There is a distinctive nexus between Bitcoin, gold, and China that weaves an intriguing narrative. With fluctuating inflation rates and prices, both Bitcoin and gold are key economic elements garnering significant attention. As per recent trends, the triumvirate of Bitcoin, gold, and China’s monetary strategies shows a fascinating play of economic forces.

The Interplay of Bitcoin and Gold in Inflation Dynamics

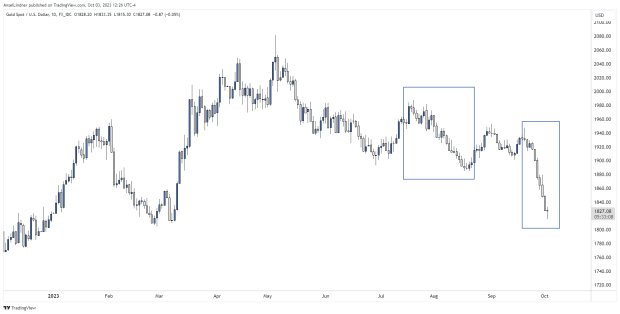

Bitcoin and gold both act as hedges against inflation, with gold presently demonstrating a lower inflation rate (1.7%) as compared to Bitcoin (1.8%). However, a pivotal shift is imminent induced by the Bitcoin halving phenomenon. A rudimentary inflation discourse suggests an increase in both gold and Bitcoin. However, interestingly, in the past few days, gold prices have stumbled while Bitcoin has sprung back.

An intriguing trend has been the climbing value of Bitcoin accompanying the crash of gold prices. A somewhat inverse proximity with the Consumer Price Index (CPI) for gold and Bitcoin is noticeable. As the CPI shot up last year, gold and Bitcoin whittled down — undermining the popular notion that inflation is the dominating force in this marketplace.

The Chinese Gold Sell-Off Phenomenon

While the world witnesses the peculiar paradox of gold plummet and Bitcoin soar, it can be probable that the Chinese are shelling off their gold reserves. This move might be a strategy to safeguard their currency value along with conserving their valuable US dollar foreign exchange reserves.

In an unexpected turn of events, it was found that China lifted the ceiling on gold imports to cut down the necessity for local banks to acquire dollars. This brings new enlightenment to the falling gold prices.

The Influence of Chinese Financial Engagements

The Chinese economic activities have been highly consequential, particularly the prevailing dollar deficit which they are trying to combat by strategically selling off gold. Such a decision could potentially alleviate the selling pressure on US Treasuries and possibly control the skyrocketing US 10Y yield, reflected in the yield spiking from about 3% to 4%.

An easing strain on the Chinese yuan from the gold sell-off might spark a significant surge in Bitcoin values. Previously, similar or weaker yuan movements caused Bitcoin to rally between 26% to 40%.

Balancing Inflation Expectations and Market Forces

A validating measure for general inflation anticipation includes three main market-based indicators: the 5-year-5-year Forward Contract, 5-year Breakevens, and 10-year Breakevens. Each portrays a compelling insight into the trajectory of the market and its expectations of future inflation.

Amid economic uncertainty, current data exhibits a recurrent pattern of narrowing gaps, which might indicate burgeoning market anxieties. This might lead to downward shifts in inflation expectations as we inch closer to a potential recession.

Cognizing Bank Credit Stagnancy

Understanding bank credit stagnation is key in predicting an impending deflationary outcome. Flat bank credit rates are a clear indication of potential deflation, favourable for Bitcoin as it effectively hedges against systemic credit risk. In a credit-based system, this makes Bitcoin a safe refuge devoid of counterparty risk.

Inferring Recession from Economic Indicators

This economic turmoil roundabout predictably adds strength to the narrative that we could be headed towards a recession rather than encountering inflation. Historically, once inflation expectations dip, a recession generally follows in around 15 months. This gives an ample window leading up to a recession where assets such as Bitcoin might pose promising investment prospects and consequently deliver robust returns.

Frequently Asked Questions

How much of your IRA should include precious metals?

It is important to remember that precious metals can be a good investment for anyone. You don't need to be rich to make an investment in precious metals. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. Also, you could buy shares in companies producing precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

No matter what your preference, precious metals will still be of benefit to you. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices rise with time, which is a different to traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

What are some of the benefits of a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It is tax-deferred until it's withdrawn. You have complete control over how much you take out each year. There are many types available. Some are better suited for people who want to save for college expenses. Others are made for investors seeking higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. However, once they begin withdrawing funds, these earnings are not taxed again. So if you're planning to retire early, this type of account may make sense.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This eliminates the need to constantly make deposits. Direct debits could be set up to ensure you don't miss a single payment.

Finally, gold is one of the safest investment choices available today. It is not tied to any country so its value tends stay steady. Even in times of economic turmoil gold prices tend to remain stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

What should I pay into my Roth IRA

Roth IRAs allow you to deposit your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, your principal (the deposit amount originally made) is not transferable. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

You cannot withhold your earnings from income taxes. Withdrawing your earnings will result in you paying taxes. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's further assume you earn $10,000 annually after contributing. The federal income tax on your earnings would amount to $3,500. This leaves you with $6,500 remaining. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA can be used to withdraw your balance and interest when you are retired. A traditional IRA can be withdrawn up to the maximum amount allowed.

A Roth IRA doesn't allow you to deduct your contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal amount, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

How do you withdraw from an IRA that holds precious metals?

First, determine if you would like to withdraw money directly from an IRA. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. You will need to weigh each one before making a decision.

Bullion bars require less space, as they don't contain individual coins. However, you'll need to count every coin individually. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep their coins in a vault. Others prefer to store their coins in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

bbb.org

investopedia.com

irs.gov

finance.yahoo.com

How To

Investing with gold or stocks

It might seem risky to invest in gold as an investment vehicle these days. This is because many people believe gold is no longer financially profitable. This belief is due to the fact that many people see gold prices dropping because of the global economy. They fear that investing in gold will result in a loss of money. In reality, however there are still many significant benefits to gold investing. Below are some of them.

The oldest form of currency known to mankind is gold. It has been in use for thousands of year. It has been used as a store for value by people all over the globe. Even today, countries such as South Africa continue to rely heavily on it as a form of payment for their citizens.

Consider the price per gram when you decide whether you should invest in or not. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. If you plan to buy enough gold to cover your wedding rings then it is probably a good idea to wait before buying any more. If you plan to do so as long-term investments, it is worth looking into. If you sell your gold for more than you paid, you can make a profit.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. We recommend that you investigate all options before making any major decisions. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————-

By: Ansel Lindner

Title: Exploring the Intricate Relationship Between Bitcoin, Gold, and China

Sourced From: bitcoinmagazine.com/markets/the-bitcoin-gold-china-connection

Published Date: Mon, 09 Oct 2023 21:55:00 GMT