times, Bitcoin's reputation as a safe-haven asset and alternative to traditional finance may gain traction.

- Liquidity Considerations: Reduced short-term yields lower borrowing costs, potentially boosting financial system liquidity. This liquidity often spills into risk assets like Bitcoin, fueling upward price momentum.

Broader Market Implications

The impact of yield divergence extends beyond Bitcoin to various sectors of the financial ecosystem:

- Stock Market: Lower short-term yields typically benefit equities by reducing borrowing costs and supporting valuation multiples. However, rising long-term yields can exert pressure on growth stocks, particularly those sensitive to higher discount rates.

- Debt Sustainability: Elevated long-term yields raise financing costs for governments and corporations, potentially straining heavily indebted entities and creating ripple effects in global markets.

- Economic Outlook: The divergence may indicate market expectations of slower near-term growth alongside longer-term inflationary pressures, hinting at potential stagflation risks.

Key Points for Bitcoin Investors

For Bitcoin investors, comprehending the interaction between Treasury yields and macroeconomic trends is crucial for making informed decisions. Here are some essential considerations:

- Monitor Monetary Policy: Stay informed about Federal Reserve updates and economic data. A dovish shift could benefit Bitcoin, while tighter policies might present temporary challenges.

- Diversify and Hedge: Increased long-term yields could induce volatility across asset classes. Diversifying into Bitcoin as part of a broader portfolio strategy can help hedge against inflation and economic uncertainties.

- Leverage Bitcoin's Narrative: In a scenario of fiscal deficits and monetary easing, Bitcoin's narrative as a non-inflationary store of value gains significance. Educating new investors about this narrative could drive further adoption.

In Conclusion

The disparity in Treasury yields reflects evolving market expectations regarding growth, inflation, and monetary policy—factors with profound implications for Bitcoin and the broader financial landscape. Understanding these dynamics and adjusting strategies accordingly can unlock opportunities to leverage Bitcoin's distinct role in a swiftly changing economic environment. Remaining proactive and well-informed is essential for navigating these intricate times.

For live data access, advanced analytics, and exclusive content, visit BitcoinMagazinePro.com.

Disclaimer: This article serves informational purposes only and does not offer financial advice. Readers are advised to conduct thorough independent research before making investment decisions.

Frequently Asked Questions

Can I keep a Gold ETF in a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

An IRA traditional allows both employees and employers to contribute. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP gives employees tax advantages as they share the stock of the company and the profits it makes. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

You can also get an Individual Retirement Annuity, or IRA. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs do not have to be taxable

How much should you have of gold in your portfolio

The amount of capital that you require will determine how much money you can make. If you want to start small, then $5k-$10k would be great. You could then rent out desks and office space as your business grows. This will allow you to pay rent monthly, and not worry about it all at once. It's only one monthly payment.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. This is why you should consider what you expect from each client if you're doing this kind of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. Therefore, you might only get paid one time every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

What precious metal is best for investing?

Answering this question will depend on your willingness to take some risk and the return you seek. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if your goal is to make quick money, gold may not suit you. If you have time and patience, you should consider investing in silver instead.

If you're not looking to make quick money, gold is probably your best choice. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

finance.yahoo.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

cftc.gov

How To

Investing in gold vs. investing in stocks

It might seem risky to invest in gold as an investment vehicle these days. This is because many people believe that gold investment is no longer profitable. This belief stems from the fact that most people see gold prices being driven down by the global economy. People believe that investing in gold would result in them losing money. In reality, though, gold investment can offer significant benefits. Here are some examples.

The oldest form of currency known to mankind is gold. Its use can be traced back to thousands of years ago. It was used by many people around the globe as a currency store. As a means of payment, South Africa and many other countries still rely on it.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. The first thing you should do when considering buying gold bullion is to decide how much you will spend per gram. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. So while the price of gold has declined, production costs haven't changed.

You should also consider the amount of your intended purchase when considering whether you should buy or not. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. It is worth considering if you intend to use it for long-term investment. If you sell your gold for more than you paid, you can make a profit.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We strongly recommend that you research all available options before making any decisions. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————-

By: Mark Mason

Title: Impact of Declining Short-Term U.S. Treasury Yields on Bitcoin Price

Sourced From: bitcoinmagazine.com/markets/how-declining-short-term-u-s-treasury-yields-impact-bitcoin-price

Published Date: Mon, 27 Jan 2025 18:54:56 GMT