Imagine a world where real estate meets cryptocurrency, creating a groundbreaking fusion of traditional assets and digital currency. That's exactly what Grupo Murano, a renowned $1 billion real estate giant from Mexico, is doing. By diving headfirst into the world of Bitcoin, Grupo Murano is not just making a financial investment; it's pioneering a new era for the real estate industry.

The Vision Behind Grupo Murano's Bitcoin Integration

Bitcoin's Impact on Real Estate Operations

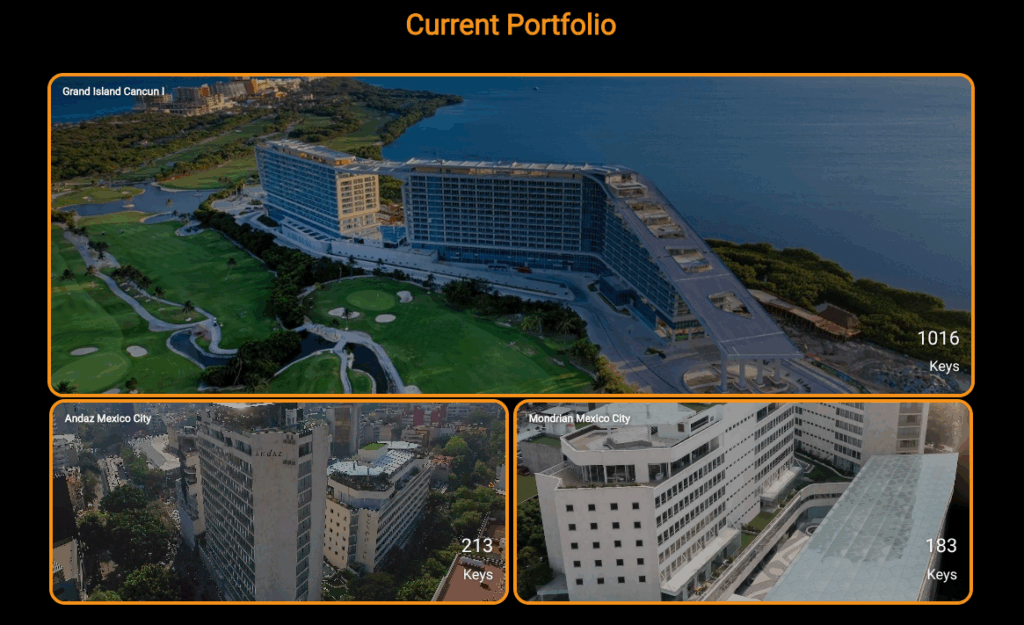

CEO Elías Sacal, a seasoned real estate developer, envisions a future where bitcoin reshapes how real estate businesses operate. Grupo Murano, known for managing prestigious hotels and prime properties, is strategically converting its assets into bitcoin. This strategic move aims to optimize finances, reduce debt, and unlock the potential for substantial appreciation.

Revolutionizing Real Estate Financing

Shifting from Traditional Models to Bitcoin-Centric Treasury

Grupo Murano's shift from conventional asset-heavy models to a bitcoin-centric treasury is not just a financial decision; it's a strategic leap into the future. By embracing bitcoin, the company aims to navigate volatile interest rates and currencies, setting a new standard for financial resilience in the real estate sector.

The Practical Implications of Grupo Murano's Bitcoin Strategy

Empowering Stakeholders and Enhancing Transactions

By educating employees, investors, and guests about the benefits of bitcoin, Grupo Murano is paving the way for seamless transactions and enhanced financial efficiency. The deployment of Bitcoin ATMs in its properties and partnerships with payment platforms signal a commitment to embracing cryptocurrency in everyday operations.

Transitioning a significant portion of its business towards bitcoin holdings, Grupo Murano is making a strategic bet on the digital currency's potential for growth and stability. Embracing Bitcoin as the ultimate champion among cryptocurrencies, Grupo Murano sets the stage for a transformative journey towards a decentralized economy.

