On January 31, 2023, the U.S. Federal Reserve announced its decision to maintain the federal funds rate at its current level. The Federal Open Market Committee (FOMC) emphasized that it will not consider reducing the target range until it has a higher level of confidence in achieving the 2% inflation target. While the stock market experienced declines, the price of bitcoin remained unaffected.

Fed Maintains Rates, Aims for Inflation Confidence

The U.S. central bank has decided to keep the federal funds rate between 5.25% and 5.5% until the next FOMC meeting. The Fed acknowledged the robust expansion of economic activity and noted that although job growth has slowed compared to the previous year, it remains strong, and the unemployment rate remains low. Despite moderating inflation, it is still higher than desired.

"To support our objectives, the committee has decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent," stated the central bank. "When considering any adjustments to the target range, we will carefully assess incoming data, the evolving outlook, and the balance of risks." The Fed further added:

The committee will not consider reducing the target range until there is a higher level of confidence in achieving sustainable inflation towards 2 percent.

Market Performance and Bitcoin Stability

Following the announcement, the three main indices tracking market performance in the United States, namely the Dow Jones Industrial Average, the Standard & Poor's 500, and the Nasdaq Composite, all experienced declines. However, the price of bitcoin (BTC) remained steady at $43,258 per unit after the FOMC announcement.

The decision on interest rates also had little impact on the stability of the gold and silver markets. However, the banking sector faced turbulence, with shares of New York Community Bancorp (NYSB) plunging over 40% and affecting a wide range of banking stocks.

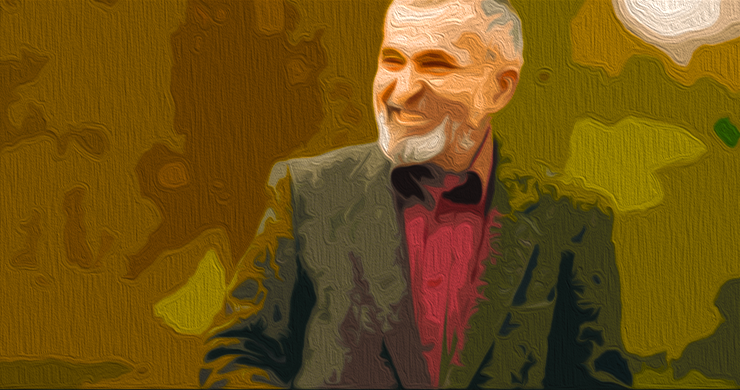

Fed Chair's Statement and Future Rate Cuts

During the subsequent press conference, Fed Chair Jerome Powell stated that the FOMC requires more data and "greater confidence" regarding inflation reduction. This positions the central bank to potentially reduce the federal funds rate later this year. Powell reassured the public by saying, "We are fully committed to returning inflation to our 2% goal." He added:

While the lower inflation readings in the second half of last year are positive, we need to see continued evidence to build confidence in achieving our inflation goal sustainably.

By 3:45 p.m. Eastern Time (ET) on Wednesday, the price of bitcoin (BTC) had dropped 2.1% below the $43K threshold to $42,796 per unit. Powell expressed doubt about the committee reaching a sufficient level of confidence by the time of the March meeting to consider rate cuts. This disappointed the market, as there was widespread anticipation of rate cuts in March 2024.

What are your thoughts on the Fed's decision to maintain the rates? Share your opinions in the comments section below.

Frequently Asked Questions

Can I keep physical gold in an IRA?

Not only is gold paper currency, but it's also money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

One reason is that gold has historically performed better than other assets during periods of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

The best thing about gold investing is the fact that there's virtually no counterparty risk. If your stock portfolio goes down, you still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold offers liquidity. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. The liquidity of gold makes it a good investment. This allows for you to benefit from the short-term fluctuations of the gold market.

How much gold can you keep in your portfolio

The amount that you want to invest will dictate how much money it takes. For a small start, $5k to $10k is a good range. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. It's only one monthly payment.

It's also important to determine what type business you'll run. In my case, we charge clients between $1000-2000/month, depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k in gold and working my way up.

What are the benefits of a gold IRA

Many benefits come with a gold IRA. It is an investment vehicle that can diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best part is that you don't need special skills to invest in gold IRAs. They are readily available at most banks and brokerages. Withdrawals can happen automatically, without any fees or penalties.

That said, there are drawbacks too. The volatility of gold has been a hallmark of its history. Understanding why you want to invest in gold is essential. Are you seeking safety or growth? Are you trying to find safety or growth? Only when you are clear about the facts will you be able take an informed decision.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. One ounce won't be enough to meet all your needs. You could need several ounces depending on what you plan to do with your gold.

You don’t necessarily need a lot if you’re looking to sell your gold. Even a single ounce can suffice. But you won't be able to buy anything else with those funds.

What is the tax on gold in Roth IRAs?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

The rules that govern these accounts differ from one state to the next. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York offers a waiting period of up to 70 1/2 years. To avoid penalties, you should plan ahead and take distributions as soon as possible.

What are the pros and cons of a gold IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. But, this type of investment comes with its own set of disadvantages.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds, you'll need to pay a penalty.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management charges ranging anywhere from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. Most insurers require you to own a minimum amount of gold before making a claim. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers limit the amount of gold that you are allowed to own. Some providers allow you to choose your weight.

You will also have to decide whether to purchase futures or physical gold. Gold futures contracts are more expensive than physical gold. Futures contracts allow you to buy gold with more flexibility. They enable you to establish a contract with an expiration date.

You also need to decide the type and level of insurance coverage you want. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does offer coverage for natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

In addition to insurance, you'll need to consider the cost of storing your gold. Insurance won't cover storage costs. Safekeeping costs can be as high as $25-40 per month at most banks.

If you decide to open a gold IRA, you must first contact a qualified custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians cannot sell your assets. They must instead keep them for as long as you ask.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. Also, you should specify how much each month you plan to invest.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. After receiving your application, the company will review it and mail you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

Who has the gold in a IRA gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

It is a good idea to consult an accountant or financial planner to learn more about your options.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

cftc.gov

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Lawful – WSJ

forbes.com

investopedia.com

How To

A growing trend: Gold IRAs

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Gold IRA owners can now invest in physical gold bullion or bars. It is tax-free and can be used by investors who aren't concerned about stocks and bond.

A gold IRA allows investors to manage their assets without worrying about market volatility. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

Additional benefits of the gold IRA include the ability to quickly pass ownership to heirs. Additionally, the IRS does not consider gold a money or a commodity.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————-

By: Jamie Redman

Title: Federal Reserve Keeps Rates Unchanged, Focusing on Inflation Confidence

Sourced From: news.bitcoin.com/fed-maintains-interest-rates-seeks-greater-confidence-on-inflation-goal-bitcoin-and-gold-hold-steady/

Published Date: Wed, 31 Jan 2024 20:30:21 +0000

Related posts:

Federal Reserve increases benchmark rate of 75bps to fight rising inflation

Federal Reserve increases benchmark rate of 75bps to fight rising inflation

If markets forget that Central Banks do not have the ability to fix the world with interest rate,

If markets forget that Central Banks do not have the ability to fix the world with interest rate,

Predictions of Bitcoin and World Markets at the Upcoming FOMC Meeting

Predictions of Bitcoin and World Markets at the Upcoming FOMC Meeting

Federal Reserve Maintains Current Rates, Eyes Potential Reductions in 2024

Federal Reserve Maintains Current Rates, Eyes Potential Reductions in 2024