Introduction

This article provides a heuristic analysis of GBTC outflows, offering insights into the current state of GBTC selling and predicting the scale of future outflows. While this analysis is not strictly mathematical, it serves as a valuable tool for understanding the market dynamics surrounding GBTC and estimating the potential impact on Bitcoin.

Number Go Down

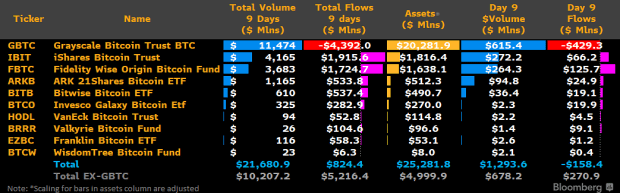

Since Wall Street entered the Bitcoin market through the approval of the Spot ETF, the Grayscale Bitcoin Trust (GBTC) has been experiencing significant selling pressure. With over 630,000 Bitcoin at its peak, GBTC's treasury (3% of all 21 million Bitcoin) has seen outflows of more than $4 billion during the first 9 days of ETF trading. Surprisingly, despite the negative price action, there have been net inflows of $824 million over the same period.

Forecasting GBTC Outflows

To understand the near-term price impact of Spot Bitcoin ETFs, it is crucial to analyze the duration and magnitude of GBTC outflows. This section reviews the causes of these outflows, identifies the sellers, estimates their stockpiles, and predicts the duration of the outflows. Despite the large projected outflows, it is important to note that they can be unexpectedly bullish for Bitcoin in the medium-term.

The GBTC Hangover: Paying For It

GBTC played a significant role in driving the 2020-2021 Bitcoin bull run. The GBTC premium fueled market demand, allowing participants to acquire shares at net asset value and mark up their book value. However, when the GBTC premium disappeared, a chain of liquidations occurred, causing the GBTC discount to impact the entire industry. This led to a series of bankruptcies and forced liquidations, with the FTX estate selling 20,000 BTC to repay its creditors.

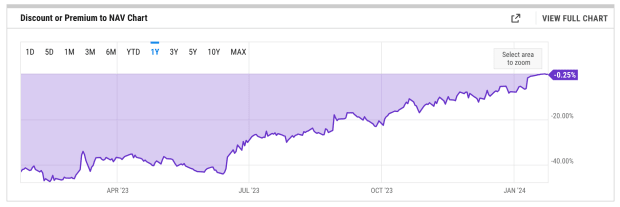

Role of the GBTC Discount

The steep GBTC discount relative to NAV has affected spot Bitcoin demand. Investors were incentivized to go long on GBTC and short on BTC to collect BTC-denominated returns as GBTC approached NAV. This combination diverted spot Bitcoin demand away, further impacting the market. However, after the ETF approval, the GBTC discount has returned to near-neutral levels, reducing its negative impact.

Optimal Strategy For Different GBTC Owners

To estimate the total number of BTC likely to exit GBTC, it is important to consider the financial strategy of different GBTC shareholders. This section discusses the optimal path forward for different segments of GBTC owners, including bankruptcy estates, retail brokerage accounts, retirement accounts, and institutional investors.

Bankruptcy Estates

Bankruptcy estates hold approximately 15% of GBTC shares, and it is expected that most or all of these shares will be sold to repay creditors. The FTX estate has already liquidated its holdings, while other bankrupt parties, such as Genesis Global, still hold shares. It is likely that a significant portion of bankruptcy sales has already

Frequently Asked Questions

What precious metals could you invest in to retire?

It is gold and silver that are the best precious metal investment. Both can be easily bought and sold, and have been around since forever. You should add them to your portfolio if you are looking to diversify.

Gold: One of the oldest forms of currency, gold, is one of mankind's most valuable. It is very stable and secure. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. It's a good choice for those who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinium is another precious metal that is becoming increasingly popular. It's resistant to corrosion and durable, similar to gold and silver. However, it's much more expensive than either of its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used as a jewelry material. And, it's relatively cheap compared to other types of precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also more affordable. It's a popular choice for investors who want to add precious metals into their portfolios.

How much money should my Roth IRA be funded?