Looking Towards the Future: A Bitcoin-Powered Real Estate Landscape

Bitcoin's Role in Unifying Economies and Driving Innovation

Grupo Murano's bold move underscores Bitcoin's capacity to revolutionize capital-intensive industries, offering a blueprint for businesses seeking resilience and growth. As the real estate industry embraces Bitcoin transactions, a more stable and decentralized future emerges, signaling a paradigm shift in global transactions.

Grupo Murano's $1 billion Bitcoin bet is not just a financial maneuver; it's a visionary step towards a future where real estate and cryptocurrency seamlessly intertwine, creating a new norm for businesses worldwide. As Elías Sacal aptly puts it, "The future of real estate will be shaped by Bitcoin transactions," ushering in a transformative era of financial evolution.

Frequently Asked Questions

How much of your IRA should include precious metals?

It is important to remember that precious metals can be a good investment for anyone. It doesn't matter how rich you are to invest in precious metals. There are many methods to make money off of silver and gold investments.

You might also be interested in buying physical coins, such bullion rounds or bars. It is possible to also purchase shares in companies that make precious metals. Your retirement plan provider may offer an IRA rollingover program.

Regardless of your choice, you'll still benefit from owning precious metals. These metals are not stocks, but they can still provide long-term growth.

And, unlike traditional investments, their prices tend to rise over time. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

What is the best precious metal to invest in?

Answering this question will depend on your willingness to take some risk and the return you seek. Although gold has been considered a safe investment, it is not always the most lucrative. Gold may not be right for you if you want quick profits. If patience and time are your priorities, silver is the best investment.

If you're not looking to make quick money, gold is probably your best choice. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

How much should you have of gold in your portfolio

The amount of capital required will affect the amount you make. You can start small by investing $5k-10k. You could then rent out desks and office space as your business grows. Renting out desks and other equipment is a great way to save money on rent. Rent is only paid per month.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. This means that you may only be paid once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k-$2k in gold and working my way up.

Can I hold a gold ETF in a Roth IRA?

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

An IRA traditional allows both employees and employers to contribute. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP gives employees tax advantages as they share the stock of the company and the profits it makes. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

A Individual Retirement Annuity (IRA), is also available. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs can be made without tax.

Is gold a good investment IRA?

If you are looking for a way to save money, gold is a great investment. It's also a great way to diversify your portfolio. But gold is not all that it seems.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the oldest currency in the world.”

But gold is mined from the earth, unlike paper currencies that governments create. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This leads to more gold being produced which decreases its value.

This is why it makes sense to invest in gold for individuals and companies. If you invest in gold, you'll benefit whenever the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

Is buying gold a good option for retirement planning?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

Physical bullion bar is the best way to invest in precious metals. There are other ways to invest gold. Research all options carefully and make an informed decision about what you desire from your investments.

If you're not looking to secure your wealth, it may be worth considering purchasing shares in mining equipment or companies that extract gold. If you require cash flow, gold stocks can work well.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

Who is the owner of the gold in a gold IRA

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

A financial planner or accountant should be consulted to discuss your options.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

bbb.org

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

How To

Tips for Investing In Gold

Investing in Gold is one of the most popular investment strategies worldwide. This is due to the many benefits of investing in gold. There are many ways you can invest in gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, check to see if your country permits you to possess gold. If so, then you can proceed. If not, you may want to consider purchasing gold from overseas.

- Secondly, you should know what kind of gold coin you want. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, you should take into consideration the price of gold. It is better to start small, and then work your way up. You should diversify your portfolio when buying gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Lastly, you should never forget that gold prices change frequently. Keep an eye on current trends.

—————————————————————————————————————————————————————————————-

By: Juan Galt

Title: Grupo Murano’s Bold Move: Embracing Bitcoin to Revolutionize Real Estate

Sourced From: bitcoinmagazine.com/news/grupo-muranos-1b-bitcoin-bet-real-estate

Published Date: Tue, 22 Jul 2025 00:11:35 +0000