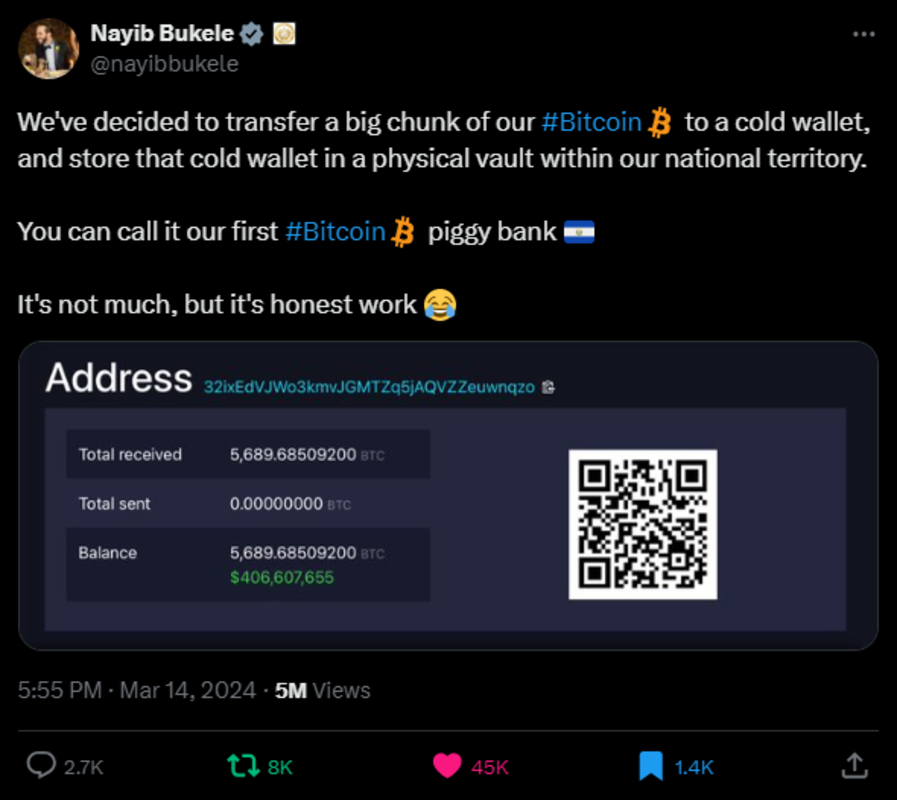

On March 14, 2024, El Salvador’s president-elect, Nayib Bukele, made a groundbreaking announcement that reverberated throughout the Bitcoin community. The country confirmed the transfer of a significant portion of its Bitcoin holdings into cold storage, securely housed within a vault on its national soil. This strategic move signifies a crucial turning point in El Salvador's Bitcoin narrative following the enactment of the Bitcoin Law, which has garnered both admiration and skepticism on a global scale.

Embracing Transparency Amidst Critiques

Despite facing a barrage of criticisms, including allegations of human rights violations and concerns about outdated infrastructure, El Salvador has remained steadfast in its commitment. The decision to transfer its Bitcoin reserves into cold storage within the country's borders represents a bold step towards transparency and instilling confidence in the nation's dedication to fostering a thriving Bitcoin-friendly ecosystem.

Fostering Trust and Openness

By allowing Salvadorans and Bitcoin enthusiasts worldwide to audit the country's Bitcoin reserves and track all transactions, El Salvador has demonstrated a strong commitment to trust and openness. This voluntary move underscores El Salvador's pledge to uphold the values of its citizens and the broader Bitcoin community, setting a new standard for financial governance.

Strategic Maneuver for Financial Autonomy

With the transfer of 5,689 Bitcoins valued at $385,111,456 USD to a secure vault within its borders, El Salvador has not only secured its digital wealth but also navigated the complexities of international relations. This decision, which involved moving the holdings from an American custodian to a sovereign vault, serves as a strategic imperative to safeguard the country's financial autonomy amidst potential regulatory challenges.

Balancing Opacity and Strategy

While the disclosure of the Bitcoin reserves has garnered widespread approval, El Salvador's initial reluctance to reveal its complete holdings may have been strategically motivated. By maintaining a level of opacity and disclosing only a portion of the reserves, the country demonstrates a nuanced understanding of strategic financial management in the realm of a Bitcoin Standard.

Innovative Approaches to Bitcoin Wealth

Bukele's revelation of El Salvador's multifaceted approach to accumulating Bitcoin wealth, including innovative visa programs, exchange profits, government revenues, and mining endeavors, showcases the country's forward-thinking strategies. These initiatives not only dispel misconceptions but also highlight El Salvador's innovative spirit in leveraging diverse avenues to bolster its Bitcoin treasury.

Building Trust and Prosperity

By disclosing its Bitcoin reserves and embracing transparency, El Salvador aims to create a positive business environment that fosters trust and encourages Bitcoin entrepreneurs to establish ventures within its borders. This move is not just about silencing critics but about laying a foundation for a prosperous future where citizens can thrive and contribute to the nation's growth.

