Grayscale's Bitcoin ETF Outflows

Grayscale's spot bitcoin exchange-traded fund (ETF), known as GBTC, has experienced increased outflows since its recent update. Present data reveals that a substantial 14,292.18 bitcoin, valued slightly above $556 million, exited the fund after Monday's trading activities.

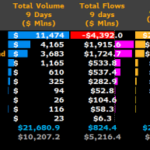

Recent figures indicate a notable decrease in Grayscale's spot bitcoin ETF holdings, declining from 566,973.40 BTC on Friday to 552,681.22 BTC currently. This reduction highlights that the fund's most recent outflow is its largest to date, with 14,292.18 BTC, equivalent to $556 million, departing from the trust. Since Jan. 12, 2024, GBTC has seen its reserves diminish from 617,079.99 BTC to its present level, a loss of roughly 64,398.77 BTC, now valued at just over $2.5 billion.

Increased Holdings in Competing Bitcoin ETFs

On Jan. 22, the trade volumes for spot bitcoin ETFs reached $2.09 billion, with GBTC volume contributing $1.08 billion to this total. The latest figures reveal that Blackrock's IBIT spot bitcoin exchange-traded fund (ETF) has experienced a notable uptick in its holdings, currently possessing 39,925.37 BTC as of Jan. 22, 2024. In a similar vein, Fidelity's Wise Origin spot bitcoin ETF, known as FBTC, now boasts a holding of 30,169.54 BTC.

Social Media Discussion and Bitcoin Price Decline

Grayscale's outflows and the declining value of bitcoin have sparked widespread discussion on social media platforms. Bitcoin's price has slid below the $39K threshold. Etoro's market strategist, Simon Peters, commented on Monday morning that a portion of GBTC's outflows can be attributed to investors migrating towards options with lower fee alternatives. Concurrently, xs.com's market analyst, Antonio Ernesto Di Giacomo, pointed to bitcoin miner outflows as contributing to the downturn.

Expert Advice for Retail Investors

In a note sent to Bitcoin.com News, Blockguard CEO Anthony Bevan emphasized that retail investors should remain calm during the correction. "Retail investors need to be aware that large players in the market will always try to manipulate prices, this is done to flush out sellers' lower price, and more often than not the big player will buy back in," Bevan explained. "The important thing you is to stay calm and where possible DCA (dollar-cost-average) into your investment."

Bevan additionally emphasized that predicting the duration of this downturn is an uncertainty. "However, in my opinion, we will see a strong wick down to liquidate longs with bounce and slight recovery so that we find a range again, once we find a new range, we will have a better idea of where the market would go next," the Blockguard executive added. Over the last 24 hours, coinglass.com metrics show $91.92 million in bitcoin long positions have been liquidated.

What do you think about the GBTC outflows and bitcoin's price sinking below $39K? Let us know what you think about this subject in the comments section below.

Frequently Asked Questions

What is a gold IRA account?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase gold bullion coins in physical form at any moment. You don’t have to wait to begin investing in gold.

An IRA allows you to keep your gold forever. Your gold assets will not be subjected tax upon your death.

Your heirs can inherit your gold and avoid capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts like a middleman between the IRS and you.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual returns.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 A higher interest rate will be offered if you invest more.

Taxes will apply to gold that you take out of an IRA. You will be liable for income taxes and penalties if you take the entire amount.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

It's best not to take out more 50% of your total IRA investments each year. If you do, you could face severe financial consequences.

How to Open a Precious Metal IRA?

The first step is to decide if you want an Individual Retirement Account (IRA). To open the account, complete Form 8606. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form must be submitted within 60 days of the account opening. You can then start investing once you have this completed. You can also choose to pay your salary directly by making a payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, it will be the same process as an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS says you must be 18 years old and have earned income. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. Contributions must be made regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can use a precious-metals IRA to purchase gold, silver and palladium. You can only purchase bullion in physical form. You won't have the ability to trade stocks or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is available from some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they are not as liquid or as easy to sell as stocks and bonds. This makes it harder to sell them when needed. They also don't pay dividends, like stocks and bonds. Therefore, you will lose money over time and not gain it.

What is the best precious-metal to invest?

Answering this question will depend on your willingness to take some risk and the return you seek. While gold is considered a safe investment option, it can also be a risky choice. For example, if you need a quick profit, gold may not be for you. If you have the patience to wait, then you might consider investing in silver.

If you don’t want to be rich fast, gold might be the right choice. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

What does gold do as an investment?

The supply and demand for gold affect the price of gold. Interest rates are also a factor.

Due to limited supplies, gold prices are subject to volatility. There is also a risk in owning gold, as you must store it somewhere.

How much should precious metals be included in your portfolio?

First, let's define precious metals to answer the question. Precious elements are those elements which have a high price relative to other commodities. They are therefore very attractive for investment and trading. Gold is currently the most widely traded precious metal.

There are however many other types, including silver, and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. They do not always move in the same direction. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. Because they are rare, they become more pricey and lose value.

Diversifying across precious metals is a great way to maximize your investment returns. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

Should You Invest in gold for Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you're unsure about which option to choose then consider investing in both.

Gold is a safe investment and can also offer potential returns. Retirees will find it an attractive investment.

While most investments offer fixed rates of return, gold tends to fluctuate. Therefore, its value is subject to change over time.

But this doesn't mean you shouldn't invest in gold. You should just factor the fluctuations into any overall portfolio.

Another advantage of gold is its tangible nature. Gold is more convenient than bonds or stocks because it can be stored easily. It can be easily transported.

You can always access your gold if it is stored in a secure place. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold usually rises when stocks fall.

You can also sell gold anytime you like by investing in it. Just like stocks, you can liquidate your position whenever you need cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Don't buy too many at once. Begin by buying a few grams. You can add more as you need.

Keep in mind that the goal is not to quickly become wealthy. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement plans

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

cftc.gov

How To

Investing gold vs. stocks

This might make it seem very risky to invest gold as an investment tool. The reason behind this is that many people believe that gold is no longer profitable to invest in. This belief arises because most people believe that the global economy is driving down gold prices. They feel that gold investment would cause them to lose money. However, investing in gold can still provide significant benefits. Let's take a look at some of the benefits.

One of the oldest forms known of currency is gold. There are records of its use going back thousands of years. It was used by many people around the globe as a currency store. It is still used as a payment method by South Africa and other countries.

The first point to consider when deciding whether or not you should invest in gold is what price you want to pay per gram. It is important to determine the price per gram you are willing and able to pay for gold bullion. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

Another thing to remember when thinking about whether or not you should buy gold is the amount of gold you plan on purchasing. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. However, if you are planning on doing so for long-term investments, then it is worth considering. If you sell your gold for more than you paid, you can make a profit.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend that you investigate all options before making any major decisions. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Grayscale's Bitcoin ETF Sees Record Outflows as Bitcoin Price Falls

Sourced From: news.bitcoin.com/gbtc-experiences-record-bitcoin-outflow-blockguard-ceo-advises-investor-calm-amidst-market-shift/

Published Date: Tue, 23 Jan 2024 16:00:43 +0000