GBTC's Bitcoin Holdings Decline

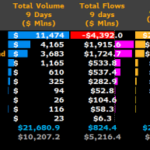

In the most recent update, Grayscale's Bitcoin Trust (GBTC) experienced a decrease of 4,461.36 bitcoin, valued at approximately $190.53 million, over the past day. Since Jan. 12, 2024, GBTC has observed a cumulative reduction of about 124,967.54 bitcoin, equivalent to an estimated $5.33 billion. Meanwhile, the nine recently launched spot bitcoin exchange-traded funds have collectively garnered an impressive total of 160,661.38 bitcoin.

Recent Slowdown in GBTC Outflows

Recent trends indicate a slowdown in the outflows from Grayscale's Bitcoin Trust (GBTC), with each trading day experiencing a smaller decline over the last two sessions. As of Jan. 30, 2024, data revealed that GBTC's holdings dipped below the 500,000 BTC mark, registering at 496,573.81 BTC. However, in the past 24 hours, the holdings have further decreased by 4,461.36 BTC, bringing the total down to 492,112.45 BTC, currently valued at approximately $21.43 billion.

The recent reductions in GBTC have been notable, yet they pale in comparison to the substantial drop of 20,803 bitcoin observed on Jan. 26. From Jan. 12 to Jan. 31, 2024, GBTC's reserves have shrunk from 617,079.99 BTC to 492,112.45 BTC, marking a significant loss of 124,967.54 BTC, according to current metrics. In contrast, Blackrock's IBIT has seen growth over the past day, increasing from 56,629 BTC to 63,488.22 BTC, an uptick of 6,859.22 BTC.

New ETFs Show Growth

As highlighted in their Jan. 31, 2024, daily holdings report, Fidelity's FBTC has witnessed a rise, moving from 47,238 BTC to 53,802.34 BTC. Meanwhile, Ark Invest's ETF, ARKB, has expanded its holdings to 15,175 BTC, an increase of 385 BTC in the last 24 hours. Bitwise's BITB has seen a notable jump, going from 13,576.10 to 14,039.54 BTC. According to the latest assets under management (AUM) data, the Invesco Galaxy ETF BTCO is currently holding 6,898 BTC.

In other developments, Vaneck's HODL ETF now contains 2,941.99 BTC, and Valkyrie's BRRR ETF has a total of 2,635.29 BTC. Franklin Templeton's holdings have climbed from 1,363 BTC to a present total of 1,421 BTC. As of Jan. 31, Wisdomtree's BTCW ETF is holding 260 BTC. Collectively, these nine newly introduced spot bitcoin ETFs have amassed a significant 160,661.38 BTC, valued at $6.88 billion at the current market rate. Although the combined accumulation of these nine new ETFs is impressive, GBTC's fund remains notably larger, being 3.11 times more valuable than the aggregate of all nine.

What are your thoughts on the nine new ETFs accumulating more than 160,000 bitcoin? Share your opinions in the comments section below.

Frequently Asked Questions

How much tax is gold subject to in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

You can use gold as collateral to secure loans. When you borrow against your assets, lenders try to find the highest return possible. Selling gold is usually the best option. However, there is no guarantee that the lender would do this. They may just keep it. Or they might decide to resell it themselves. Either way, you lose potential profit.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. You should leave it alone if you don't intend to lend against it.

What precious metals do you have that you can invest in for your retirement?

It is gold and silver that are the best precious metal investment. Both can be easily bought and sold, and have been around since forever. Consider adding them to the list if you're looking to diversify and expand your portfolio.

Gold: Gold is one the oldest forms currency known to man. It's also very safe and stable. It is a good way for wealth preservation during uncertain times.

Silver: The popularity of silver has always been a concern for investors. It is an excellent choice for investors who wish to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinium is another precious metal that is becoming increasingly popular. It's resistant to corrosion and durable, similar to gold and silver. However, it's much more expensive than either of its counterparts.

Rhodium: The catalytic converters use Rhodium. It's also used in jewelry making. It is also quite affordable compared with other types of precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also much more affordable. This is why it has become a favourite among investors looking for precious metals.

How much do gold IRA fees cost?

An Individual Retirement Account (IRA) fee is $6 per month. This includes account maintenance fees and investment costs for your chosen investments.

If you wish to diversify your portfolio, you may need to pay additional fees. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking, but charge monthly fees for IRAs.

In addition, most providers charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% each year. These rates are often waived if a broker like TD Ameritrade is used.

Can I have physical gold in my IRA

Not only is gold paper currency, but it's also money. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one asset that outperformed stocks in turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your shares will still be yours even if your stock portfolio drops. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold is liquid. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. You can buy gold in small amounts because it is so liquid. This allows you to profit from short-term fluctuations on the gold market.

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Experts believe this could change soon. According to them, gold prices could soar if there is another financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

Consider these things if you are thinking of investing in gold.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save enough money to retire without investing in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each offers varying levels of flexibility and security.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Losing your gold coins could result in you never being able to retrieve them.

Do your research before you buy gold. And if you already own gold, ensure you're doing everything possible to protect it.

Who holds the gold in a gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

bbb.org

investopedia.com

How To

Investing in gold or stocks

This might make it seem very risky to invest gold as an investment tool. Many people believe that investing in gold is not profitable. This belief is based on the fact that gold prices are being driven down by global economic conditions. They believe they would lose their money if they invested gold. In reality, though, gold investment can offer significant benefits. Below we'll look at some of them.

One of the oldest currencies known to man is gold. Its use can be traced back to thousands of years ago. It is a valuable store of value that has been used by many people throughout the world. It is still used as a payment method by South Africa and other countries.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. It is important to determine the price per gram you are willing and able to pay for gold bullion. You could contact a local jeweler to find out what their current market rate is.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

The amount of gold that you are planning to purchase is another important consideration when deciding whether or not gold should be bought. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. If you plan to do so as long-term investments, it is worth looking into. You can profit if you sell your gold at a higher price than you bought it.

We hope you have gained a better understanding about gold as an investment tool. We recommend that you investigate all options before making any major decisions. Only then can informed decisions be made.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Grayscale's Bitcoin Trust (GBTC) Sees Decrease in Bitcoin Holdings While New ETFs Gain Momentum

Sourced From: news.bitcoin.com/grayscales-bitcoin-trust-sees-reduction-slowdown-as-new-etfs-gain-ground-with-over-160000-btc-acquired/

Published Date: Wed, 31 Jan 2024 17:00:06 +0000