Hey there! Curious about where the Bitcoin price might head next? While the hype around soaring prices is exciting, it's equally crucial to peek into the crystal ball and prepare for the future. Let's dive into the numbers and formulas that can give us a glimpse of where Bitcoin's price floor might land in the upcoming cycle.

Decoding Historical Bitcoin Price Bottoms

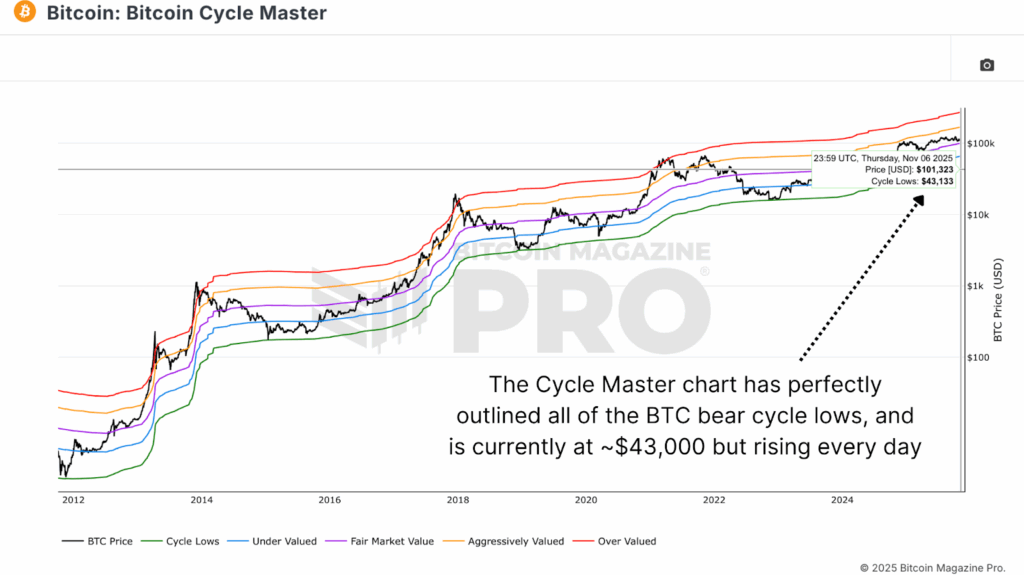

Ever heard of the Bitcoin Cycle Master chart? This magical chart has been pretty spot-on in predicting Bitcoin's lows over the years. From $160 to $3,200 and $15,500, it's been a reliable guide. Currently, it hovers around $43,000, painting a picture of where Bitcoin might bottom out next.

Insight:

Looking at past data and on-chain metrics helps us understand where Bitcoin might find solid ground in the future.

Understanding Diminishing Drawdowns

Now, let's talk about the MVRV Ratio. It's a nifty tool that compares Bitcoin's market price to its actual price. During bear markets, Bitcoin tends to dip to around 0.75x its true price. And guess what? The depth of these drops has been softening over time. Less pain, more gain!

Key Point:

By analyzing these ratios, we can anticipate how far Bitcoin might tumble in the next market downturn.

Predicting Bitcoin's Future Price Movements

Before we dive into the lows, let's peek at the highs. History shows us that Bitcoin usually hits its peak at about 2.5x its actual value. Based on this trend, a potential top near $180,000 by late 2025 seems plausible. Fast forward to 2027, and we might see Bitcoin bottoming around $55,000–$60,000.

Insight:

By connecting the dots between past performance and current trends, we can project where Bitcoin might reach in the future.

Bitcoin's Valuation and Production Costs

Another fascinating metric is Bitcoin's production cost, reflecting the electricity needed to mine one BTC. This cost has historically influenced Bitcoin's lowest points. Whenever Bitcoin falls below this production cost, miners feel the heat, signaling a prime time to buy. At present, this cost hovers around $70,000.

Insight:

Understanding production costs sheds light on potential buying opportunities during market downturns.

In Conclusion: Brace for a Less Turbulent Ride

With each Bitcoin cycle, we hear the same tune of "This time is different." But history tends to repeat itself. While Bitcoin's landscape has evolved, the cyclicality remains intact. The data hints that the next bear market might not be as harsh, signaling a more mature market. So, don't fear a dip to $55,000–$70,000; it's just part of Bitcoin's rhythm of growth and correction.

Exciting, right? Keep an eye on these indicators to navigate the thrilling world of Bitcoin with more confidence!