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. The account cannot be withdrawn from until you are 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, your principal (the deposit amount originally made) is not transferable. No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule says that you cannot withdraw your earnings without paying income tax. So, when you withdraw, you'll pay taxes on those earnings. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's say you earn $10,000 each year after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. You can withdraw your contributions plus interest from your traditional IRA when you retire. You can withdraw as much as you want from a traditional IRA.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. Unlike a traditional IRA, there is no minimum withdrawal requirement. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

What are the advantages of a gold IRA

It is best to put your retirement money in an Individual Retirement Account (IRA). It's not subject to tax until you withdraw it. You can decide how much money you withdraw each year. There are many types available. Some are better suited for college students. Some are for investors who seek higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This type account may make sense if it is your intention to retire early.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. For people who would rather invest than spend their money, gold IRA accounts are a good option.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. It means that you don’t have to remember to make deposits every month. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. Because it's not tied to any particular country, its value tends to remain steady. Even in times of economic turmoil gold prices tend to remain stable. This makes it a great investment option to protect your savings from inflation.

How does a gold IRA work?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

Physical gold bullion coin can be purchased at any time. You don't have to wait until retirement to start investing in gold.

An IRA allows you to keep your gold forever. Your gold holdings will not be subject to tax when you are gone.

Your gold is passed to your heirs without capital gains tax. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done that, you'll receive an IRA custody. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 However, you'll receive a higher interest rate if you put in more.

You'll have to pay taxes if you take your gold out of your IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

You may not be required to pay taxes if you take out only a small amount. However, there are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

You shouldn't take out more then 50% of your total IRA assets annually. You'll be facing severe financial consequences if you do.

What is the cost of gold IRA fees

A monthly fee of $6 for an Individual Retirement Account is charged. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

To diversify your portfolio you might need to pay additional charges. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer free checking, but charge monthly fees for IRAs.

Many providers also charge annual management fees. These fees can range from 0% up to 1%. The average rate for a year is.25%. However, these rates are typically waived if you use a broker like TD Ameritrade.

What precious metal should I invest in?

This question depends on how risky you are willing to take, and what return you want. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if your goal is to make quick money, gold may not suit you. If you have the patience to wait, then you might consider investing in silver.

If you're not looking to make quick money, gold is probably your best choice. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Can the government take your gold

Your gold is yours, so the government cannot confiscate it. It is yours because you worked hard for it. It belongs to your. This rule could be broken by exceptions. Your gold could be taken away if your crime was fraud against federal government. If you owe taxes, your precious metals could be taken away. However, even if taxes are not paid, gold is still your property.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

cftc.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads. Example. And Risk Metrics

How To

Tips for Investing In Gold

Investing in Gold is a popular investment strategy. This is due to the many benefits of investing in gold. There are several ways to invest in gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, find out if your country allows gold ownership. If the answer is yes, you can go ahead. If not, you may want to consider purchasing gold from overseas.

- You should also know the type of gold coin that you desire. You have the option of choosing yellow, white, or rose gold.

- You should also consider the price of gold. It is best to begin small and work your ways up. It is important to diversify your portfolio whenever you purchase gold. Diversify your investments in stocks, bonds or real estate.

- Remember that gold prices are subject to change regularly. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

By: David Bailey,Spencer Nichols

Title: GBTC Outflows: Analyzing Bitcoin Selling Pressure and Market Impact

Sourced From: bitcoinmagazine.com/markets/gbtc-outflows-forecasting-total-bitcoin-selling-pressure-market-impact-

Published Date: Fri, 26 Jan 2024 16:36:09 GMT

Related posts:

Grayscale’s Bitcoin Trust Sees a Decline in its NAV Discount to 16.59%

Grayscale’s Bitcoin Trust Sees a Decline in its NAV Discount to 16.59%

Grayscale’s GBTC Sees Significant BTC Reduction Amid Bitcoin ETF Competition

Grayscale’s GBTC Sees Significant BTC Reduction Amid Bitcoin ETF Competition

JPMorgan Warns of Bitcoin Selloff as Grayscale Sees $3 Billion Outflow

JPMorgan Warns of Bitcoin Selloff as Grayscale Sees $3 Billion Outflow

Grayscale’s Bitcoin Holdings Decrease as Blackrock and Fidelity Bitcoin ETFs Expand

Grayscale’s Bitcoin Holdings Decrease as Blackrock and Fidelity Bitcoin ETFs Expand