As El Salvador continues on its path towards economic empowerment and progress, these strategic initiatives serve as pillars for a brighter and more prosperous future, transforming the nation into a hub of opportunity for its people.

Frequently Asked Questions

How to Open a Precious Metal IRA?

First, you must decide if your Individual Retirement Account (IRA) is what you want. To open the account, complete Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be filled within 60 calendar days of opening the account. After this, you are ready to start investing. You might also be able to contribute directly from the paycheck through payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS says you must be 18 years old and have earned income. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. And, you have to make contributions regularly. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, you won't be able purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option can be provided by some IRA companies.

There are two major drawbacks to investing via an IRA in precious metals. First, they're not as liquid as stocks or bonds. This makes it harder to sell them when needed. Second, they are not able to generate dividends as stocks and bonds. Therefore, you will lose more money than you gain over time.

Is gold a good investment IRA?

Any person looking to save money is well-served by gold. It's also a great way to diversify your portfolio. But gold is not all that it seems.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply and demand factors determine how much gold is worth. If the economy is strong, people will spend more money which means less people can mine gold. Gold's value rises as a result.

The flip side is that people tend to save money when the economy slows. This results in more gold being produced, which drives down its value.

This is why investing in gold makes sense for individuals and businesses. If you have gold to invest, you will reap the rewards when the economy expands.

Also, your investments will earn you interest which can help increase your wealth. Plus, you won't lose money if the value of gold drops.

What are some of the benefits of a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It's not subject to tax until you withdraw it. You are in complete control of how much you take out each fiscal year. There are many types and types of IRAs. Some are better suited to college savings. Others are intended for investors seeking higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. But once they start withdrawing funds, those earnings aren't taxed again. This account is a good option if you plan to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit to owning IRA gold is the ability to withdraw automatically. This means that you don't need to worry about making monthly deposits. Direct debits could be set up to ensure you don't miss a single payment.

Finally, the gold investment is among the most reliable. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil the gold price tends to remain fairly stable. It is therefore a great choice for protecting your savings against inflation.

How much are gold IRA fees?

An Individual Retirement Account (IRA) fee is $6 per month. This fee includes account maintenance fees as well as any investment costs related to your selected investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees vary depending on what type of IRA you choose. Some companies offer free checking, but charge monthly fees for IRAs.

Most providers also charge annual management costs. These fees are usually between 0% and 1%. The average rate is.25% each year. These rates are often waived if a broker like TD Ameritrade is used.

What are the pros and disadvantages of a gold IRA

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. However, there are also disadvantages to this type of investment.

You could lose all of your accumulated money if you take out too much from your IRA. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. A penalty fee will be charged if you decide to withdraw funds.

Another disadvantage is that you must pay fees to manage your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers may charge monthly management fees, ranging between $10 and $50.

You can purchase insurance if you want to keep your money out of a bank. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers limit how many ounces you can keep. Some providers allow you to choose your weight.

It's also important to decide whether or not to buy gold futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts allow you to buy gold with more flexibility. They enable you to establish a contract with an expiration date.

You'll also need to decide what kind of insurance coverage you want. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. It does include coverage for damage due to natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

Additional to your insurance, you will need to consider how much it costs to store your gold. Insurance doesn't cover storage costs. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

Before you can open a gold IRA you need to contact a qualified Custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians can't sell assets. Instead, they must hold them as long as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). It is also important to specify how much money you will invest each month.

After filling in the forms, please send them to the provider. After reviewing your application, the company will send you a confirmation mail.

Consider consulting a financial advisor when opening a golden IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

How much of your portfolio should you hold in precious metals

To answer this question we need to first define precious metals. Precious metals have elements with an extremely high worth relative to other commodity. This makes them highly valuable for both investment and trading. Today, gold is the most commonly traded precious metal.

There are however many other types, including silver, and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. They do not always move in the same direction. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. Investors expect lower interest rate, making bonds less appealing investments.

However, when an economy is strong, the reverse effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. Because they are rare, they become more pricey and lose value.

Diversifying across precious metals is a great way to maximize your investment returns. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads and Example. Risk Metrics

irs.gov

finance.yahoo.com

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was widely accepted around the world and enjoyed its purity, divisibility and uniformity. It was also traded internationally due to its high value. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

In the 1860s the United States began issuing American currency made up 90% copper (10% zinc) and 0.942 gold (0.942 pure). This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. The United States began minting large quantities gold coins at this time, which led to a drop in the price. Because the U.S. government had too much money coming into circulation, they needed to find a way to pay off some debt. To do so, they decided to sell some of the excess gold back to Europe.

Since most European countries were not confident in the U.S. dollar they began accepting gold as payment. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The price of gold has risen significantly since then. Even though gold's price fluctuates, it is still one of the most secure investments you could make.

—————————————————————————————————————————————————————————————-

By: Jaime García

Title: El Salvador's Bold Move: A Historic Shift in Bitcoin Reserves

Sourced From: bitcoinmagazine.com/el-salvador-bitcoin-news/el-salvador-moves-bitcoin-reserves-to-cold-storage-vault

Published Date: Mon, 18 Mar 2024 15:32:02 GMT