Frequently Asked Questions

Who is entitled to the gold in a IRA that holds gold?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

How is gold taxed within a Roth IRA

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules governing these accounts vary by state. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. To avoid penalty fees, it is important to plan and take distributions in time to pay all your retirement savings.

What should I pay into my Roth IRA

Roth IRAs can be used to save taxes on your retirement funds. You cannot withdraw funds from these accounts until you reach 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, your principal (the deposit amount originally made) is not transferable. No matter how much money you contribute, you cannot take out more than was originally deposited to the account. You must pay taxes on the difference if you want to take out more than what you initially contributed.

You cannot withhold your earnings from income taxes. Also, taxes will be due on any earnings you take. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's say you earn $10,000 each year after contributing. The federal income tax on your earnings would amount to $3,500. That leaves you with only $6,500 left. The amount you can withdraw is limited to the original contribution.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types of Roth IRAs: Traditional and Roth. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

Physical gold bullion coin can be purchased at any time. You don't have a retirement date to invest in gold.

You can keep gold in an IRA forever. You won't have to pay taxes on your gold investments when you die.

Your heirs can inherit your gold and avoid capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

First, an individual retirement account will be set up to allow you to open a golden IRA. After you have done this, an IRA custodian will be assigned to you. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. The minimum deposit required to purchase gold bullion coins is $1,000 If you make more, however, you will get a higher interest rate.

You'll have to pay taxes if you take your gold out of your IRA. You will be liable for income taxes and penalties if you take the entire amount.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

Avoid taking out more that 50% of your total IRA assets each year. A violation of this rule can lead to severe financial consequences.

How do I Withdraw from an IRA with Precious Metals?

First, you must decide if you wish to withdraw money from your IRA account. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

A taxable brokerage account is a better option than an IRA if you are prepared to pay a penalty for early withdrawals. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities can accept bullion bar, while others require you buy individual coins. You will need to weigh each one before making a decision.

Bullion bars, for example, require less space as you're not dealing with individual coins. You will need to count each coin individually. However, individual coins can be stored to make it easy to track their value.

Some prefer to keep their money in a vault. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Are You Ready to Invest in Gold?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold is a safe investment and can also offer potential returns. Retirees will find it an attractive investment.

While most investments offer fixed rates of return, gold tends to fluctuate. This causes its value to fluctuate over time.

However, this does not mean that gold should be avoided. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit to gold is its tangible value. Gold can be stored more easily than stocks and bonds. It's also portable.

Your gold will always be accessible as long you keep it in a safe place. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold usually rises when stocks fall.

Another benefit to investing in gold? You can always sell it. Like stocks, you can sell your position anytime you need cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

You shouldn't buy too little at once. Start with just a few drops. Then add more as needed.

Keep in mind that the goal is not to quickly become wealthy. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Is gold a good choice for an investment IRA?

If you are looking for a way to save money, gold is a great investment. It is also an excellent way to diversify you portfolio. There's more to gold that meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It's often referred to as “the world's oldest currency.”

But unlike paper currencies, which governments create, gold is mined out of the earth. Because it is rare and difficult to make, it is extremely valuable.

The supply-demand relationship determines the gold price. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. The result is that gold's value increases.

The flip side is that people tend to save money when the economy slows. This results in more gold being produced, which drives down its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

In addition to earning interest on your investments, this will allow you to grow your wealth. If gold's value falls, you don't have to lose any of your investments.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads and Example. Risk Metrics

How To

3 Ways to Invest Gold for Retirement

It's important to understand how gold fits in with your retirement plan. You can invest in gold through your 401(k), if you have one at work. You might also be interested to invest in gold outside the workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. If you don't have any precious metals yet, you might want to buy them from a reputable dealer.

If you do invest in gold, follow these three simple rules:

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, deposit cash into your accounts. This will help protect you against inflation and keep your purchasing power high.

- Physical Gold Coins – Physical gold coins are better than a paper certificate. Physical gold coins can be sold much faster than paper certificates. There are no storage fees for physical gold coins.

- Diversify your Portfolio. By investing in multiple assets, you can spread your wealth. This helps reduce risk and gives you more flexibility during market volatility.

—————————————————————————————————————————————————————————————-

By: Matt Crosby

Title: Estimating Bitcoin's Future: A Math-Based Approach

Sourced From: bitcoinmagazine.com/markets/predicting-bitcoin-price-floor

Published Date: Fri, 07 Nov 2025 21:50:58 +0000